Featured Article

-

Performance Metrics of Su …

FXWW is a provider of professional services as well as being a network of professional traders in the interban …More>> -

Weekly Game Plan 2 Dec 19 …

We enter quite a busy week with central bank meetings, NFP and other data coming up above and beyond the usual …More>>

MOST RECENT ARTICLES

US$ and EUR indices: back within their weekly Flags

USDX Monthly: The July candle closed as a bullish candle, matching in size of the previous monthly bearish candle. The last five months have alternated between bullish and bearish candles. Monthly Ichimoku: The July candle closed above the Cloud. Weekly: Last week’s candle closed as a bearish coloured Doji candle pointing to ongoing indecision. There […]

Stock Index Weekly Market Type Analysis 1/08/2015

Each week I review the current market type and fundamental considerations on a variety of stock and commodity indices. Market type analysis is critical to trade planning. MT = Market Type ( See lesson 8 in the Share Investing Course for Smart People) US Dow Jones – MT is sideways normal. Go long off the bottom […]

Citi techs: Converting GBPUSD short to EURGBP long – FXWW Chatroom

Yesterday we went short GBPUSD at 1.5610 targeting 1.5260-1.5330 with a stop at 1.5720. This trade utilized 15% of capital. The price action today in both EURUSD and EURGBP (and to a certain extent GBPUSD) inclines us to believe that we can see both a USD squeeze lower and a EUR squeeze (higher near term) We are […]

Amazing gap in the eurusd again – FXWW Chatroom

When you become so data dependent, the fed creates market gaps. Yesterday on GDP we traded 60 pct of the daily range in 13 seconds. Today the eurusd gapped from 1.0973 to 1.1020/40 which will be filled, probably not today though, because the market is so wrong footed. So even when we have traded so […]

Citi…Month-End FX Hedge Rebalancing: July 2015 – FXWW Chatroom

This note presents our final estimates of the net currency impact of month-end hedge rebalancing flows for July. The model anticipates net USD selling against G10 currencies except EUR. Indeed, European stocks and bonds have outperformed G10 peers. Therefore we expect net EUR selling from passive investors tracking hedged benchmarks. By contrast Japanese assets have lagged, […]

GS G10 FX – London Spot Trader Views – FXWW Chatroom

Upcoming data prints will be very important with the U. of Michigan Consumer Sentiment and Employment Cost Index (ECI) today. We continue to like EURUSD lower especially if the data delivers. Our favorite commodity currency shorts are AUD and CAD. We are also still short EURGBP. {EU} EURUSD Lower => We like the pair lower from here […]

FX: Option expiries for today’s Friday NY cut (10:00 NY, 15:00 London)

* EUR/USD: $1.0850(E418mn), $1.0900-05(E502mn), $1.1000(E2.47bn) * USD/JPY: Y123.50-70($948mn), Y124.00-15($840mn), Y125.00($1.66bn) * AUD/USD: $0.7250(A$886mn;Barrier expiry A$1.1bn), $0.7275-80(A$591mn) * NZD/USD: $0.6650(NZ$389mn) * USD/CAD: C$1.2900($310mn), C$1.2925-30($700mn), C$1.3000(405mn)

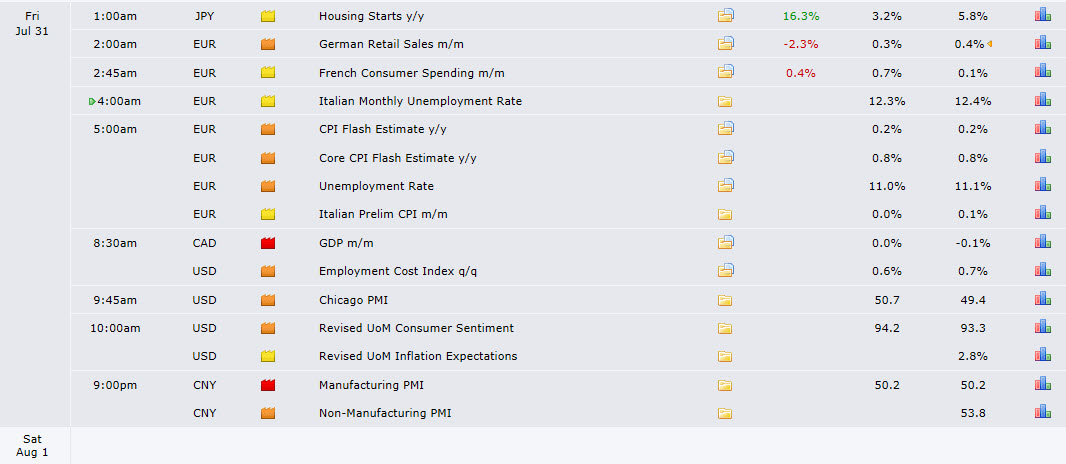

News Releases for Fri July 31 (GMT-5:00 ET)

About Forexsites

Forexsites was established in 2002 and cater primarily for beginner to intermediate traders.

Forexsites offers currency specific information, sector-specific news, and many other useful features helping to create informed trading decisions.

If you are a trader that wants to move to the next level then Forexsites can help through its many worldwide contacts. You may want to enter the Hedge Fund industry but don’t know where to start Forexsites can assist in this process and assess through its contacts whether you have what it takes in this specialist field.

You may be entering the forex markets for the first time and are unsure where to start Forexsites will guide and inform you of what you are doing right and where you are going wrong.

The forex industry is growing daily and there are thousands of sites offering information. Forexsites goal is to deliver information to not only foreign exchange traders but all traders worldwide in a convenient format easily accessed and of consistently high quality.

Follow Forexsites on Twitter. For editorial inquiries please e-mail: [email protected]. For advertising opportunities please email [email protected].