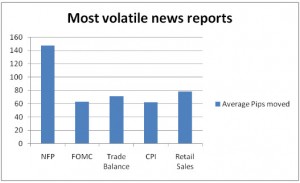

For traders to know when to trade let’s look at five major news events that have the biggest impact on the forex market. The convenience of these events is that they have a constant schedule and may create a huge volatility on the financial markets.

- Manufacturing PMI. German and French PMIs are the most important European leading indicators. They are released in one day with just a slight delay between reports. Moreover, they have some sort of correlation between each other, so the first one is more important. Chinese Manufacturing PMI is also perfect for trading as it hugely affects risk currency pairs like Eur/Usd and Aud/Usd.

- GDP reports. These are very important reports that have a big impact on the forex market. Usually a GDP report comes out every quarter. The exception is only for Canadian GDP which is released every month. There are 3 GDP reports in the US: Advanced, Preliminary and Final GDP. The first one makes the most impact on the forex market.

- Monthly employment reports.The most awaited US reports are NFP employment change and the unemployment rate. The ADP report which represents the estimates of the official data comes 2 days earlier than the official report and it also can have an impact on the forex market. However, it needs more deviation from the estimates to change the mood of the financial markets. Australian and European unemployment reports are also closely monitored by traders.

- Interest rates decisions.Only those decisions that differ from the expectations increase the volatility on the forex market. However, the biggest trends usually happen after the official data release during press conferences which are usually translated live over the internet. Traders are looking for clues from central banks leaders that could suggest the future of interest rates. Dovish tones lead to a currency sell-off and hawkish tones make the currency stronger.

- Inflation reports. Inflation reports usually do not impact the eur/usd; however, we can’t ignore them in this article. The thing is, that inflation of the US and European economies usually comes in range of 2-3%. However, central banks only take action when inflation comes outside of these borders but for the past ten years it happened only during the global financial crises and recovered rather quickly. Thereby, small deviations within the desired range usually come unnoticed by the market participants. Moreover, inflation is calculated monthly for these economies making the impact lower than for Australian and New Zealand economies where the inflation is calculated on a quarterly basis. Thanks to that, the CPI reports of these economies create nice trends on the forex market.

Trading the above events is surely much safer than trading other less significant news. It is always a good idea to monitor them and trade accordingly whether you are a technical or fundamental trader. These events can have an impact on the markets for a long period of time, up to the next 24 hours, so there is no need to rush and close the trades with small profits during important shifts in the economy. However, sometimes it can be hard to predict the exact outcome of the news. So, even if a stop loss gets hit soon after the news release, it is still a good idea to reverse the position and trade in the opposite direction together with the market. The volatility of the markets increases so high during these events so the price simply can’t stop and calm down. This significant regularity makes it simple for traders to “ride” the trends during news releases.

Source: Trust Capital – babypips