The US$ has closed higher for the week and back above the 92.50 support level. The weekly candle, whilst green, isn’t too inspiring though with its indecision-style ‘Spinning Top’ appearance and almost ‘Inside’ candle formation. We really need to see the colour and shape of the next weekly candle to be able to form any real opinion about the next directional move for the index.

USDX weekly: the index printed a bullish coloured candle and carved this out to close back above 92.50 support. I do note the ‘Shadows’ on this candle and almost ‘Inside’ candle formation as reflecting indecision here. Next week’s candle might help to clarify the situation.

Recall: the US$ longer-term uptrend remains intact until such time as it breaks and holds below the 61.8% fib of the 2014-2016 weekly swing high and this level is down near 84.50.

Also, keep note of the fact that the Fibonacci retracement on the recent swing low move, since the start of 2017, has the 61.8% fib level up near the previous S/R level of 100. I will be watching this 100 level if there is any recovery move.

Keep watch of the following levels in coming sessions:

- the weekly 200 EMA: price remains below this major level.

- the S/R level of 92.50: this remains the level to watch in coming sessions for any new make or break.

- the bottom trend line of the symmetrical wedge pattern.

- the longer-term weekly swing high 50% Fibonacci level; down near 88.

- the longer-term weekly swing high 61.8% Fibonacci level; down near 84.50.

- the recent weekly swing low 61.8% Fibonacci level; up near 100 if there is any recovery move.

EURX weekly: The EURX has printed a bearish weekly candle, albeit an almost ‘Inside’ candle, but this is only the fourth such candle of the last twenty!

This index has been in a long uptrend and a pause or pullback would not be out of order here, even if there is to be a longer-term recovery move. I note the 61.8% fib of this recent swing high move is down near previous S/R around 101.5 and the weekly 200 EMA and this would be in focus if there is any correction move to the downside:

FX Index alignment: the FX Indices are NOT currently in any alignment.

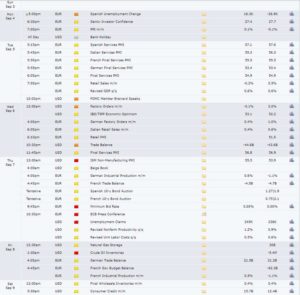

Calendar: the main high impact piece of data for next week is the EUR ECB interest rate announcement and Press Conference.