Featured Article

-

Performance Metrics of Su …

FXWW is a provider of professional services as well as being a network of professional traders in the interban …More>> -

Weekly Game Plan 2 Dec 19 …

We enter quite a busy week with central bank meetings, NFP and other data coming up above and beyond the usual …More>>

MOST RECENT ARTICLES

EURUSD: Euro steadies after Friday’s selloff: by FX Charts

EUR/USD: 1.0855 After initial dip to 1.0822 in early Asian trade the Euro stabilised and recovered mildly, to a high of 1.0905 against dollar, as the ECB commenced its quantitative easing program by purchasing German, Italian, French and Belgian bonds. Elsewhere today, the EU Sentix investor confidence climbed to a 7 year high of 18.6 […]

GBPUSD: Cable higher with cross at new lows as ECB QE begins: by FX Charts

GBP/USD: 1.5129 Cable had a solid session in heading up from a 1.5030 low, to reach 1.5130 where it is closing in NY, assisted by a decent move in the cross with EurGbp heading to a new trend low of 0.7172 as the ECB commenced its QE programme. Given that the next move from the […]

Indices/Commodities Outlook by FX Charts

INDICES/COMMODITIES S&P Futures 2078 The S+P made a bit of a recovery today after holding on above the the 2060 Fibo support at 2061 (38.2% of 1973/2116), in trading to a low of 2065 before squeezing up to a high of 2082. This will remain resistance today, although the short term indicators do point to the […]

AUD/USD – Large option expiries this week: by Milan Cutkovic

Large option expiries noted this week, with A$1 billion expiring tomorrow at 0.7740 and A$1.3 billion at 0.78 on Thursday This might help to keep AUD/USD in a range for a while, unless the employment data on Thursday causes a major move in the pair Dealers saw decent bids from 0.77 down to 0.7680 this […]

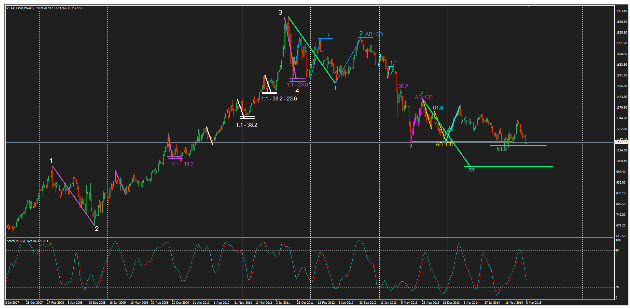

Societe Generale – FX Techs View

Reasserting the overall uptrend, USD/JPY has given a break above the triangle within which the consolidation since last December evolved. Daily RSI is breaking above a horizontal resistance which gives credence to price break. The pair looks poised to retest previous highs of 121.50/85 and will even probably head towards 2007 highs of 124, also […]

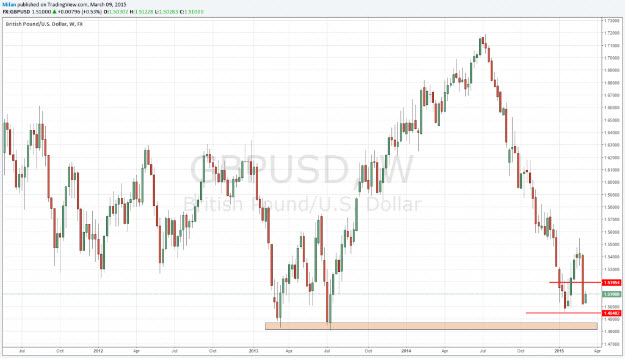

GBP/USD looking oversold s/t by Milan Cutkovic

Cable had a decent bounce off the 1.5025 support area today The pair failed to sustain momentum above 1.51, but is heavily oversold in the short-term and there is decent risk of a short squeeze 1.5190/1.52 is the next major resistance area That being said, the overall trend remains clearly negative and selling large rallies […]

Morgan Stanley Trade Idea of the Week: Sell GBP/USD

Sell GBPUSD at 1.51, target 1.47, stop at 1.53 GBP/USD is currently trading at 1.5110 The post Morgan Stanley Trade Idea of the Week: Sell GBP/USD appeared first on www.forextell.com.

Gold set to test lower levels on a break of 1130.00 by Reece Marini

GOLD Weekly Gold continues to trade on the heavy side with traders now pushing for large stops that are likely sitting below the 61.8 Fib at 1130.00, this level offered solid support back on 02/11/14. A break of this 61.8 fib opens up the door for a much larger correction to take place, with the […]

About Forexsites

Forexsites was established in 2002 and cater primarily for beginner to intermediate traders.

Forexsites offers currency specific information, sector-specific news, and many other useful features helping to create informed trading decisions.

If you are a trader that wants to move to the next level then Forexsites can help through its many worldwide contacts. You may want to enter the Hedge Fund industry but don’t know where to start Forexsites can assist in this process and assess through its contacts whether you have what it takes in this specialist field.

You may be entering the forex markets for the first time and are unsure where to start Forexsites will guide and inform you of what you are doing right and where you are going wrong.

The forex industry is growing daily and there are thousands of sites offering information. Forexsites goal is to deliver information to not only foreign exchange traders but all traders worldwide in a convenient format easily accessed and of consistently high quality.

Follow Forexsites on Twitter. For editorial inquiries please e-mail: [email protected]. For advertising opportunities please email [email protected].