The US$ is back down near its recent low and this is the level to watch for any new make or break. The weakness this week enable numerous trend line breakouts, however, the nasty spike following US CPI plagued these moves.

Data: watch today with NZ Business Manufacturing Index data, an AUD RBA Gov Lowe speech, GBP Retail Sales and USD Building Permits data.

USDX weekly: back hovering near the weekly chart’s 50% fib support so watch this for any new make or break:

USDX daily: watch for any Double Bottom at this recent support:

Trend line breakouts and TC signals: there were trend line breakouts but these were upset by the post CPI spike:

Gold 4hr: 250 pips and the all-important $1,400 S/R level is now just ahead:

EUR/USD 4hr: 230 pips and the all-important 1.260 S/R level is now just ahead:

AUD/USD 4hr: 140 pips and the all-important 0.80 level is now just ahead:

NZD/USD 4hr: 130 pips and the all-important 0.74 S/R level is now just ahead:

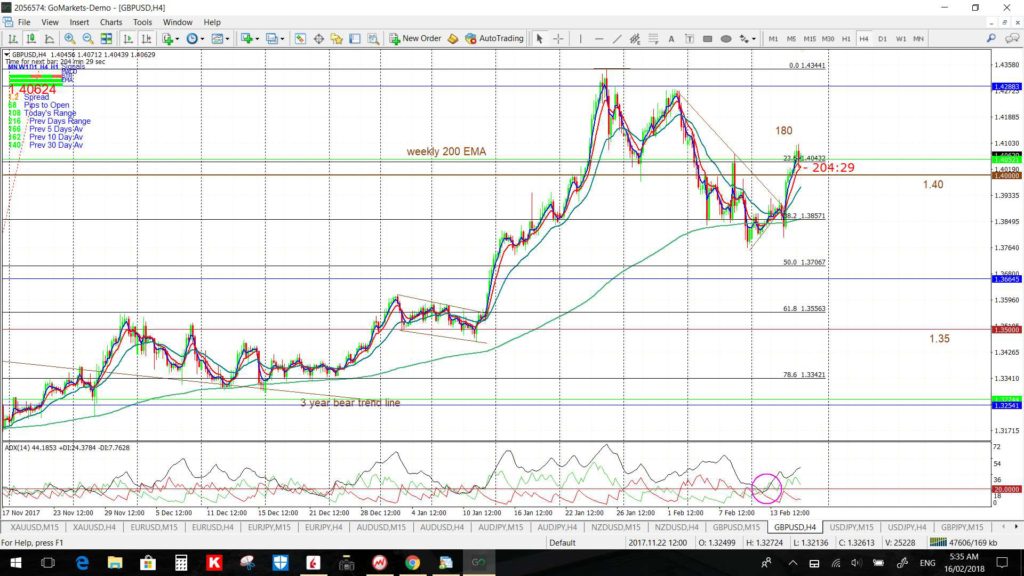

GBP/USD 4hr: 180 pips and is now sitting at the weekly 200 EMA level near 1.40 S/R:

USD/JPY 4hr: 160 pips but watch for any new make or break now that the U/J is down near the weekly chart’s support triangle trend line:

GBP/JPY 4hr: 170 pips and this is now back near the all-important 150 level:

Oil 4hr: 250 pips and this is now back above the all-important $60 S/R level:

BTC/USD daily: I had warned on the w/e to watch for any base at $8,000 and I was spot on!