It’s an important week for Australian markets, with a slew of data today, GDP released on Wednesday and the RBA meeting between them.

Today’s podcast

Overview: Even The Losers

Baby, even the losers get lucky sometimes, Even the losers keep a little bit of pride – Tom Petty & the Heartbreakers

Global equities drifted lower on Friday with a subdued US market following Europe and Asia after Thanksgiving on Thursday. Excluding China, November was a good month for equity investors with the US leading the charge. UST yield hardly moved on Friday, but moved higher over the month while AU bond futures underperformed on Friday, but outperformed in November. It was a quiet Friday in FX land with NOK the underperformer following a sharp decline in oil prices as Saudi Arabia and Russia suggest no output cuts are likely this week. The USD had a strong November while NZD and SEK where the G10 outperformers and AUD was the big loser. This morning, GBP has opened lower as weekend polls suggest a narrowing in the Conservative lead while NZD is higher as NZ Finance Minister Robertson signals “significant” fiscal package.

The S&P 500, Nasdaq and Dow fell around 0.40% on Friday in a low trading volume and shortened trading day. Earlier in the session Asia and European markets also traded with a negative tone. Still when we look at equity performance for the month, excluding China, November was a good month for equity investors. The US led the charge with the NASDAQ up 4.5% while the S&P and Dow gained 3.40% and 3.70% respectively. In contrast the Shanghai Composite lost 1.95%in November.

After 6 months in contraction China’s official manufacturing PMI surprised on Saturday printing at 50.2 vs 49.5 expected while the non-manufacturing index came at 54.4, its highest reading since March and above the 53.1 expected. The move back into expansionary mode in China’s official manufacturing PMI is good news, but under the hood the sub-indices painted a mixed picture. The new export orders sub-index climbed to a seven-month high at 48.8, but it still remains in contraction while the Employment subindex was unchanged at 47.3. Part of the jump in the output component can be attributed to the increase in working days in November relative to the holiday affected month of October. Some commentators have also noted the milder-than-usual weather for this time of the year as another positive factor. The good PMI news are also somewhat tempered by the facts China’s industrial sector is still besieged by deflationary risks and rising borrowing costs while the domestic consumer remains constraint by higher food prices.

The big mover on Friday was oil, with WTI falling 5% and Brent 4.4% lower. The expectation is that OPEC+ will delay any further supply cuts at its meeting this week and media reported that Saudi Arabia would tell other members it was no longer willing reduce its own production to compensate for above-quota production from others in the group. The reduced liquidity on Friday might have exaggerated the moves and looking at the month of November, oil prices still managed to record gains (Brent +3.65% and WTI +1.83%).

US Treasury yields barely moved on Friday, but looking at November UST yields closed higher with the 5y tenor up 10bps to 1.627% while the 10y bond gained 8.50bps to 1.777%. AU Bond futures underperformed on Friday, but were the clear outperformers on the month down, down 10.5 bps in yield terms, closing the month at 1.0325%.

FX moves were pretty subdued on Friday with NOK the one exception, falling 0.60% to 9.2248 on the back the sharp decline in oil prices. That said, NOK as opened stronger this morning (9.2019), suggesting lack of liquidity and month end flows might have been at play. The USD hit a six-week high in the London afternoon, before reversing course and ending narrowly lower on the day. Nevertheless, November was a good month for the greenback, up index terms and outperforming most major and EM currencies (for the month DXY gained 0.95%, BBDX was +1.11 and EMCI was -1.98%).

The AUD and NZD were little changed on Friday, but on the month, the NZD was the second-best performing currency, up 0.14% despite the broad-based USD strength, and only lagging the Swedish krona (+0.80%) . The AUD was the worst performing currency, down 1.9%, with Governor Lowe’s clarification that the effective lower bound in Australia was 0.25% and QE would be considered after that point weighing on the currency. The AUD opened the month of November just under the 69c mark and it closed the month at 0.6771.

Meanwhile the NZD has opened the new month on a bullish mood, jumping about 20 pips to 0.6432 following weekend comments from the government. In a speech to the Labour Party annual conference over the weekend NZ Finance Minister Grant Robertson signalled a major fiscal stimulus package, focused on infrastructure. Robertson said “we are currently finalising the specific projects that the package will fund but I can tell you this – it will be significant.” The details will be released at the Half-Year Economic and Fiscal Update (HYEFU) on 11th of December although Jacinda Ardern revealed that the government will provide $400m for state schools to upgrade their property. Some of the questions include to what extent the government will be able to meet its infrastructure Wishlist, given tight capacity constraints in the economy, especially in construction, the size of infrastructure investment planned, and whether it is funded on the Core Crown balance sheet or not. As always the devil will be in the detail.

The other big mover this morning, albeit in the opposite way, has been the 18pips decline in GBP to 1.2915. Cable has opened the new week under pressure following weekend polls showing the Labour Party gaining ground on the Tories in four of five polls with less than two weeks to go until the UK election.

In other news, Germany looks to be entering a period of political instability with Merkel’s Coalition under threat as newly elected SPD leader threatens to pull out. Over the weekend the Norbert Walter-Borjans and lawmaker Saskia Esken were chosen as the new party leaders, both are outspoken critics of the government. In his victory speech Walter-Borjans demanded Merkel review the government’s balanced-budget policy stance in order to ramp up investment on tackling climate change and on supporting poorer Germans as a condition for the SPD support. Party delegates will vote next weekend on whether to stay in government when they gather for their annual convention.

Coming Up

- We have a busy start to the week with AU GDP partials and Job ads out this morning followed by China’s Caixin Manufacturing PMI early afternoon and US ISM Manufacturing tonight. Final German and European Manufacturing PMIs are also released later today.

- AU inventories in Q3: Stocks were surprisingly weak last quarter, reflecting a rundown of stocks in retail and cars after a few quarters of build-up. Stocks are expected to be unchanged in Q3 (market: -0.2%). Meanwhile AU Q3 company profits are forecast to have declined 0.7% as mining profits pull back from a strong Q2 (market: 1.0%).

- China’s Caixin manufacturing PMI is expected to be little changed (51.5 exp. vs 51.7 prev.) while the November manufacturing ISM is expected to pick up to 49.5 from 48.3 given improvements in regional surveys.

- Looking at the rest of the week, tomorrow the RBA is expected to keep the cash rate steady at 0.75%, while retaining an easing bias (market: 0.75%). GDP is expected to be weak on Wednesday with a gain of 0.3%, which would put annual growth at 1.5% (market: 0.5%/1.7%).

- The main event for the NZ market this week is the RBNZ bank capital review. The market will be watching to see if the original proposal is softened in any way, possibly through a longer implementation period than the 5 years initially proposed or through the inclusion of hybrid debt to meet the new requirements. Governor Orr and his RBNZ colleagues are also scheduled to speak Parliament’s Finance and Expenditure Committee on Wednesday morning

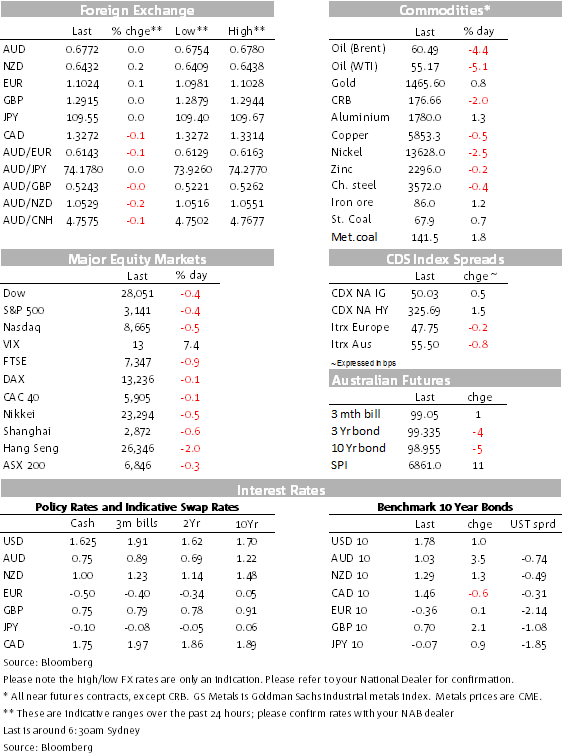

Market Prices

By Rodrigo Catril, 2 Dec 2019

Source: NAB

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets