-

U.S. stocks retreated for a second session; oil fluctuates

-

Treasury yields tick higher as focus stays on Powell testimony

Asian stocks were set for a muted start to trading as their U.S. counterparts slipped and Treasuries edged lower. The yen held near a four-week low.

Futures ticked higher in Japan and Hong Kong, and were little changed in Australia. U.S. equities fell for a second day Monday as investors took a cautious approach at the start of a week full of central bank activity. Shorter-term Treasuries fell more than longer-dated ones, gold slipped fell for a third day, and the dollar edged higher versus major peers.

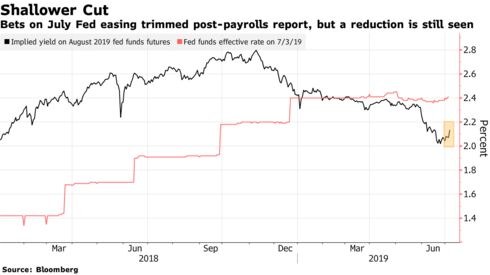

Investors are waiting for testimony this week from Federal Reserve Chairman Jerome Powell for clues on the likely path of U.S. rate cuts. The latest payroll report signaled that the American economy remains on track, increasing uncertainty over what to expect from the Fed’s July meeting. In Asia, rising tensions between Japan and South Korea have added to existing headwinds for trade and added to challenges for the tech industry.

Elsewhere, the Stoxx Europe 600 Index slipped, with Deutsche Bank AG surrendering earlier gains as traders weighed a plan to cut its workforce by one-fifth. Greek bonds rose amid hope a new government elected over the weekend will prove to be market-friendly. Oil fluctuated as economic anxiety hung over the market.

Here are some key events coming up:

- U.K. Conservative Party members start voting Monday to choose Theresa May’s successor. Front-runner Boris Johnson and Jeremy Hunt will appear at events through the week, including a televised debate on July 9.

- Federal Reserve Chairman Jerome Powell testifies before Congress on monetary policy and the state of the U.S. economy on Wednesday (the House of Representatives) and Thursday (the Senate).

- Fed minutes are due on Wednesday, ECB minutes on Thursday.

- A key measure of U.S. inflation — the core consumer price index, due Thursday — is expected to have increased 0.2% in June from the prior month, while the broader CPI is forecast to remain unchanged.

- U.S. producer prices are due on Friday.

Here are the main moves in markets:

Stocks

- Nikkei 225 futures rose 0.3%.

- Hang Seng futures rose 0.2%.

- S&P/ASX 200 futures were little changed.

- The S&P 500 Index decreased 0.5% Monday, the Nasdaq Composite lost 0.8%.

- The Stoxx Europe 600 Index declined 0.1%.

Currencies

- The Bloomberg Dollar Spot Index gained 0.1% Tuesday.

- The euro was little changed $1.1218.

- The Japanese yen was flat at 108.70

- The offshore yuan was little changed at 6.8882 per dollar.

Bonds

- The yield on 10-year Treasuries rose more than one basis point to 2.05% Monday.

Commodities

- West Texas Intermediate crude dipped 0.2% to $57.54 a barrel Tuesday.

- Gold was little changed at $1,395.70 an ounce.

By Laura Curtis and Cormac Mullen

— With assistance by Emily Barrett

9 July 2019, 08:22 GMT+10

Source: Bloomberg

Elsewhere, the Stoxx Europe 600 Index slipped, with Deutsche Bank AG surrendering earlier gains as traders weighed a plan to cut its workforce by one-fifth. Greek bonds rose amid hope a new government elected over the weekend will prove to be market-friendly. Oil fluctuated as economic anxiety hung over the market.