Featured Article

-

Performance Metrics of Su …

FXWW is a provider of professional services as well as being a network of professional traders in the interban …More>> -

Weekly Game Plan 2 Dec 19 …

We enter quite a busy week with central bank meetings, NFP and other data coming up above and beyond the usual …More>>

MOST RECENT ARTICLES

Macro Weekly – Mixed data: ABN AMRO

Weak Chinese data suggest trade deal crucial Germany escapes another quarter of small contraction Further monetary easing postponed 191115-Macro-Weekly.pdf (180 KB) Download My colleague Arjen van Dijkhuizen commented on ‘hard’ Chinese data already: here. Industrial production growth fell back to 4.7% yoy in October, down from 5.8% in September. Retail sales growth fell back to 7.2% […]

I Have Quadrupled My Account, Now What? By Justin Paolini

Recently I was contacted by two former coaching students, who both wanted to discuss the same issue: a sort of “fear of heights”. After a decent run-up in their equity curve, they started to feel dizzy and fearful of “giving it back”. In particular, one trader has quadrupled his account balance over the past 8 […]

What implied volatility says about the week ahead By Chris Weston

A look at the week starting November 4 I have put together a few thoughts in this video on the trading week ahead. If you have a 15 minutes, then the idea of the video is to prepare and to specifically help with your risk and position sizing, which is fundamental to trading. As always, […]

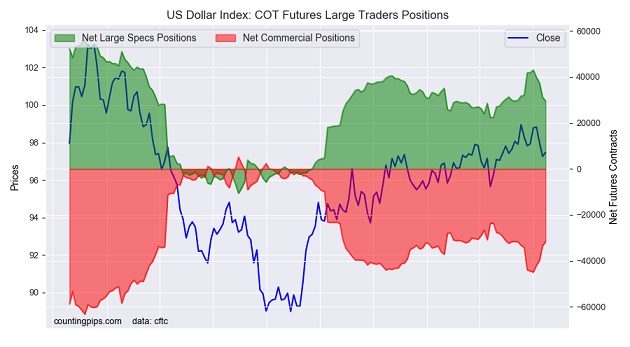

U.S. Dollar Index Speculative Bets Dip To 10-Week Low By Zachary Storella

US Dollar Index COT Futures Large Traders Positions US Dollar Index Speculator Positions Large currency speculators continued to cut back on their bullish net positions in the US Dollar Index futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday. The non-commercial futures contracts […]

Brexit Will Happen Fast If Tories Win, Johnson Tells Express: Bloomberg

U.K. Prime Minister Boris Johnson will push his Brexit deal through Parliament “very fast” and avoid any further dithering if his Conservative Party wins the general election on Dec. 12, he told the Sunday Express newspaper in an interview. The U.K. will have the chance not just to do a free trade deal with the […]

US Economic Update – October 2019 By NAB Group Economics

US growth has slowed, but remains solid. While US GDP growth has slowed, it remains solid. Consumers continued to be the main driver of growth while business investment was again weak. Due to the slightly better than expected Q3 result, we have revised up our year-average GDP growth forecasts to 2.3% in 2019 and 1.7% […]

Macro Weekly – Fed cuts and pauses, US and eurozone GDP marginally better: ABN AMRO

US and eurozone GDP data marginally better than expected Some sign of life in key Chinese PMI Fed cuts and pauses Hong Kong shows what unrest can do 191101-Macro-Weekly.pdf (204 KB) Download US GDP growth amounted to 1.9% qoq annualised in Q3. That was a touch better than expected, but lower than the last couple […]

BOJ warns economy vulnerable to riskier lending practices of financial firms: Reuters

TOKYO (Reuters) – The Bank of Japan on Thursday warned the country’s banking system is becoming increasingly fragile as financial institutions boost risky lending and investment in an environment of prolonged ultra-low interest rates. “Credit costs remain low but have recently started to rise, particularly for regional financial institutions,” the BOJ said in a semi-annual […]

About Forexsites

Forexsites was established in 2002 and cater primarily for beginner to intermediate traders.

Forexsites offers currency specific information, sector-specific news, and many other useful features helping to create informed trading decisions.

If you are a trader that wants to move to the next level then Forexsites can help through its many worldwide contacts. You may want to enter the Hedge Fund industry but don’t know where to start Forexsites can assist in this process and assess through its contacts whether you have what it takes in this specialist field.

You may be entering the forex markets for the first time and are unsure where to start Forexsites will guide and inform you of what you are doing right and where you are going wrong.

The forex industry is growing daily and there are thousands of sites offering information. Forexsites goal is to deliver information to not only foreign exchange traders but all traders worldwide in a convenient format easily accessed and of consistently high quality.

Follow Forexsites on Twitter. For editorial inquiries please e-mail: [email protected]. For advertising opportunities please email [email protected].