The first round of the French vote went largely according to what recent polls had suggested. Macron is the overwhelming favourite for the 2nd round. Markets should largely price out Le Pen tail risks, but there will be broader consequences as well.

A big step towards president Macron

The first round of the French election did not provide surprises and took Macron and Le Pen to the second round. The first results showed that Macron was taking the first place with a clear margin by having 23.7% of votes. Le Pen’s second place was also clear at 21.7%. Fillon and Mélenchon both achieved 19.5% of votes. The turnout was estimated at around 77%.

Macron the big winner in the first round of the French vote

| Candidate | Preliminary share of votes, % |

| Macron | 23.9 |

| Le Pen | 21.7 |

| Fillon | 20.0 |

| Mélenchon | 19.2 |

Source: France 24 / IPSOS, (21.50 CET)

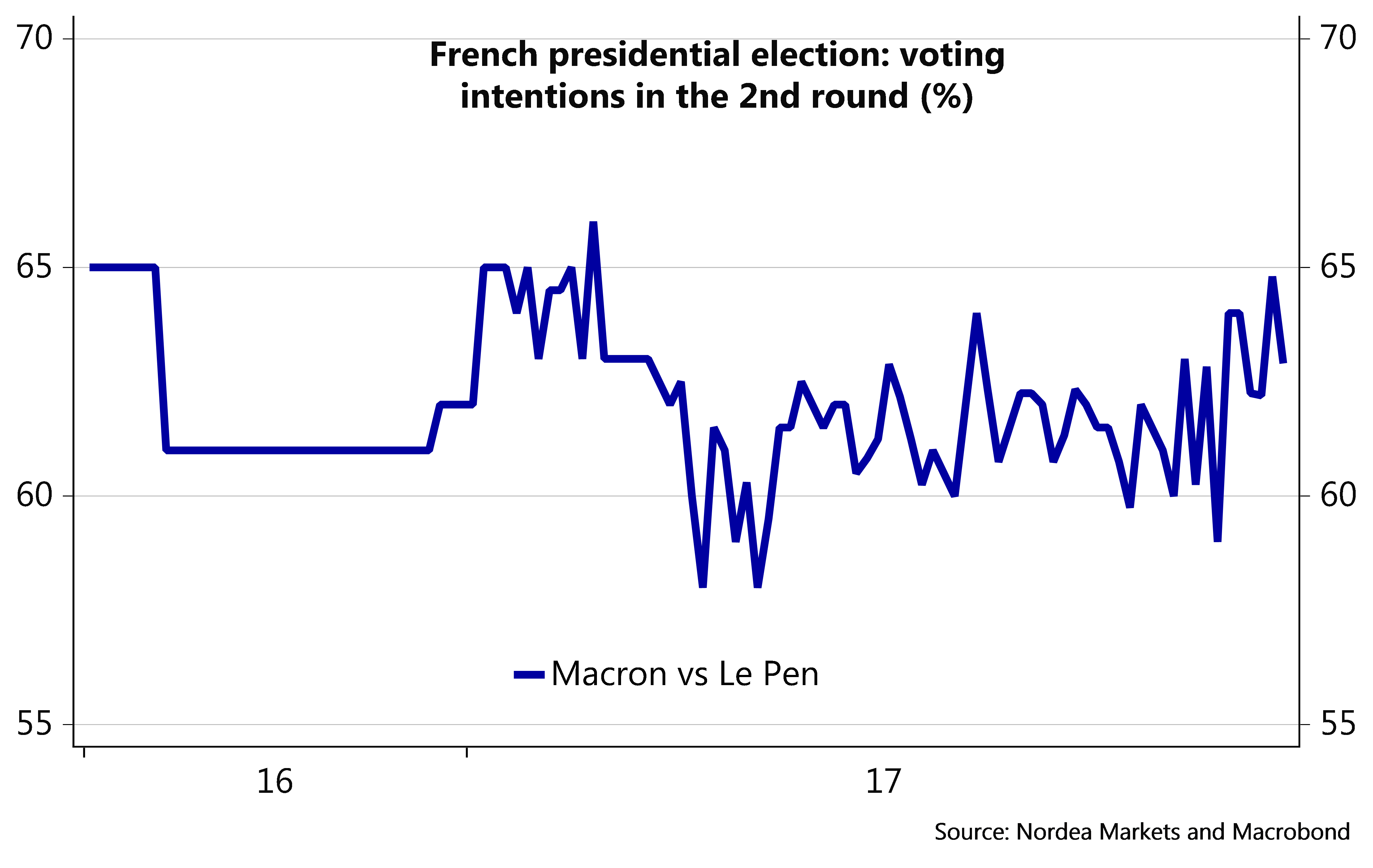

Most importantly, that results followed very much the polls indicates that they should be capable to forecast results also of the second round. The latest polls indicate Macron to win more than 60% of votes and he is thus a clear favourite to become the next president in France.Macron’s position was further strengthened by both the conservative Fillon and the socialist candidate Hamon who already recommended voting Macron in the second round.

Macron miles ahead of Le Pen in second-round polling

Big near-term relief ahead in financial markets – France will be forgotten for now

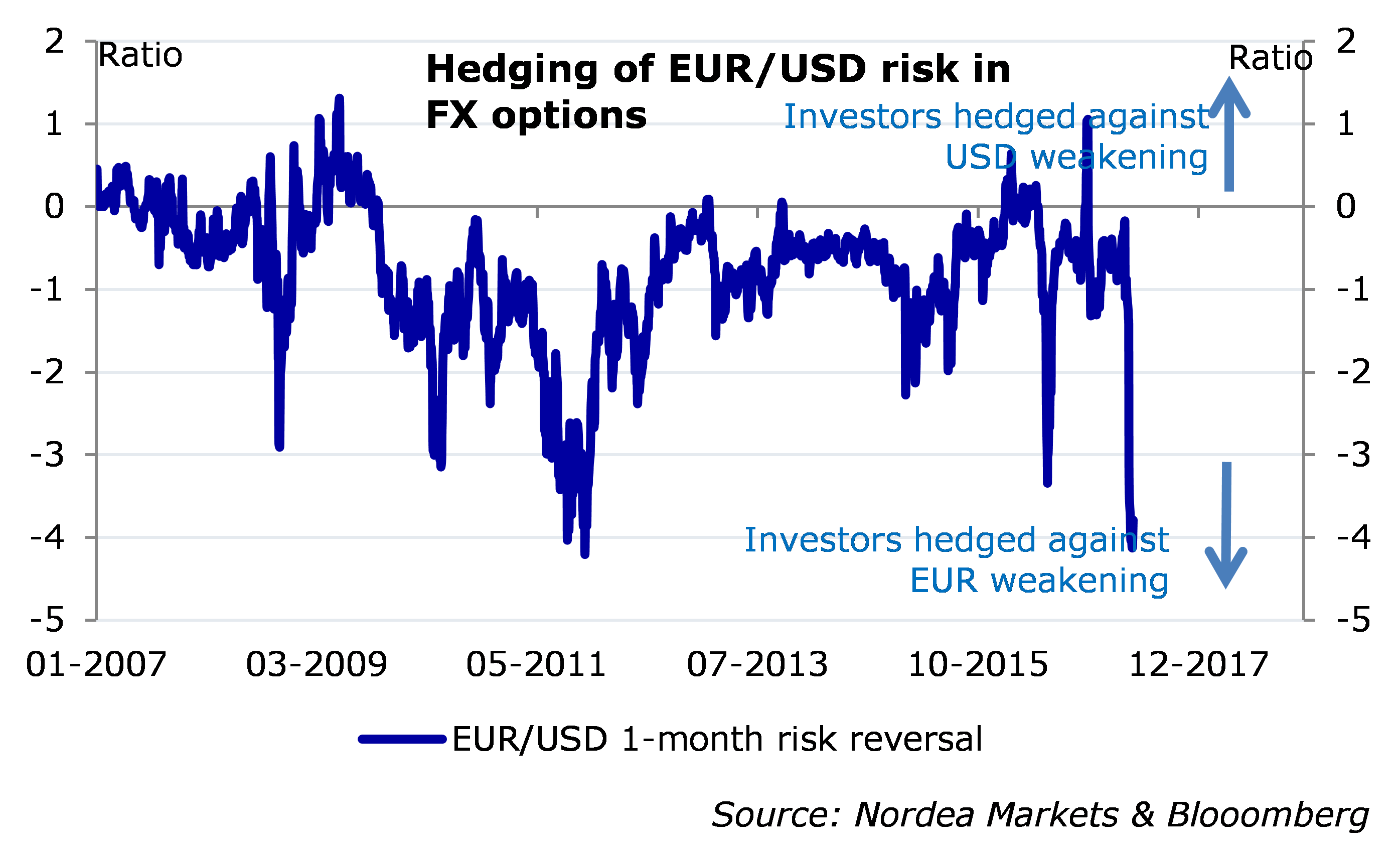

While the broader markets did not experience any huge swings ahead of the vote, the derivatives markets suggest considerable hedges were in place towards an unfavourable outcome. This was very apparent e.g. on the FX markets, where the so called risk-reversals on EUR/USD pointed to extreme hedging positions towards a weakening of the EUR. A significant part of these hedges will probably now be reversed, and the EUR/USD should see a jump towards 1.10.

On the bond markets, French spreads should see a clear narrowing, while the German 10-year yield should climb back towards the upper end of its recent trading range at around 50bp.

Beyond the next few days, there will be a lot in the calendar to determine the direction for markets. President Trump has promised details on his tax reform plans on Wednesday, the ECB meeting will be on Thursday, while especially US economic data is under the magnifying glass after the few recent weak numbers. Still, the removal of at least some political uncertainty should clear one of the obstacles that have prevented the EUR and long yields form rising. After all, the uncertainty related to the French parliamentary elections is unlikely to become a driver for broader markets.

Big hedges in place towards EUR weakening

Low turnout is Le Pen’s last hope – parliamentary elections important for France

Polls can change between now and 7 May, but they have consistently been pointing to Macron for quite a while. Voter turnout, or more specifically differences in mobilisation of the two candidates’ supporters, could determine the outcome. Turnout is usually higher in the second round than in the first. Since 1988, the lowest turnout in the second round was 79.7% (in both 1995 and 2002) and it was 80.3% in the last election. Assuming 47m eligible voters and a turnout of 80% means that roughly 18.8m votes are necessary to become president. For Le Pen, who got some 8m votes in the first round that would be 11m more than in the first round – very unlikely to be realised in our view. Le Pen’s chances rise in case of a weak mobilisation of left-wing voters and a radicalisation of (formerly) moderate right-wing voters in her favour. We don’t believe in this scenario.

While the second round of the presidential election looks now a clear case, the selection of Macron implies a lot of uncertainty for the future and parliamentary elections in June. Macron will have a lot of work in front of him to convince voters and politicians especially from the Socialist Party but perhaps even more broadly to gain a majority in parliament. The name of the future prime minister, for example, is very difficult to forecast even if that person will be key for economic reforms that Macron is aiming for. Without sufficient support in parliament, it will be impossible for Macron to implement the key reforms in e.g. pension system and labour market. Thus, even if in a short-run the clear win of Macron reduces the uncertainty, a lot of question marks continue to exist when it is about the French reform agenda in the coming years.

One take-away from the election will be that Front National’s progress continues even if Le Pen doesn’t become president this time. Aged 48, she will likely run again and her ideas could get further support, depending not least on the economic development. This, however, will be more of a longer-term development, not a short-term concern.

Trust in polls restored – sort of

The French vote will have broader ramifications. After the shocks of Brexit and Trump victory last year, the validity of polls has been severely questioned – even if in the big picture the polls were not hugely off in either of those cases, considering the popular vote in the US and the share of uncertain voters in Britain.

Now that the pollsters were largely able to call the French vote, at least some of the trust they have lost should be restored. More specifically and what financial markets care most about, the polls were able to capture the support for the anti-establishment and extreme candidates rather accurately (as was also the case in the Dutch parliamentary elections earlier).

This will not help in cases like Italy, where polls put the anti-establishment Five-Star Movement ahead, but will help in reducing the uncertainty on the night of the vote.