North Korea concern faded during the US session so much so that US stocks recovered to close higher. I’d mentioned recently that you need to be nimble in these current markets and this stock recovery reinforces that notion in spades. Longer term trends are few and far between on many FX pairs and the choppy movement makes for challenging trading. I continue to look for any consolidation patterns on the 4hr charts and then narrow down to lower time frames to stalk any breakout moves and this forms up the TC Trading System.

Data: There is US ADP NFP, Prelim GDP and Crude Inventories to come in the next session so watch for any impact from these on US$ index movement. There is also an NZD RBNZ Gov Wheeler speech to navigate.

USDX weekly: has pulled back a bit so watch for any impact from today’s US data.

EURX weekly: this just keeps going:

TC System in these choppy markets:

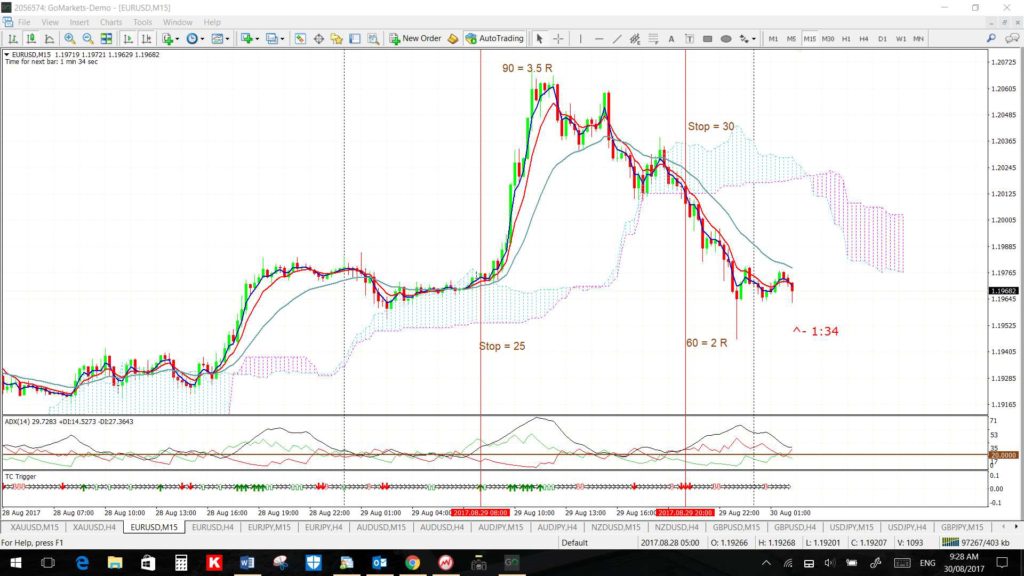

EUR/USD 15 min: this 15 min chart of the EUR/USD illustrates the back and forth experienced with the current markets. The TC system is not perfect but it does manage to get a better than average grab of momentum-based moves and functions without directional bias. The EUR/USD had been on a breakout move and so there were no 4hr chart trend lines in place for guidance. Despite this though, there were two valid TC signals yesterday offering low Risk set ups. One signal gave 90 pips for a 3.5 R move and the other gave 60 pips in a 2 R move. This is an example of how the TC system can function for profit in choppy trading and without concern for directional bias.

Trend line breakouts: the A/J and G.J might be trying to break upwards.

AUD/JPY 4hr: a new breakout? Watch for any continuation:

GBP/JPY 4hr: a new breakout? Watch for any continuation and whole-number levels:

Two of the three TC signals worked here yesterday on the GBP/JPY 15 min chart. The two that triggered closer to the trend line worked best; as to be expected!

Gold 4hr: this breakout move peaked at 240 pips BUT note the revised 4hr chart trend lines to monitor here now:

EUR/USD 4hr: this breakout move peaked at 260 pips BUT note the revised 4hr chart trend lines to monitor here now:

EUR/AUD 4hr: this breakout move peaked at 190 pips BUT note the revised 4hr chart trend lines to monitor here now:

EUR/NZD 4hr: this breakout move peaked at 550 pips BUT note the revised 4hr chart trend lines to monitor here now:

Silver 4hr: this breakout move peaked at 40 pips BUT note the revised 4hr chart trend lines to monitor here now:

USD/CNH 4hr: this breakout move has now reached 840 pips:

Other Forex:

EUR/JPY 4hr: revised trend lines here to watch for any new breakout:

AUD/USD 4hr: watch trend lines, and the key 0.80 level, for any breakout:

NZD/USD 4hr: revised trend lines here to watch for any new breakout; especially with today’s RBNZ Gov Wheeler speech:

GBP/USD 4hr: revised trend lines here to watch for any new breakout:

USD/JPY 4hr: revised trend lines here to watch for any new breakout:

Note how the 15 min chart of the USD/JPY gave a great low Risk trade to start the US session that has gone on for 5R!

GBP/AUD 4hr: watch trend lines for any new breakout:

GBP/NZD 4hr: messy as price negotiates the major bear trend line. This might be one best left until there is a decisive make or break. It could be choppy here for a bit?

Stock Index:

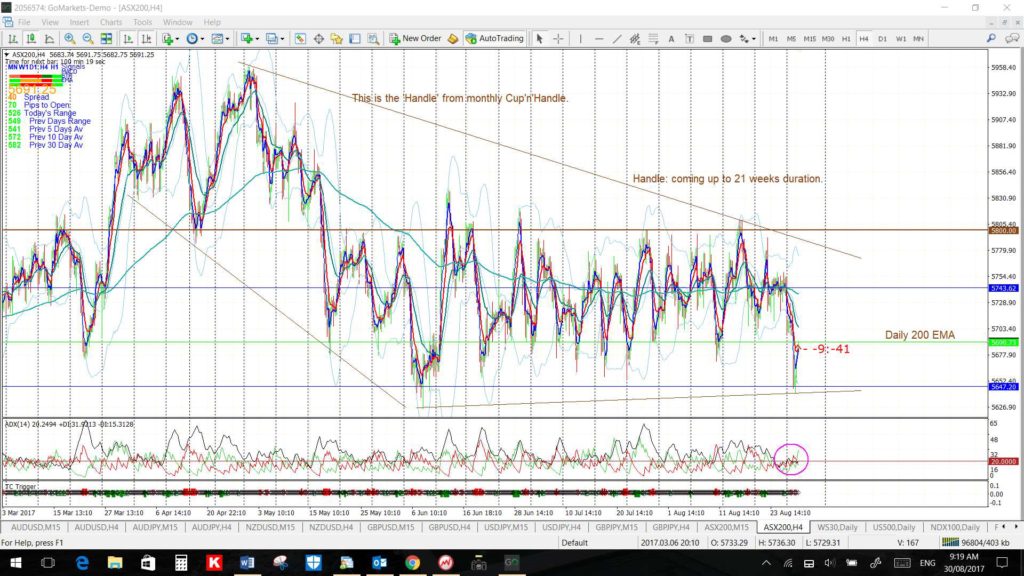

ASX-200 4hr: this index broke down below the lower trend line but I have revised the pattern now that we’re not worried about North Korea, well at least, not today: