Featured Article

-

Performance Metrics of Su …

FXWW is a provider of professional services as well as being a network of professional traders in the interban …More>> -

Weekly Game Plan 2 Dec 19 …

We enter quite a busy week with central bank meetings, NFP and other data coming up above and beyond the usual …More>>

MOST RECENT ARTICLES

AUD/USD challenges 100-day moving average as buyers eye further upside extension By Justin Low

AUD/USD approaches a key resistance level, can buyers find enough conviction to break the bearish hold? Buyers are continuing to keep the upside momentum from last week as price is now challenging a move above the 100-day MA (red line) @ 0.6858. If they can hold a break above that, it will see the bearish […]

Dollar Had A Poor Week But Technicals Warn Against Chasing It Much Further By Marc Chandler

The dollar fell against the major currencies, but the dollar and {{|Norwegian krona}}, and slippage against the yen was minor around 0.15%. The krone’s weakness was notable. It lost 0.9% against the dollar to trade at 18-year lows. It lost around 2% against the euro to trade at record lows. It is difficult to identify the fundamental driver as the […]

THE POLITICAL CIRCUS IN THE UK MOVES ON AGAIN By Scott Pickering

Well, there I was up at 4AM this morning, coffee ready, dogs out and back ready to watch “Super Saturday” in the UK House of Commons, bringing part one of the BREXIT deal to a conclusion, one way or another with an exit based on a deal with the EU. As usual, the theatrics and […]

Markets Today: Brexit & US-China deal optimism By Rodrigo Catril

The pound has already weakened on the latest Brexit delay. Today’s podcast Overview: Tubthumping EU and US equities end the week on a sour mood. Boeing down 6.8%, soft China GDP not helping either USD eases again on Friday with GBP leading the charge AUD and NZD join the party and make further gains against […]

Weekly Game Plan 30 Sep 19 By Justin Paolini

There wasn’t any market moving news on the weekend, so it will likely be a quiet start on Monday morning. Many analysts are talking about the news that the White House was looking at delisting Chinese firms in US markets, but the FX market isn’t moved by this speculation – traders aren’t buying it, as […]

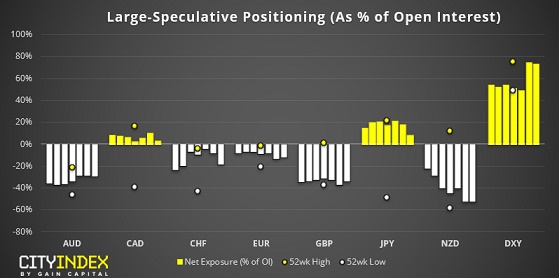

Weekly COT Report: Bullish Exposure To USD Hits A 3-Month High By Matt Simpson

As of Tuesday 24th of September: Bullish exposure to the USD is at $17.4 billion, its highest level in 3-months CAD traders reduced net-long exposure by -15.2k contracts, their least bullish positioning since June Net-long exposure to JPY was reduced by 11.1k contracts Bearish exposure to NZD hit a fresh record high DXY: Bullish exposure to […]

Global third-quarter M&A sinks to three-year low amid U.S.-China trade war fears: Reuters

LONDON/NEW YORK (Reuters) – Global mergers and acquisitions (M&A) plunged 16% year-on-year to $729 billion in the third quarter, according to Refinitiv data, the lowest quarterly volume since 2016, as growing economic uncertainty curbed the risk appetite of companies considering deals. Concerns that the trade war between the United States and China has plunged global […]

AUD Under Pressure Ahead Of Tomorrow’s RBA Meeting By Matt Simpson

RBA are expected to cut rate tomorrow by 25 bps, to a new record low of 0.75%. RBA last cut rates back in July, having already done so in June to shave 50 bps over the two months, which takes the total amount of cuts to 14 since their last hike in 2010. Interestingly, if […]

About Forexsites

Forexsites was established in 2002 and cater primarily for beginner to intermediate traders.

Forexsites offers currency specific information, sector-specific news, and many other useful features helping to create informed trading decisions.

If you are a trader that wants to move to the next level then Forexsites can help through its many worldwide contacts. You may want to enter the Hedge Fund industry but don’t know where to start Forexsites can assist in this process and assess through its contacts whether you have what it takes in this specialist field.

You may be entering the forex markets for the first time and are unsure where to start Forexsites will guide and inform you of what you are doing right and where you are going wrong.

The forex industry is growing daily and there are thousands of sites offering information. Forexsites goal is to deliver information to not only foreign exchange traders but all traders worldwide in a convenient format easily accessed and of consistently high quality.

Follow Forexsites on Twitter. For editorial inquiries please e-mail: [email protected]. For advertising opportunities please email [email protected].