-

Crude rises above $70 a barrel as U.S. Iran decision looms

-

Earnings season continues; U.S. consumer price data in focus

Asian stocks advanced after spending most of Monday’s session fluctuating as oil gained to the highest in more than three years and the dollar stuck close to its recent high.

Shares pared earlier losses in Japan while climbing in Australia and Hong Kong. Euro Stoxx 50 futures climbed with S&P 500 Index contracts. The greenback steadied and the yen pared gains as traders returned from Golden Week holidays. Oil pushed through $70 a barrel for the first time since November 2014 as investors braced for a re-imposition of some U.S. sanctions on Iran. The U.S. 10-year Treasury yield ticked higher.

Geopolitics remain in focus this week with President Donald Trump saying he’ll decide by May 12 whether the U.S. stays in or pulls out of the Iran nuclear deal. Earnings season continues, and on the economic front traders will watch out for an expected acceleration in U.S. consumer prices. Emerging markets will also be closely followed after stocks and currencies extended their losses last week, punctuated by sell-offs from Turkey to Argentina.

Terminal users can read more in our markets live blog.

Some key events coming up this week:

- Nafta talks resume in Washington Monday. The negotiators are expected to push for a final deal, but U.S. Commerce Secretary Wilbur Ross said talks could drag on for months.

- Chinese trade data due Tuesday.

- Australian annual budget Tuesday.

- Malaysia holds a general election Wednesday.

- Japanese Prime Minister Shinzo Abe hosts South Korean President Moon Jae-in and Chinese Premier Li Keqiang Wednesday.

- Bank of England policy decision Thursday.

- Deadline set by President Trump on whether to stick with with 2015 Iran nuclear accord or pull out and reimpose sanctions on the Persian Gulf nation.

- Walt Disney, Petrobras, Marriott, Toyota, Ambev, Deutsche Telekom, Sun Life Financial, Nvidia, Brookfield Asset Management, Anheuser-Busch InBev, Panasonic, Banco do Brasil, Nissan, Thomson Reuters, Sysco, Tyson Foods, SoftBank, Siemens and 21st Century Fox are among many companies announcing earnings.

- South Korean markets are closed for a holiday.

And these are the main moves in markets:

Stocks

- The MSCI Asia Pacific Index rose 0.1 percent as of 3:05 p.m. Tokyo time.

- Topix index added 0.1 percent.

- Hong Kong’s Hang Seng Index rose 0.4 percent.

- Australia’s S&P/ASX 200 Index gained 0.4 percent.

- Futures on the S&P 500 Index advanced 0.3 percent.

- Euro Stoxx 50 futures climbed 0.3 percent.

Currencies

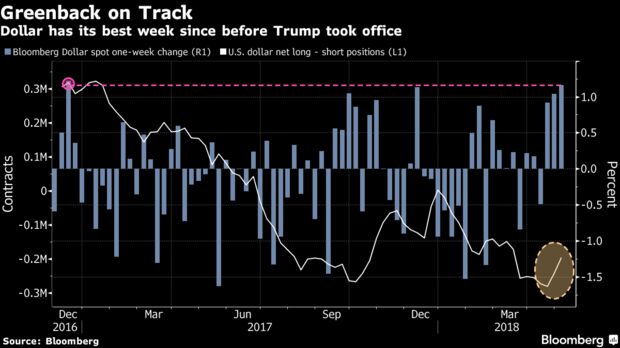

- The Bloomberg Dollar Spot Index rose less than 0.05 percent.

- The Japanese yen fell less than 0.1 percent to 109.19 per dollar.

- The euro fell 0.1 percent to $1.1946.

Bonds

- The yield on 10-year Treasuries rose less than one basis point to 2.95 percent.

- Japan’s 10-year yield fell less than one basis point to 0.043 percent.

- Australia’s 10-year yield fell one basis point to 2.76 percent.

- The German 10-year bund yield was flat at 0.54 percent.

Commodities

- West Texas Intermediate crude rose 1.1 percent to $70.46 a barrel.

- Gold was little changed at $1,313.85 an ounce.

Updated on

Source: Bloomberg