The week ahead will be jam-packed with key macro events affecting currency markets. Chief among these major events will be the US jobs report for July; a slew of PMI numbers from the US, UK, and Eurozone countries; and critical central bank decisions from the Bank of England (BoE) and Reserve Bank of Australia (RBA). With next Friday’s US jobs report and Tuesday’s RBA decision on the schedule, the week ahead will be of particular importance for theAUD/USD currency pair.

First up will be the Reserve Bank of Australia. Although the central bank is mostly expected to keep its cash rate steady at 1.5%, there have been recent indications that the RBA may be becoming more hawkish in-line with other major central banks, and could be preparing to raise interest rates at some point in the foreseeable future. Some bets are being made that such a hike could occur as early as next week. This hawkish RBA shift is in sharp contrast with the US Federal Reserve, which issued yet another wait-and-see statement with respect to interest rates and balance sheet reduction this past week that simply served to prolong the prevailing environment of dovish uncertainty. Though the US dollar rebounded on Thursday, Friday saw the greenback come under heavy pressure once again.

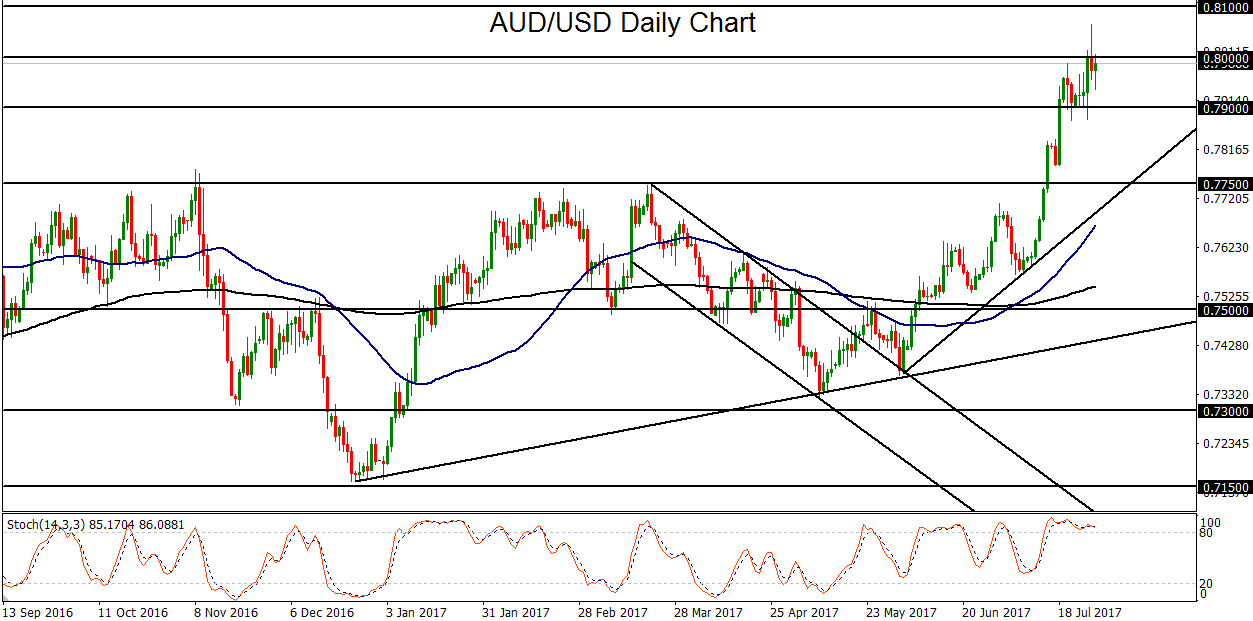

This contrast between a more hawkish RBA and less hawkish Fed has helped push AUD/USD into a sharp incline that has been in place for the past two months. Most recently, this climb has culminated in a key shooting star candlestick pattern around the 0.8000 psychological resistance level. A daily candle with a long upper shadow (wick) and small lower body, this shooting star pattern suggests some potential exhaustion near a key resistance level.

Whether AUD/USD adheres to this downside reversal pattern or not will depend largely on what happens next week with the RBA and, to a somewhat lesser extent, the US jobs report. An unexpected RBA rate hike would likely result in a substantial up-move for the currency pair, potentially boosting it towards key upside resistance targets at 0.8100 and 0.8300. The more likely scenario, however, is that there is no rate hike. If that is indeed the case, since much of the RBA’s new-found hawkishness and the Fed’s continued dovishness have already been priced-in to AUD/USD’s recent rise, the shooting star reversal pattern could indicate an impending pullback. Any such pullback that makes a sustained breakdown below the 0.7900 level could trigger a substantial move back down towards the key 0.7750 support level.

By James Chen

By James Chen

Jul 31, 2017 02:29AM ET

Source: Investing.com