Featured Article

-

Performance Metrics of Su …

FXWW is a provider of professional services as well as being a network of professional traders in the interban …More>> -

Weekly Game Plan 2 Dec 19 …

We enter quite a busy week with central bank meetings, NFP and other data coming up above and beyond the usual …More>>

MOST RECENT ARTICLES

Pre-FOMC nerves seen with US$ & Stocks by Mary McNamara

The US$ and US stocks chopped a bit lower on Monday ahead of the two-day US Federal Reserve meeting. Stocks were also looking ahead to the earnings report from Apple which ended up being a beat on both earnings and revenue. The FOMC Fed Funds Rate is announced on Wednesday and, with US Interest rate […]

EURUSD: Euro firmer after Greece eases tensions with negotiating partners by FX Charts Daily

EUR/USD: 1.0886 After looking heavy through Europe as a result of the ongoing concerns of a Greek default, the Euro turned around sharply when stories began to circulate that the Greek Government had reshuffled the team involved in the negotiation with the international creditors, with the role of the finance minister, Varoufakis, being reduced after being criticized […]

Indices/Commodities Outlook by FX Charts Daily

INDICES/COMMODITIES S&P Futures 2103 The S+P made a new all time high at 2119.25 today before giving up the gains after some weak corporate earnings from the health sector. Now back at 2104, there is not a whole lot of change from the medium term perspective although the 4 hour charts now point a […]

AUD/USD: Further gains looking likely by Sean Lee

Iron ore price recovery continues to maintain momentum; Gold price jumps sharply overnight; AUD/USD closes above previous resistance at .7840; AUD/NZD consolidating above recent pivot at 1.0220. I’d suggest a bullish intraday bias with support now at .7820 and the next topside technical targets at the 100-dma (.7884) and the neckline of developing double bottom, […]

BNP Paribas: STEER model showing NZD/USD undervalued

Our model indicates that the recent decline in NZDUSD has not been justified by its short-term fundamentals. On the contrary, the pair’s STEER has increased in response to a rise in commodity prices, higher global equities and a rise in New Zealand bond yields. As a result the STEER has increased to 0.7864; contributing to […]

UBS: FX Flows Update via FXWW Chatroom

EURUSD Sell rally to 1.0880 – 1.0900, stops above 1.0920, downside target 1.0800 EURCHF Buy dips to 1.0330/50, stops below 1.0320, topside target 1.0400 USDCHF Buy dips 0.9500/20, stops below 0.9480, topside target 0.9600 EURJPY Buy dips to 129.00/20, stops below 128.80, topside target 130.00 USDJPY Buy dips to 118.60/80, stops below 118.50, topside target 119.50 EURGBP Sell 0.7160/70, stop above 0.7190, target 0.7120 GBPUSD Sell 1.5200/20, stop […]

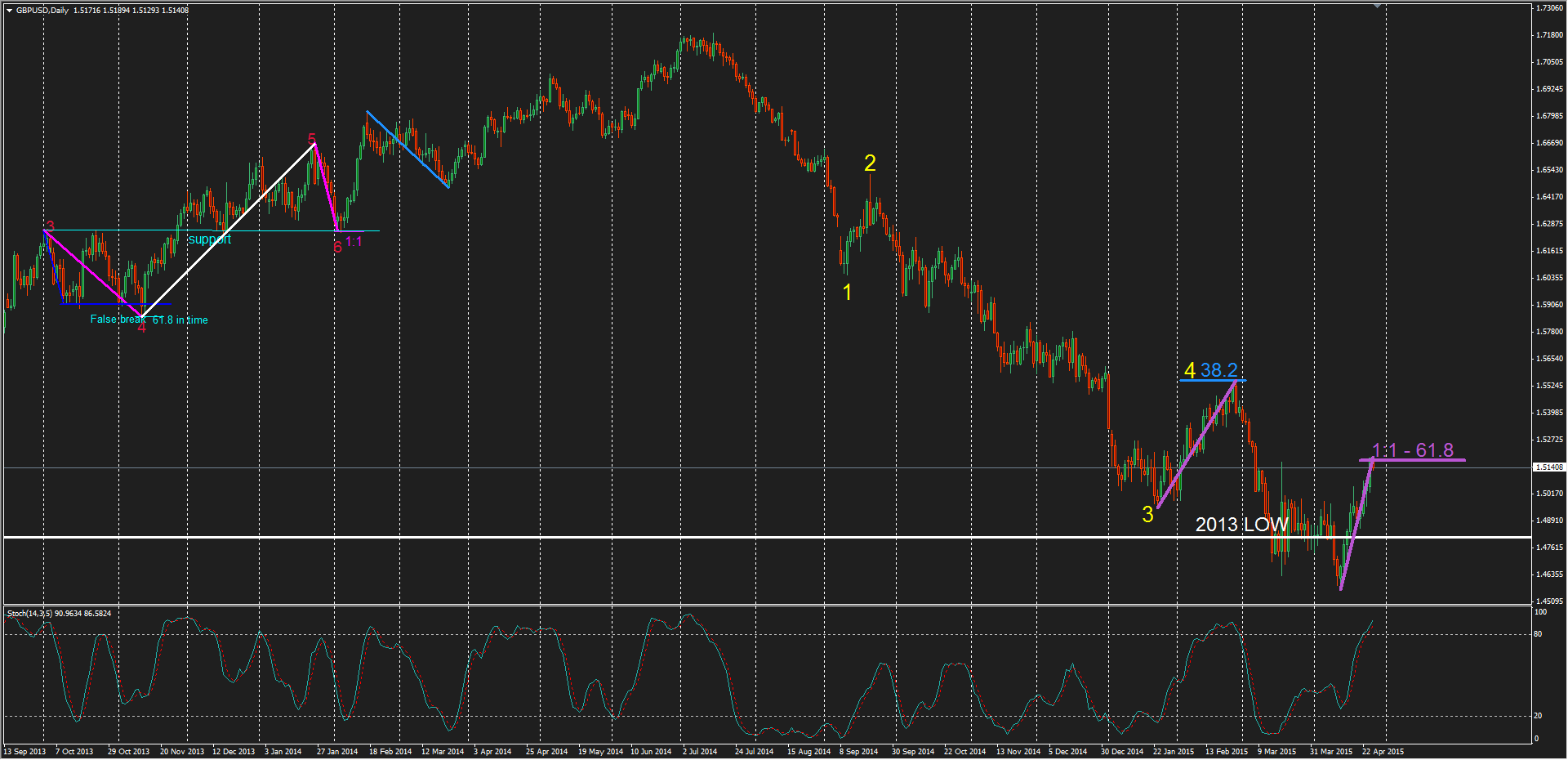

Cable: Bears eying resistance at 1.51750

GBPUSD Daily Cable bears will be closely eying the 1:1 (Purple) and 61.8 Fib resistance that coincide at 1.51750, this resistance level has already seen some decent selling throughout Asian trade, with the market currently 50 pips below the high. As long as the market can continue to hold below this level in the coming […]

Citi: Spec Positioning: Yours the dollar via FXWW Chatroom

The latest Commitment of Traders (COT) report from the US CFTC shows that leveraged players* reduced net USD longs across the board in most actively traded currency pairs on the IMM (CME) in the week to Tuesday April 21. The notable exception was in USDMXN, where buying returned after last week’s heavy selling. · In EURUSD, longs […]

About Forexsites

Forexsites was established in 2002 and cater primarily for beginner to intermediate traders.

Forexsites offers currency specific information, sector-specific news, and many other useful features helping to create informed trading decisions.

If you are a trader that wants to move to the next level then Forexsites can help through its many worldwide contacts. You may want to enter the Hedge Fund industry but don’t know where to start Forexsites can assist in this process and assess through its contacts whether you have what it takes in this specialist field.

You may be entering the forex markets for the first time and are unsure where to start Forexsites will guide and inform you of what you are doing right and where you are going wrong.

The forex industry is growing daily and there are thousands of sites offering information. Forexsites goal is to deliver information to not only foreign exchange traders but all traders worldwide in a convenient format easily accessed and of consistently high quality.

Follow Forexsites on Twitter. For editorial inquiries please e-mail: [email protected]. For advertising opportunities please email [email protected].