Featured Article

-

Performance Metrics of Su …

FXWW is a provider of professional services as well as being a network of professional traders in the interban …More>> -

Weekly Game Plan 2 Dec 19 …

We enter quite a busy week with central bank meetings, NFP and other data coming up above and beyond the usual …More>>

MOST RECENT ARTICLES

Indices/Commodities Outlook by FX Charts Daily

INDICES/COMMODITIES S&P Futures 2095 The S+P finally broke above the recent range top at around 2080, in heading to a high of 2096 on Friday, and by the look of the indicators a test of 2100 is just a matter of time, beyond which we could be looking at a retest of the all […]

FX Charts Outlook for: EURJPY, GBPJPY, NZDJPY, EURAUD, GBPAUD, EURGBP.

EURJPY: 127.50 EURJPY: 127.50. The cross looks sick again and has closed back towards the 126.90 low seen in March. The weekly/monthly indicators suggest that there is plenty more downside ahead, and if we do push immediately lower the first target, below 126.90 would be at the Fibo support at 126.30 (76.4% of 119.10/149.78), a break […]

Barclays trade of the week: Long USD/CAD

Our bullish technical view for USDCAD was encouraged by the recent development of basing candles on the daily plot. We expect buying interest ahead of the 1.2350 range lows to underpin a move higher in range towards the 1.2835 year-to-date highs. A move above 1.2835 would confirm further upside. Our greater targets are near 1.3065, […]

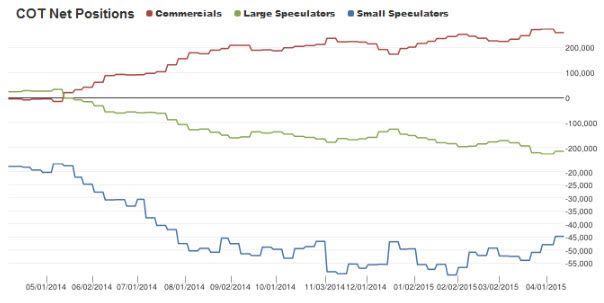

CFTC Positioning Data – EUR shorts steady, AUD shorts increase by Milan Cutkovic

EUR shorts 215k vs 227k previously GBP shorts 34k vs 36k previously JPY shorts 24k vs 24k previously AUD shorts 40k vs 24k previously CAD shorts 30k vs 29k previously CHF longs 120 vs 706 previously EUR short positioning remains at extreme levels. Chart source: COTBase.com The post CFTC Positioning Data – EUR shorts steady, […]

Stock Index and Commodity Weekly Market Type Analysis 12/04/15 by Sam Eder

Each week I review the current market type and fundamental considerations on a variety of stock and commodity indices. Market type analysis is critical to trade planning. MT = Market Type ( See lesson 8 in the Share Investing Course for Smart People) US Dow Jones – MT is sideways normal. Look for range […]

The Week Ahead – Upcoming Data/Events by Milan Cutkovic

Here is a list of the upcoming data releases and events, with the important one’s in bold. All times are BST (British Summer Time). Tuesday, April 14th 2015 02:30 BST – Australian NAB Business Confidence 07:00 BST – Swedish Unemployment Rate 07:00 BST – German WPI (0.2 % m/m) 08:00 BST – Spanish CPI (0.6 […]

Forex Trading Opportunities for the Week Ahead 13 March 2015 By Sam Eder

I plan my trading for the week ahead each weekend. Here are the Forex trading opportunities I will be stalking this week. Note that this is my current view, but if market conditions change my view can change too. Generally I will trade in alignment with what I have noted here, though I will wait for […]

US$ and global stock indices higher by Mary McNamara

Last week: The US$ remained choppy until mid-week but there were two new TC signals: U/J = -20 (closed) and Cable= 140 (still open). This week: The US$ seemed to get its mojo back last week but I am still waiting for a decisive breakout move either above 100 or below 95.5. An update on […]

About Forexsites

Forexsites was established in 2002 and cater primarily for beginner to intermediate traders.

Forexsites offers currency specific information, sector-specific news, and many other useful features helping to create informed trading decisions.

If you are a trader that wants to move to the next level then Forexsites can help through its many worldwide contacts. You may want to enter the Hedge Fund industry but don’t know where to start Forexsites can assist in this process and assess through its contacts whether you have what it takes in this specialist field.

You may be entering the forex markets for the first time and are unsure where to start Forexsites will guide and inform you of what you are doing right and where you are going wrong.

The forex industry is growing daily and there are thousands of sites offering information. Forexsites goal is to deliver information to not only foreign exchange traders but all traders worldwide in a convenient format easily accessed and of consistently high quality.

Follow Forexsites on Twitter. For editorial inquiries please e-mail: [email protected]. For advertising opportunities please email [email protected].