-

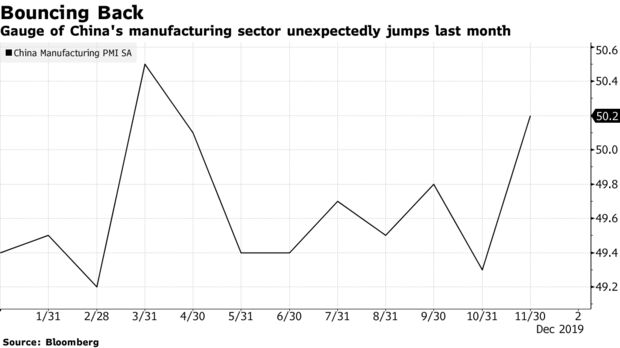

China manufacturing PMI beat all estimates in Bloomberg suvey

-

U.S. Treasuries tumble, sending 10-year yields to 1.81%

Financial markets started December with a risk-on mood in Asia following a better-than-expected reading on Chinese manufacturing that added to evidence the global economy is turning a corner.

Japanese stocks led equity gains across the region, while S&P 500 Index futures edged up. Ten-year Treasury yields climbed to 1.81%, and their Japanese counterparts ticked up closer toward zero. The yen retreated. Sentiment could still be kept somewhat in check by the continuing lack of closure on a U.S.-China trade deal. China’s Global Times underscored that its government wants tariffs to be rolled back as part of “phase one.”

The so-called official China manufacturing purchasing-manager index exceeded all estimates in a Bloomberg survey, and suggested an acceleration in activity in November. A private gauge released Monday also showed an increase.

“This improvement in the manufacturing PMI is important because we can say with more certainty, than at the beginning of the year, that China’s macro outlook is indeed stabilizing,” said Aninda Mitra, senior sovereign analyst at BNY Mellon Investment Management.

Also looming on the data front this week are readings on American manufacturing and employment. Meantime, Black Friday hit a record $7.4 billion in U.S. online sales.

Hong Kong shares had modest gains, even after clashes between protesters and police resumed over the weekend. Elsewhere, oil prices recouped some of their 5%-plus sell-off on Friday.

Here are some key events coming up this week:

- U.S. ISM manufacturing and construction spending on Monday.

- Saudi Aramco’s initial public offering is scheduled to be priced on Thursday.

- Friday brings the U.S. jobs report, where estimates are for nonfarm payrolls to rise by 190,000 in November.

These are the main moves in markets:

Stocks

- Japan’s Topix index added 1% at the 3 p.m. close in Tokyo.

- South Korea’s Kospi climbed 0.1%.

- The Shanghai Composite Index rose 0.1%.

- Hong Kong’s Hang Seng Index gained 0.4%.

- Futures on the S&P 500 rose 0.3%. The underlying gauge slipped 0.4% on Friday.

- Euro Stoxx 50 futures advanced 0.2%.

Currencies

- The yen dipped 0.1% to 109.62 per dollar.

- The offshore yuan held at 7.0308 per dollar.

- The pound slid 0.1% to $1.2917.

- The euro was at $1.1019.

- Bloomberg Dollar Spot Index was little changed.

Bonds

- The yield on 10-year Treasuries climbed three basis points to 1.81%.

- Australia’s 10-year yield rose about six basis points to 1.09%.

Commodities

- West Texas Intermediate crude rose 1.7% to $56.13 a barrel.

- Gold slipped 0.3% to $1,459.41 an ounce.

By Adam Haigh

Updated on

Source: Bloomberg