Featured Article

-

Performance Metrics of Su …

FXWW is a provider of professional services as well as being a network of professional traders in the interban …More>> -

Weekly Game Plan 2 Dec 19 …

We enter quite a busy week with central bank meetings, NFP and other data coming up above and beyond the usual …More>>

MOST RECENT ARTICLES

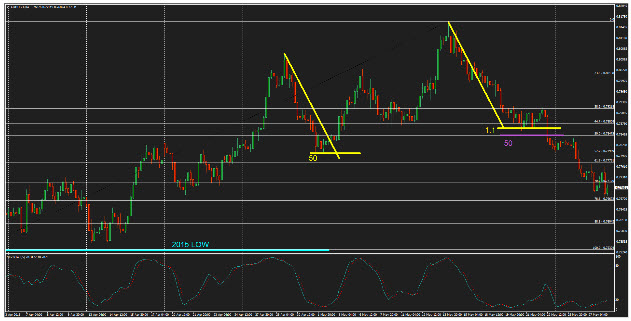

Smart money selling into 0.77600 ahead of Aussie data

AUDUSD H4 After taking out the major 1:1 (Yellow) and 50 Fib (Purple) the Aussie has continued to slid with the bears now pushing for large stops that are likely sitting just below the 2015 lows at 0.75320. AUDUSD H1 The smart money has been seen selling the Aussie on a number of 1:1 rally’s […]

What I Wish I Knew When I First Started Trading – Part 2

If you have not read the first part of the article, I suggest you do so here. Here are a few more things that I wish I knew when I first started out. Simplify… but not so much that your strategy does not work I’m sure you have heard it’s best to keep things simple […]

BNP Paribas: Go long USD/NOK

We enter a long USDNOK trade recommendation at 7.8030, targeting 8.1500, with a stop placed at 7.6900. Upcoming event risk, the relative rate outlook, positioning and technicals all support a rise in USDNOK. We expect the Norges Bank to cut rates next month. In addition, we expect OPEC to maintain its current production target at […]

CitiFX Techs recommend short EUR/USD

CitiFX: short EUR/USD at 1.0900. Stop 1.1115,. Target zone 1.0458/1.0521 The post CitiFX Techs recommend short EUR/USD appeared first on www.forextell.com.

Citibank remains Nr. 1 FX dealing bank

Citibank remains the #1 FX dealing bank Deutsche Bank is still the #2, followed by Barclays and JP Morgan UBS takes the 5th spot, followed by BofA Euromoney estimates that electronic platforms now handle 53.2 % of all FX transaction The estimated volume of the FX market is $5.3 trillion per day Full story: http://www.bloomberg.com/news/articles/2015-05-26/electronic-trading-takes-over-currency-market-roiled-by-scandals […]

FX: most pairs holding up pretty well considering

I posted a separate article about the US$ index this morning and suggested watching for any break up through the 61.8% fib. This resistance seems to be keeping the index in check for the time being and this has meant that the expected FX vulnerability with the stronger US$ hasn’t taken a strangle hold grip […]

Aussie stocks worth noting as May draws to a close

Some Aussie stocks/ETFs worth watching as May draws to a close and as key support seems to be holding. Note how some of the Mining/Resource stocks are starting to look interesting again! First off though let’s look at a few of the main indices; XAO, XJO and XSO: XAO weekly: All Ordinaries: the 61.8% fib […]

US$: stuck under 96.50

The US$ remains stuck under the 96.50 S/R level and the lack of activity here continues to drive action, or lack thereof, with FX. Silver and Gold are both consolidating in triangle patterns though so any trend line breakout with momentum might be worth watching for on these two. USDX daily: the 96.50 was the neck […]

About Forexsites

Forexsites was established in 2002 and cater primarily for beginner to intermediate traders.

Forexsites offers currency specific information, sector-specific news, and many other useful features helping to create informed trading decisions.

If you are a trader that wants to move to the next level then Forexsites can help through its many worldwide contacts. You may want to enter the Hedge Fund industry but don’t know where to start Forexsites can assist in this process and assess through its contacts whether you have what it takes in this specialist field.

You may be entering the forex markets for the first time and are unsure where to start Forexsites will guide and inform you of what you are doing right and where you are going wrong.

The forex industry is growing daily and there are thousands of sites offering information. Forexsites goal is to deliver information to not only foreign exchange traders but all traders worldwide in a convenient format easily accessed and of consistently high quality.

Follow Forexsites on Twitter. For editorial inquiries please e-mail: [email protected]. For advertising opportunities please email [email protected].