Featured Article

-

Performance Metrics of Su …

FXWW is a provider of professional services as well as being a network of professional traders in the interban …More>> -

Weekly Game Plan 2 Dec 19 …

We enter quite a busy week with central bank meetings, NFP and other data coming up above and beyond the usual …More>>

MOST RECENT ARTICLES

FX daily charts: fairly revealing

We have month-end activity today, Chinese Manufacturing PMI data on Saturday and further Greek-debt IMF related negotiations to get through before the next trading week starts. Stepping out to the daily FX charts can be rather revealing and is the topic of this blog update today. In fact, those traders bearish on the Kiwi might be wise […]

Barclays FX Month-End Analysis

The passive rebalancing of FX hedges at month-end is expected to lead to moderate amounts of USD selling. Equities in US and Europe outperformed most of their developed peers, as better economic data, fewer concerns about Greece in the short term, and a relatively benign earnings season pushed stock markets up. On the other hand, […]

NZD/USD falls back below 0.66

NZD/USD posted a shooting star on the daily chart Channel breakout was a fake one and daily close sub-0.66 would confirm the short-term swing high at 0.6740 Unlikely 0.66 will hold much longer, test of 0.6560 seems likely Selling rallies the preferred strategy here; key intraday resistance seen at 0.6640 The post NZD/USD falls back […]

FX Trader Talk – FXWW Chatroom

USD: Modest hawkish evolution in the FOMC’s language on labor markets signals low bar on data improvement for a September hike. USD gains on this likely reflect the fact that positioning is not yet stretched andshould skew risks to dollar upside on coming data. GDP today the next focus with investors attentive to whether there […]

EURO-DOLLAR: MNI Fundamental levels (orders, options, technicals) – FXWW Chatroom

*$1.1080/84 Pre-Fed high/Jul29 high *$1.1015 Hourly resistance Jul29($1.1017 100-dma) *$1.1000 Expiry E1.14bn *$1.0989 Intraday high Asia *$1.0980 Offers back in place above $1.0980 *$1.0967 Recovery high off $1.0942 *$1.0960 Expiry E1bn *$1.0956 ***Current market rate 0726GMT Thursday *$1.0950 Expiry E647mn *$1.0942 Intraday low Europe, Asia $1.0959 *$1.0925/22 Jul24/23 lows/$1.0916 Jul7 low *$1.0900 Medium demand *$1.0884 76.4% $1.0808-$1.1129 *$1.0870 Jul22 low *$1.0819 May27 low(still important on close basis)

GS: G10 FX – London Spot Trader Views – FXWW Chatroom

The FOMC we interpret as slightly hawkish and we think September is definitely in play. Upcoming data prints becoming very important with US GDP today and Euro zone inflation tomorrow. We like EURUSD lower especially if the data delivers. Our favorite commodity currency shorts are AUD and CAD. We are also still short EURGBP. {EU} EURUSD […]

CitiFX Wire – FXWW Chatroom

EURAUD – going short..In light of my morning note on the AUD and Brent’s piece overnight – I am going short EURAUD in spot and options with stops above 1.5100 and targeting a move to 1.4800. In addition I have bought 6 week 1.4850/1.4650 put spreads with a RKI on the short strike at 1.4350. […]

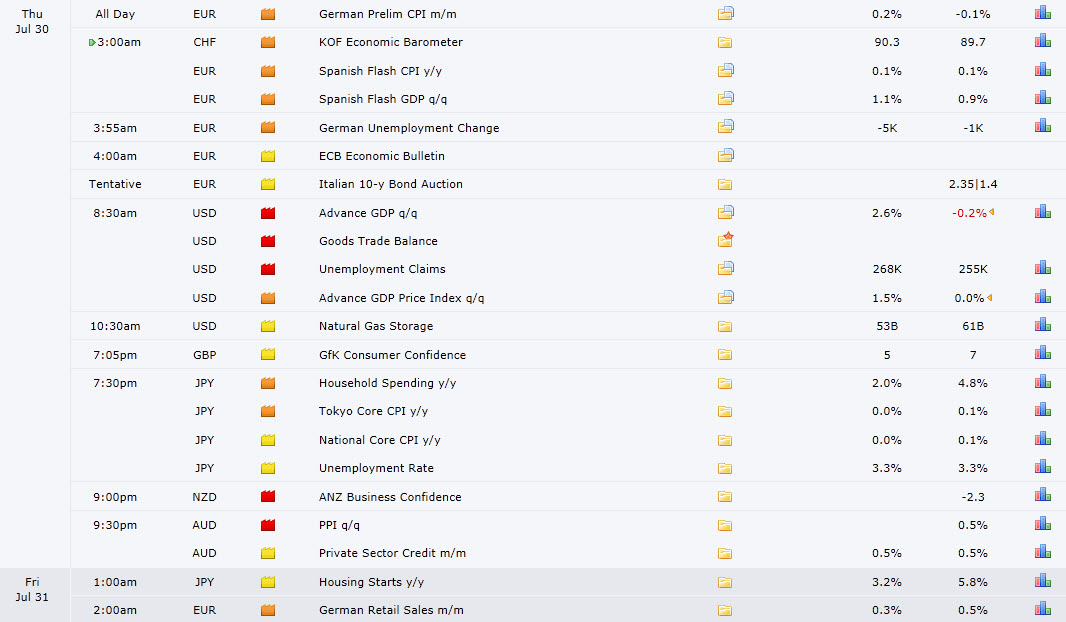

News Releases for Thur July 30 (GMT-5:00 ET)

About Forexsites

Forexsites was established in 2002 and cater primarily for beginner to intermediate traders.

Forexsites offers currency specific information, sector-specific news, and many other useful features helping to create informed trading decisions.

If you are a trader that wants to move to the next level then Forexsites can help through its many worldwide contacts. You may want to enter the Hedge Fund industry but don’t know where to start Forexsites can assist in this process and assess through its contacts whether you have what it takes in this specialist field.

You may be entering the forex markets for the first time and are unsure where to start Forexsites will guide and inform you of what you are doing right and where you are going wrong.

The forex industry is growing daily and there are thousands of sites offering information. Forexsites goal is to deliver information to not only foreign exchange traders but all traders worldwide in a convenient format easily accessed and of consistently high quality.

Follow Forexsites on Twitter. For editorial inquiries please e-mail: [email protected]. For advertising opportunities please email [email protected].