-

Crude fluctuates after falling into bear market this week

-

Australian shares rebound while European equities retreat

The yen strengthened and gold rose for a second day as oil languished in a bear market. Global stocks were mixed.

West Texas Intermediate crude fluctuated amid speculation that rising U.S. output will blunt OPEC-led efforts to trim a global glut. Energy shares led declines in Europe while technology companies gave a lift to Asian equities. Australian shares bounced back after the biggest drop since November. The yen headed for its longest winning streak since May, while gold continued to climb from a one-month low.

The oil rout is raising the chance that inflation will be harder to come by, adding to concerns at the world’s most influential central banks. The weakness in crude and other commodities dents arguments from U.S. Federal Reserve officials that weak inflation rates will be transitory, even as the economy shows few signs of distress. More reaction from central bank policy makers may come from Jerome Powell, James Bullard and Loretta Mester who are all due to speak this week.

Investors are also watching negotiations on Britain’s split with the European Union. Prime Minister Theresa May, in the first EU summit since the election, will outline how the U.K. proposes to treat the bloc’s citizens after it leaves. While the week’s opening round of talks was considered to be constructive, diplomats said May’s plan for expats may lay bare the divisions between them.

Read our Markets Live blog here.

Here’s what’s ahead for investors on Thursday:

- Fed Governor Powell speaks at a hearing of the Senate Banking Committee in Washington.

- The Fed releases results of part one of its annual bank stress tests, after the close of U.S. markets.

- Mexico’s central bank will probably raise its key rate for a seventh straight meeting, as inflation has more than doubled in the last year.

Here are the main market moves:

Commodities

- West Texas oil slipped 0.1 percent to $42.48 a barrel as of 8:35 a.m. in London, after climbing as much as 0.5 percent earlier. Crude tumbled 2.3 percent in the previous session.

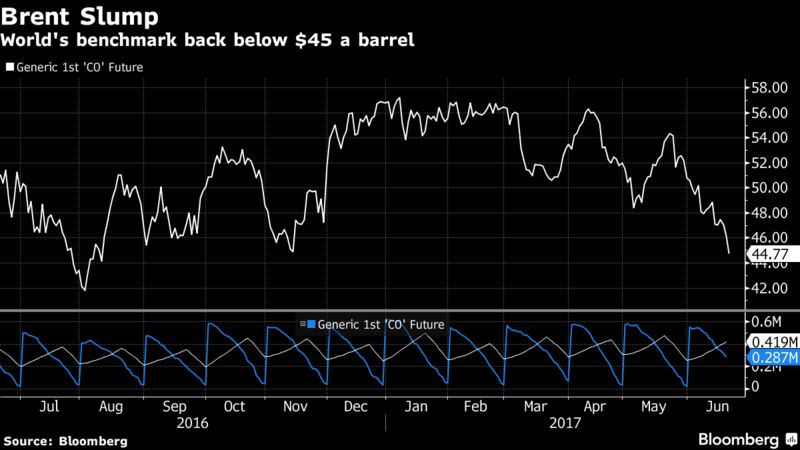

- Brent crude slipped 0.1 percent after entering a bear market Wednesday, plunging below $45 a barrel for the first time since November.

- Gold climbed 0.5 percent to $1,252.74 an ounce, extending gains after halting a five-day slide on Wednesday.

Stocks

- The Europe Stoxx 600 fell 0.3 percent, dropping for a third straight session.

- The MSCI Asia Pacific Index rose 0.5 percent, led by financial and technology shares.

- Australia’s S&P/ASX 200 Index jumped 0.7 percent, after tumbling 1.6 percent on Wednesday to erase its gain for the year. Japan’s Topix fell 0.1 percent after fluctuating throughout the day.

- Hong Kong’s Hang Seng was little changed, after jumping as much as 0.7 percent earlier in the day. The Shanghai Composite Index slipped 0.3 percent, after climbing yesterday on MSCI Inc.’s decision to include mainland shares in its indexes. The CSI 300 Index, which includes A-shares slated for inclusion in the indexes, erased almost all of a 1.3 percent gain.

- Futures on the S&P 500 Index fell 0.1 percent. The underlying gauge fell 0.1 percent on Wednesday, with Exxon Mobil Corp. and Chevron Corp. contributing the most to the decline. The Nasdaq 100 Index climbed 1 percent, continuing its rebound from a two-week selloff. It’s still 1.8 percent away from its June 8 high.

Currencies

- The yen climbed 0.3 percent to 111.04 per dollar, strengthening for a third day. The kiwi rose 0.4 percent to 72.54 U.S. cents after the nation’s central bank maintained its neutral policy stance.

- The Bloomberg Dollar Spot Index fell 0.1 percent. The South Korean won and Mexican peso gained at least 0.3 percent and the South African rand jumped 0.7 percent.

- The pound rose less than 0.1 percent to $1.2677 after jumping 0.3 percent on Wednesday. Bank of England chief economist Andy Haldane said that the risks of leaving policy tightening too late are rising, contrasting sharply with the tone set by the bank’s Governor Mark Carney just the day before.

- The euro was little changed at $1.1166.

Bonds

- The yield on 10-year Treasuries fell two basis points to 2.15 percent. U.K. benchmark yields also dropped two basis points.

- Yields in France and Germany were down one basis point.

By Adam Haigh June 22, 2017, 5:36 PM GMT+10

Source: Bloomberg