Featured Article

-

Performance Metrics of Su …

FXWW is a provider of professional services as well as being a network of professional traders in the interban …More>> -

Weekly Game Plan 2 Dec 19 …

We enter quite a busy week with central bank meetings, NFP and other data coming up above and beyond the usual …More>>

MOST RECENT ARTICLES

This Wednesday…All Eyes on Stephen Poloz

The Weekly FX Drive Thru The FX Market Place: 1.1: Last Week’s News – My Thoughts: 1.1.1: Oil and it’s Effects on the Broader Markets: The big news item that dominated the financial news last week was without question oil. We saw prices fall below $30 a barrel. Oil is the most hedged, artificially priced […]

Falling knives and rockets

The situation in China is not getting better and this is affecting stock markets worldwide. With currencies is slightly different since they cannot all fall and some are getting more affected than others. The biggest victim is (for now) the CAD that is now trading at levels going back to 2003 following OIL’s fate. Another […]

Your “Identity” as a Trader

“A losing trader can do little to transform himself into a winning trader. A losing trader is not going to want to transform himself. That’s the kind of thing winning traders do.” – Ed Seykota A trader friend of mine (thanks Pater!), brought up the topic of “identity” recently. Firstly, a warning. This article is […]

US$ higher but FX still fairly quiet relative to stocks

The US$ is a bit higher but still range-bound under the $100. There is a batch of USD data in the next US session and I’ll be interested to see if this can shake the US$ out of its recent trading range. Stocks have bounced on the back of stronger Oil and some dovish Fed […]

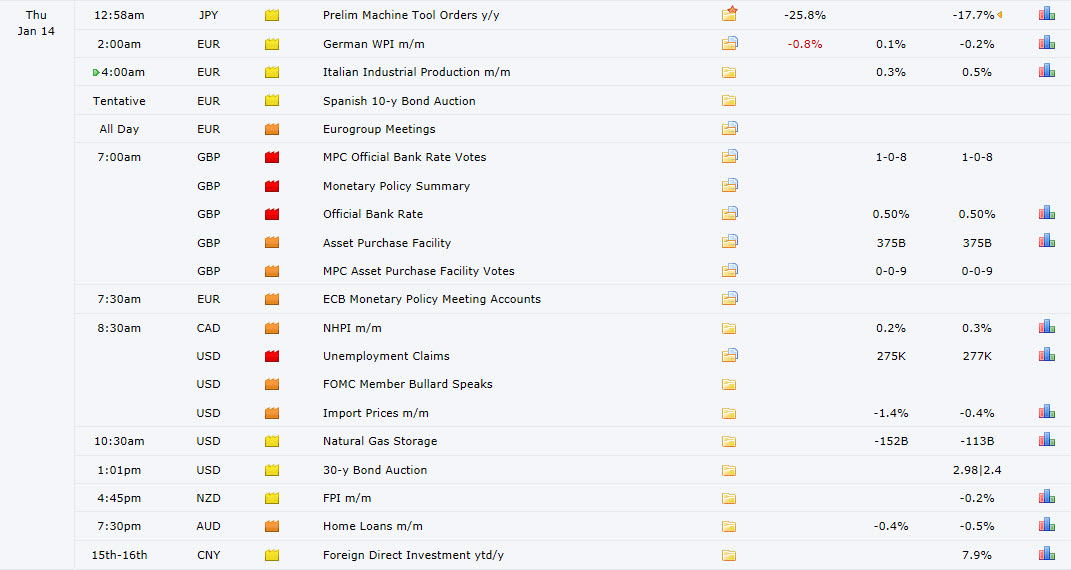

News Releases for Thur January 14 (ET GMT-5:00)

Stocks risk off. FX not yet, but, to follow?

US stocks were certainly back to ‘risk off’ with gusto in the last session but we’re not seeing the follow through action on Forex just yet. The US$ remains range bound and many FX pairs continue to hover near the key levels I’ve been harping on about all week. Whilst FX has yet to follow […]

Credit Suisse cuts GBP/USD forecasts

Credit Suisse cut its 12-M GBP/USD forecast to 1.33 from 1.45 Cut 3-M forecast to 1.40 from 1.48 The post Credit Suisse cuts GBP/USD forecasts appeared first on www.forextell.com.

EURO-DOLLAR: MNI Fundamental levels (orders, options, technicals)

From the FXWW Chatroom – *$1.1035-37 Expiry E2.585BLN *$1.1004 Dec25 high *$1.0992/93 29-28Dec highs *$1.0970/78 Jan11 high/76.4% $1.1060-1.0711 *$1.0934-39 Hourly high Jan11($1.0932 76.4% $1.0970-1.0811) *$1.0900/10 Jan12 high/Strong offers *$1.0878 NY recovery high *$1.0862 Intraday high Asia *$1.0835 ***Current Price 0628GMT Wednesday *$1.0811 Intraday low Asia($1.0810 61.8% $1.0711-1.0970) *$1.0805-03 1.618% swing $1.0841-1.0900/Jan8 low(NFP react) *$1.0800 Demand on approach *$1.0772-71 76.4% $1.0711-1.0970/Jan7 low *$1.0750 Medium demand *$1.0716/11 Jan5/6 lows View further market information in the FXWW Chatroom with a free trial

About Forexsites

Forexsites was established in 2002 and cater primarily for beginner to intermediate traders.

Forexsites offers currency specific information, sector-specific news, and many other useful features helping to create informed trading decisions.

If you are a trader that wants to move to the next level then Forexsites can help through its many worldwide contacts. You may want to enter the Hedge Fund industry but don’t know where to start Forexsites can assist in this process and assess through its contacts whether you have what it takes in this specialist field.

You may be entering the forex markets for the first time and are unsure where to start Forexsites will guide and inform you of what you are doing right and where you are going wrong.

The forex industry is growing daily and there are thousands of sites offering information. Forexsites goal is to deliver information to not only foreign exchange traders but all traders worldwide in a convenient format easily accessed and of consistently high quality.

Follow Forexsites on Twitter. For editorial inquiries please e-mail: [email protected]. For advertising opportunities please email [email protected].