Last week: There was a bit of US$ movement last week as trade war tension eased and this enabled a few trend line breakout trades, although, the looming Easter break probably kept things a bit quiet. The US$ remains range-bound above weekly support but maybe this week’s NFP might get it going?

Trend line breakouts and TC signals: there were a few trend line breakout trades last week and these were updated on my site here, here, here and here:

- EUR/USD: 85 pips and a TC signal for 5 R.

- EUR/JPY: 70 pips and a TC signal for 3.5 R.

- GBP/USD: a TC signal for 1.5 R.

- Gold: 220 pips and a TC signal for 270 pips and 13 R.

- USD/JPY: 80 pips and a TC signal for 4.5 R.

- AUD/JPY: 40 pips.

- NZD/USD: 65 pips.

Next week:

- FX Indices: The US$ index printed a bullish coloured candle for the week but it was an indecision-style, almost, ‘Inside’ candle so probably nothing to get excited about. An update on both FX indices can be found through this link.

- Data: there is a lot of data for the AUD this week with the RBA rate statement being the biggest and there is also NFP to negotiate in the shorter trading week. Watch also to see how the weekend release of CNY Manufacturing (better than expected) and Non-Manufacturing PMI (as expected) data impacts markets at their open.

- Yen pairs: Yen strength eased last week as trade war tension eased but keep watch for any further trade war commentary though as news here could turn these pairs on a dime!

- TC Upgrade: Recall that I am upgrading my website so please be patient throughout this process in case access is impacted at all. My blog site started rather humbly as a method of distraction for me back in 2011 when I was undergoing chemotherapy. During that time it has evolved to be a more professional site where I post charts and detailed technical analysis on numerous trading instruments for free and on a very regular basis. The roll over to the new site will take place within the next couple of weeks and part of this change will involve a small subscription fee, of $10 AUD per month, for access to SOME of my weekday Posts and ALL of my weekend Posts. I consider this a modest cost for my intellectual property given the time taken to prepare and post the various articles of analysis. I have enjoyed a lot of support over the years and received abundant positive feedback and I hope this relationship can continue with my many followers.

- May-June 2018: Just FYI: I will be spending the last week of May and the first three weeks of June in the UK giving my TC system a thorough workout during the European and US trading sessions.

- NB: I am traveling this week so this update is brief and further updates this week will be brief.

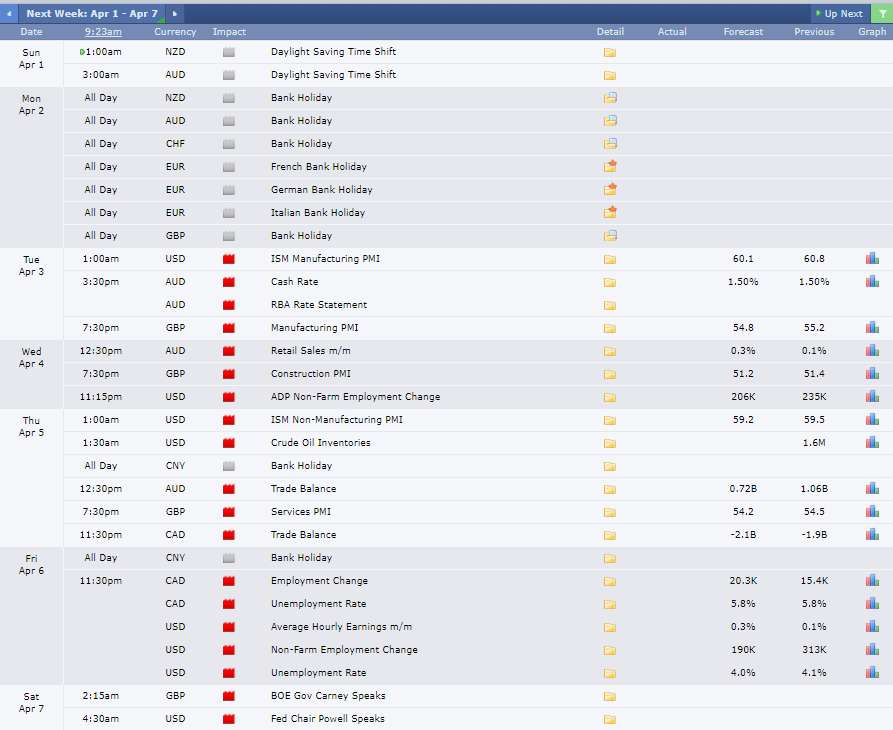

Calendar: it might be a slow start to the week given the Easter break but there is NFP to look forward to on Friday.

Forex:

EUR/USD: Very little has changed here again with the EUR/USD as price remains range-bound in a 4hr triangle under the key 1.26 level. Although, it did close below the monthly 200 EMA and with a bearish coloured ‘indecision’ candle last week but this probably carries reduced significance given the lighter volume trading with the Easter week.

As per my commentary over recent weeks, I see all of this as consolidation under the major 1.260 S/R level.

The 1.260 region remains a major S/R level for this pair as the weekly chart’s 61.8% fib is nearby and it also intersects with the monthly chart’s 10-year bear trend line. Thus, whilst STILL around 290 pips away, the 1.26 remains the major level to monitor in coming sessions.

Bullish targets: The first target on any bullish 4hr chart triangle breakout would be 1.260 which is about 290 pips away. After that, the 1.40 S/R level would be in focus as this is near the monthly chart’s 61.8% fib. A move from 1.26 to 1.40 comprises about 1,400 pips and so is well worth stalking!

Bearish targets: Any pullback and break below the 4hr chart’s triangle support trend line would have me looking for a test of the key 1.20 level.

- Watch the 4hr chart’s triangle trend lines for any new breakout:

EUR/JPY: Trade war tension eased last week and so JPY-related strength also eased which sent this pair a bit higher, although, momentum remains low with Easter trading. The wedge trend lines have been revised and price remains within this pattern and near the daily 200 EMA but above the key 130 level. The monthly chart shows the long-term impact of this 130 S/R region.

Bullish targets: Any bullish 4hr chart descending wedge breakout would keep the major 135 S/R level in focus as this is still up near the 4hr chart’s 61.8% fib.

Bearish targets: Any bearish 4hr chart descending wedge breakout would have me looking to the 120 region as this is the weekly chart’s 61.8% fib level of the last swing high move.

- Watch the 4hr chart descending wedge trend lines for any new breakout:

AUD/USD: The Aussie chopped a bit lower last week and, whilst still in a bullish-style descending wedge, it closed below the support of the 0.77 level. There is a lot of data to impact the Aussie this week starting over the weekend with CNY Manufacturing and Non-Manufacturing PMI data.

Bullish targets: Any bullish 4hr chart wedge breakout would bring the 0.78 level into focus as this is near upper bear trend line.

Bearish targets: Any bearish 4hr chart wedge breakout would bring the 2.5 year support trend line into focus but this is now only about 50 pips away from current price.

- Watch the 0.77 and the 4hr chart wedge for any new breakout, especially with this week’s RBA rate update, Retail Sales and Trade Balance data and the weekend release of CNY Manufacturing and Non-Manufacturing PMI data :

AUD/JPY: Like with other Yen pairs price action recovered a bit here with price holding above the key 80 S/R level and I’ve not got it trading within a 4hr triangle. The 80 level is a major S/R zone and remains the level to watch in coming sessions for any new make or break.

Bullish targets: Any bullish 4hr chart triangle breakout would bring the 83 region into focus as this is the 4hr chart’s 61.8% fib. After that, the whole-number 85, 86 and 87 S/R levels would come into focus.

Bearish targets: Any break and hold below the 80 level, near the weekly chart’s 61.8% fib level, would bring the monthly charts support trend line into focus and this intersects down near the weekly 78.6% fib near recent lows circa 76.

- Watch the 4hr chart triangle trend lines for any new breakout:

NZD/USD: Little changed here last week as the Kiwi chopped around above the 0.72 level but, again, managed to close above this S/R zone. So the 0.72 remains the level to watch for any new make or break activity.

Bullish targets: any bullish triangle breakout would bring the 0.73 and then the 0.74 S/R levels back into focus.

Bearish targets: any bearish triangle breakout would bring the 0.72 immediately into focus followed by 0.71 and other whole-number levels.

- Watch for any new 4hr chart triangle breakout; especially with this week’s GDT Price Index and Business Confidence data:

GBP/USD: The bit of US$ strength that presented last week may have helped this pair to drift back down to the major 1.40 S/R level and weekly 200 EMA region. However, this is a huge S/R region for this pair, as the monthly chart reveals, and so price may struggle to break free from here unless there is some major news at some point. Maybe some Brexit-related news?

Bullish targets: Any bullish 4hr chart triangle breakout would have me looking to the recent High near 1.434. After that, the 1.50 region would come into greater focus as this is the 61.8% fib of the weekly chart’s longer-term swing low move. This is a move worth around 1,000 pips so is worth stalking!

Bearish targets: Any bearish 4hr chart triangle breakout would bring the recent low near 1.371 into focus. After that, the daily chart shows a weekly support trend line in play and any break below this would have me looking down to the 1.25 level as this is the 61.8% fib of the last major swing high move (see daily chart).

- Watch for any new 4hr chart trend line breakout; especially with this week’s GBP Manufacturing, Services and Construction PMIs and the BoE Carney speech:

USD/JPY: The USD/JPY bounced up last week from the major support zone of the key 105 level which was also near a 22-month support trend line.

Bullish targets: any bullish wedge breakout would bring the monthly 200 EMA, then the weekly 200 EMA near 109.50, followed by the key 110 S/R level near the 4hr chart’s 61.8% fib level, into focus.

Bearish targets: any bearish wedge breakout and break and hold back below the whole-number 105 S/R level would bring the 100 level into focus followed by the 2016 Low, near 99.

- Watch for any wedge breakout; especially wit this week’s US NFP and JPY Manufacturing and Non-Manufacturing data:

GBP/JPY: The GBP/JPY continues consolidating under some serious resistance from the 150 region and this is the level to watch for any new make or break. The monthly chart reveals the importance of this key S/R level.

NB: given the lack of momentum on the monthly and weekly charts I have revised my longer-term trend lines here.

Bullish targets: any bullish breakout above the 150 S/R level would bring the weekly 200 EMA into focus.

Bearish targets: any bearish retreat from 150 would bring the 147 into focus as this is near the revised 18-month support trend line. After that, the 145 level and 139 level would loom and the latter of these two is near the weekly chart’s 61.8% fib region for added confluence.

- Watch for any make or break at the 150 level:

Oil: Watch the 4hr chart Flag pattern and $67 resistance level for any new make or break:

Gold: Watch the 4hr chart wedge pattern for any new make or break: