Featured Article

-

Performance Metrics of Su …

FXWW is a provider of professional services as well as being a network of professional traders in the interban …More>> -

Weekly Game Plan 2 Dec 19 …

We enter quite a busy week with central bank meetings, NFP and other data coming up above and beyond the usual …More>>

MOST RECENT ARTICLES

Markets Today: will Lowe signal RBA rate cut? By Tapas Strickland

RBA Governor Philip Lowe is talking in Armidale later today. Today’s podcast Overview: Chain reaction – services now feeling the chill German PMI disappoints with manufacturing at 41.4 and weakest in 10 years EUR down -0.5% initially, before clawing back losses to be -0.2% at 1.0997 More worryingly the services sector is now feeling the […]

Where to rebuy AUDNZD By Tony Sycamore

If we were to narrow down our best trade ideas to complete a trade review for the year thus far, AUDNZD would feature prominently as two breakout type trades played out in almost textbook precision. After AUDNZD last week all but reached the 1.0850 target mentioned in this article https://www.cityindex.com.au/market-analysis/audnzd-trade-receives-a-boost/ we discuss two upcoming tier-one macro events […]

US Economic Update – September 2019: NAB

Economy tracking OK but trade & other headwinds will take their toll. The US economy still appears to be growing at a reasonable pace, but trade headwinds continue to strengthen. While consumers have been resilient, trade and other factors are weighing on business investment which is likely to result in a period of modestly below […]

Global Daily – Eurozone recession risks rise: ABN AMRO

Euro Macro: Eurozone PMIs signal that weakness is spreading to the domestic economy – The eurozone composite PMI dropped to 50.4 in September, down from 51.9 in August. The indicator has fallen to its lowest level since July 2013, as the weakness that started in the manufacturing sector and trade is spreading to domestic demand and […]

Shedding Light on Volatility Breakouts and Cycles By Justin Paolini

Recently I’ve helped a few upcoming traders in our System Development Workshop develop their volatility breakout strategies. When building strategies, there is a natural tendency to focus on the entry first and foremost, and almost disregard the fact that setup conditions and trade management are actually more important. We noted previously that most retail traders tend to […]

Gloomy European Data Hits Stocks as Bonds Advance: Markets Wrap: Bloomberg

Lousy PMI numbers knock confidence despite trade fears easing Gold turns higher; Asia markets are mixed with Tokyo closed European stocks declined and U.S. equity futures reversed an advance as disappointing data in the euro area overshadowed easing concerns about relations between America and China. Treasuries turned higher and the common currency slid. Manufacturing and […]

Look For Yuan Weakness, Yen Strength To Begin The Week By Marc Chandler

The Japanese yen and Canadian dollar were the only major currencies to gain against the U.S. dollar last week. They are also the only major currencies to appreciate against the dollar so far this year. U.S. President Trump’s apparent playing down of the pressure to strike a partial deal with China before the 2020 election weighed on stocks and lifted the so-called […]

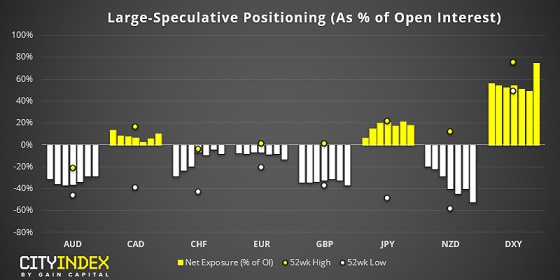

Weekly COT Report: Dollar Bears Throw In The Towel: CityIndex

As of Tuesday 17th September: Traders increased net-long exposure to the USD by $2.2 billion, taking bullish exposure to a 3-month high of $15.4 billion Bullish exposure to the USD index (DXY) was at a 29-month high Traders were the least bearish on AUD in 6-months Net-short exposure on NZD hit a record high DXY: Traders are […]

About Forexsites

Forexsites was established in 2002 and cater primarily for beginner to intermediate traders.

Forexsites offers currency specific information, sector-specific news, and many other useful features helping to create informed trading decisions.

If you are a trader that wants to move to the next level then Forexsites can help through its many worldwide contacts. You may want to enter the Hedge Fund industry but don’t know where to start Forexsites can assist in this process and assess through its contacts whether you have what it takes in this specialist field.

You may be entering the forex markets for the first time and are unsure where to start Forexsites will guide and inform you of what you are doing right and where you are going wrong.

The forex industry is growing daily and there are thousands of sites offering information. Forexsites goal is to deliver information to not only foreign exchange traders but all traders worldwide in a convenient format easily accessed and of consistently high quality.

Follow Forexsites on Twitter. For editorial inquiries please e-mail: [email protected]. For advertising opportunities please email [email protected].