Wed 6th Aug

The USD rally has continued and it has broken out of a 10 month trading channel on the daily chart time frame. The index will need to print a weekly candle close above this resistance level to be more convincing but it is looking fairly bullish for the time being:

USDX daily:

USDX weekly: showing the recent break of the 10 month old trading channel:

The stronger USD comes on the back of continuing good US data and this has traders and investors concerned that US interest rates might be set for an increase in the not too distant future. US stocks have held up reasonably well until recently but some key stock index trend lines are starting to come under some pressure.

S&P500 daily

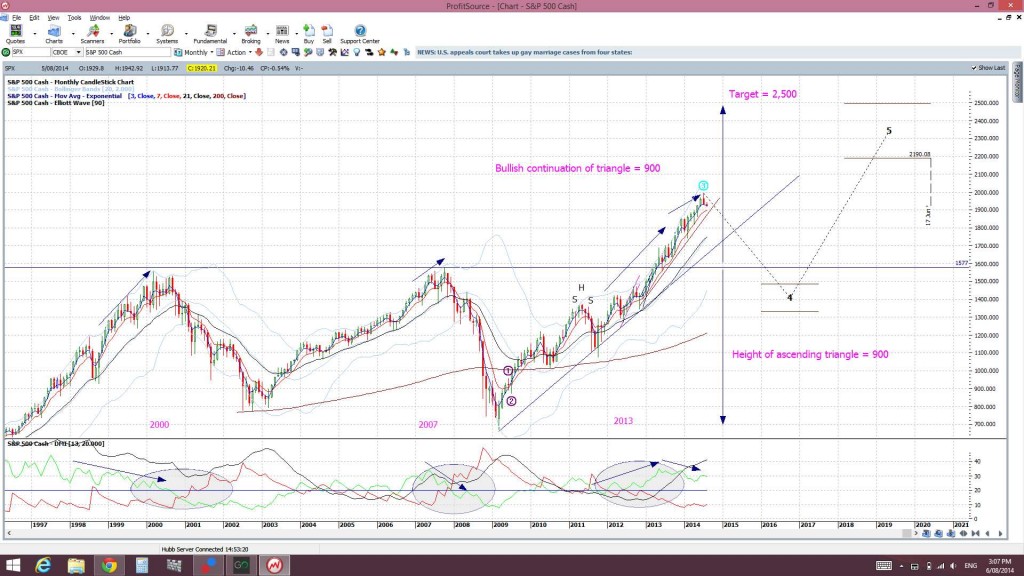

The S&P500 is still holding above a key daily support trend line for now but this trend line has been in play for almost two years now (21 months to be exact) and, at some point, there will have to be a correction lower, even if only short lived. Anxiety about increased US interest rates might be just the catalyst to affect such a correction! The monthly chart below shows possible targets for any such pull back. A break of the daily support trend line would suggest the monthly support trend line could be the next main target. After that, then the previous break out level of 1,577 looks reasonable. I would be expecting any pull back but hold above the 1,577 level would be an excellent buying opportunity:

S&P500 monthly

So, what does this have to do with FX you say? Well, in my opinion, a lot! Many US direct FX pairs have held up quite strongly over recent sessions in spite of the strengthening USD. The positive risk sentiment across on stock markets has probably helped here a bit. Any continued USD rally with a new ‘risk off’ approach on stocks though may result in these FX pairs failing to hang on to these levels and then tumbling.

The E/U, A/U, Cable and Kiwi have all held up quite well but an strengthening USD with a new ‘risk off’ on stocks, even if only temporarily, could see these pairs pull back:

E/U: has held up near the weekly 200 EMA:

A/U: has managed to keep up near the 0.94 level:

Cable: has managed to hold above the support of the 1.68 level:

Kiwi: has tried holding up near the 0.88 and, more recently, the daily 200 EMA:

The situation is clouded somewhat with interest rate decisions still to come on the EUR, GBP and JPY and these will be the main focus for most FX traders. I’m suggesting though that FX traders keep just as close an eye on the S&P500 and the trend lines here as any new shift to ‘risk off’ with broader markets may impact Forex as well.

The post FX traders: ignore the S&P500 at your peril. appeared first on www.forextell.com.