Both EUR/USD and GBP/USD opened this summer week near their highs with the U.S. dollar remaining weak ahead of Friday’s U.S. jobs report. Trading volumes could however be light at the start of this holiday shortened week with U.S. markets being closed Tuesday.

The U.S. Non-farm payrolls report, due on Friday will be the highlight while the economic docket is rather light in terms of market-moving data. The FOMC meeting minutes are due for release Wednesday but they are unlikely to spur the dollar trade, even though the minutes are expected to reaffirm the Fed’s hawkishness. The ISM Manufacturing index, scheduled for release today at 14:00 UTC could lead to volatile swings in the U.S. dollar.

Prior to this, BoE Governor Carney is scheduled to hold a speech at 12:00 UTC. His comments could have an impact on the pound sterling.

The U.S. dollar experienced its longest losing streak since 2011 as other global central banks turned hawkish while optimism around the Trump administration’s ability to boost fiscal growth dwindles. While there is still hope that the dollar will recover over the medium-term, traders should follow the current uptrend in the EUR/USD and GBP/USD. After several weeks of sideways trading, the euro finally picked a direction and traded higher versus other major peers. We expect this bullish bias to prevail in the summer months while keeping an eye on the technical picture.

EUR/USD

As long as the euro remains above 1.1220 we favor the bullish bias targeting at a test of 1.15 and possibly even 1.1550. A beak below 1.1220 could however increase the pressure on the euro driving the pair lower towards 1.11.

GBP/USD

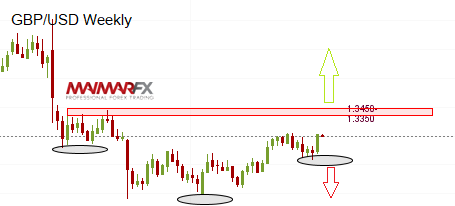

The trend of the British pound has pointed upwards and the 1.3050-resistance slides back into focus. If the pound is able to break that level significantly, we may see a rise towards 1.3220 and possibly even 1.3340 and 1.3440. The 1.3340-1.3450-resistance zone is of great importance in terms of a longer-lasting uptrend. If the cable rises towards that threshold we see an inverted head-shoulders pattern predicting upcoming bullish momentum in the long-term, provided that 1.35 is broken. A renewed break below 1.2590, however, would void this pattern.

Here are our daily signal alerts:

EUR/USD

Long at 1.1430 SL 25 TP 40-50

Short at 1.1385 SL 25 TP 20, 35

GBP/USD

Long at 1.3040 SL 25 TP 30-40

Short at 1.2980 SL 25 TP 20, 35

By Marios Krausse – Jul 03, 2017

We wish you good trades and many pips!

Disclaimer: Any and all liability of the author is excluded.

Source: Investing.com