Featured Article

-

Performance Metrics of Su …

FXWW is a provider of professional services as well as being a network of professional traders in the interban …More>> -

Weekly Game Plan 2 Dec 19 …

We enter quite a busy week with central bank meetings, NFP and other data coming up above and beyond the usual …More>>

MOST RECENT ARTICLES

Technical Views Majors & Crosses – Danske Bank – FXWW Chatroom

Majors EURUSD: SHORT AT 1.0979 FOR 1.0696 OBJECTIVE, REVISED STOP 1.1039 USDJPY: LONG AT 119.71 FOR INITIAL 121.41, STOP AT 119.08 GBPUSD: LONG AT 1.4835 FOR 1.5203; STOP AT 1.4750 USDCHF: REMOVE SELL .9600, POSS BUY LOWER AUDUSD: BUY AT .7810 FOR .8033; STOP AT .7745 USDCAD: POSS BUY Crosses EURJPY: SHORT AT 131.50 FOR 128.37 OBJECTIVE, STOP 132.15 EURGBP: POSSIBLY BUY EURCHF: SELL AT […]

FX: Option expiries for today’s NY cut (10:00 NY, 15:00 London)

EUR/USD: 1.0800 (1.6BLN), 1.0900 (2.3BLN), 1.1000 (470M), 1.1050 (1.3BLN) USD/CAD: 1.2440-55 (440M), 1.2550 (465M), 1.2570-75 (270M) USD/JPY: 118.50 (400M), 120.00 (1.5BLN), 121.00 (700M)

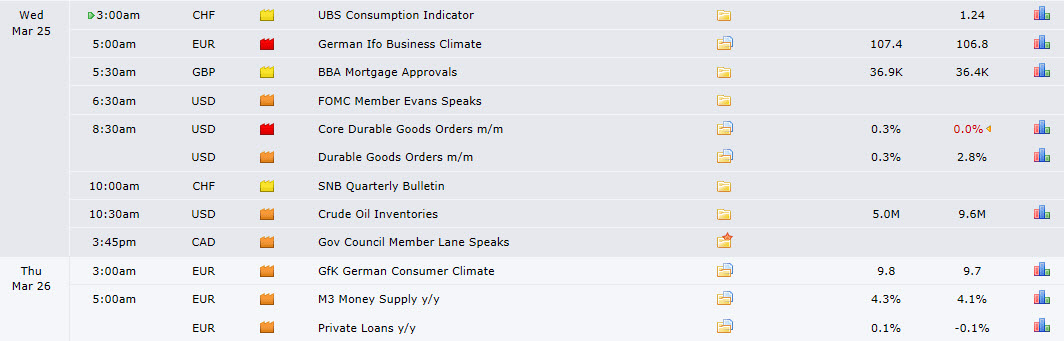

Session Data for Wed Mar 25 (GMT-5:00 ET)

Daily Global Market Wrap – Forex, Commodity & Global Market Strategy Outlook 25 March 2015

Every day the Invast team review the major economic, fundamental and technical events that are important for traders who are looking to trade the global markets, focusing in particular on the Forex & Commodity markets. Daily Global Market Wrap Missed a session? Click Here

Indices/Commodities Outlook by FX Charts

INDICES/COMMODITIES S&P Futures 2085 Equities had a second day of mild losses, closing near the lower end of the 2083/2100 range. There is no real change in view, and given the mixed look of the indicators a neutral stance is still required. Support is seen at the 200 HMA, now at 2078, below which would allow a […]

US$ holds, along with FX, but US Stocks weaken by Mary McNamara

Better than expected US inflation and home sales data has helped to lift the US$ but, despite this good news, US stocks are trading lower given the mixed messaging from recent US$ movement. USDX 4hr: the US$ has held up within a possible Bull Flag but I’m a bit surprised it hasn’t rallied higher given the up-beat US […]

Short-term trading strategies March 25th by Sean Lee

Short GBP/NZD: GBP remains weak on the crosses and looks likely to stay that way. EUR/GBP looks primed to test decent technical resistance levels near .7400 and cable has been consolidating below the psychologically important 1.50 level. It’s a tough ask to buy either EUR or USD in the current environment so either the NZD […]

GS: FX Overviews – FXWW Chatroom

EUR: I expect support back towards 1.0900 and 1.0850 with resistance initially at yesterday’s 1.0972 high and then towards the skittish 1.1050 high seen post the FOMC . JPY: Even a deviation of 0.1% in US CPI would be a surprise assuming of course that the secondary measures support the headline. Resistance well defined at 120.50/60 and […]

About Forexsites

Forexsites was established in 2002 and cater primarily for beginner to intermediate traders.

Forexsites offers currency specific information, sector-specific news, and many other useful features helping to create informed trading decisions.

If you are a trader that wants to move to the next level then Forexsites can help through its many worldwide contacts. You may want to enter the Hedge Fund industry but don’t know where to start Forexsites can assist in this process and assess through its contacts whether you have what it takes in this specialist field.

You may be entering the forex markets for the first time and are unsure where to start Forexsites will guide and inform you of what you are doing right and where you are going wrong.

The forex industry is growing daily and there are thousands of sites offering information. Forexsites goal is to deliver information to not only foreign exchange traders but all traders worldwide in a convenient format easily accessed and of consistently high quality.

Follow Forexsites on Twitter. For editorial inquiries please e-mail: [email protected]. For advertising opportunities please email [email protected].