Featured Article

-

Performance Metrics of Su …

FXWW is a provider of professional services as well as being a network of professional traders in the interban …More>> -

Weekly Game Plan 2 Dec 19 …

We enter quite a busy week with central bank meetings, NFP and other data coming up above and beyond the usual …More>>

MOST RECENT ARTICLES

GBP/USD post FOMC: levels to watch by Mary McNamara

The Cable enjoyed a huge bounce today following FOMC but, as I write now, it is back below the key 1.50 level. This is the level to watch in coming sessions. Cable 4hr: I had tweeted with FOMC that price might rally to test the 61.8% Fib and 4hr 200 EMA region and…… that it did! […]

Kiwi post FOMC: levels to watch by Mary McNamara

The Kiwi has bounced higher following FOMC but is approaching a 9 month bear trend line that might determine which way it heads from here. Kiwi 4hr: price rallied up and out from the 4hr chart’s triangle following FOMC but ran into the resistance of a daily-chart bear trend line: Kiwi daily: the daily chart shows […]

EUR/USD post FOMC: levels to watch by Mary McNamara

The EUR/USD put in a bounce after FOMC but it might take a little while for the dust to settle and for any new directional move to be sorted out. This post is simply about what I’m seeing and the levels I’m watching. E/U 4hr: I tweeted earlier today about how the region of the […]

US$ tumbles but where to from here? by Mary McNamara

The US$ has tumbled following FOMC but the big question now is….. ‘will this move continue’? Many are saying to buy this US$ dip but what are the chances that we get a bit more of a pullback? Maybe looking out the window at various ‘Cloud’ patterns might help here! USDX 4hr: price has retreated from the […]

Welcome to the new FX world-order of Jekyll and Hyde liquidity conditions by Sean Lee

I will continue to warn about this as it is now becoming the norm. There is a significant lack of market makers left and once a major event happens, and the market gets caught badly positioned, we are going to continue to witness wildly gapping markets. Cable broke above 1.50 and immediately gapped to 1.5150, […]

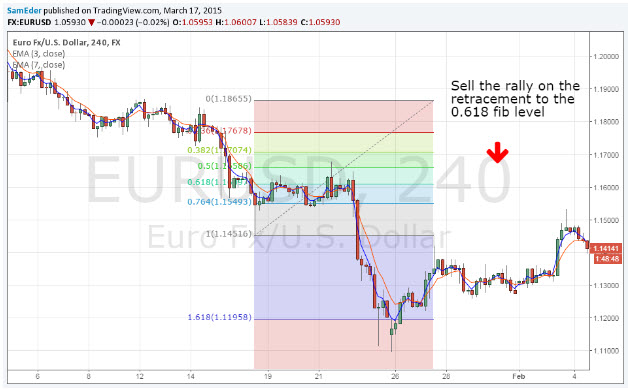

How to “Buy Dips” and “Sell Rallies” by Sam Eder

When I talk to the ex-bank traders I work with, they will often refer to the market being in “buy the dip” or “sell the rally” mode. This is an old timey bank trader way of describing the current market type. But if the market is in one of these modes, how do you actually […]

Session Data for Thur Mar 19 (GMT-5:00 ET)

Daily Global Market Wrap – Forex, Commodity & Global Market Strategy Outlook 19 March 2015

Every day the Invast team review the major economic, fundamental and technical events that are important for traders who are looking to trade the global markets, focusing in particular on the Forex & Commodity markets. Daily Global Market Wrap Missed a session? Click Here

About Forexsites

Forexsites was established in 2002 and cater primarily for beginner to intermediate traders.

Forexsites offers currency specific information, sector-specific news, and many other useful features helping to create informed trading decisions.

If you are a trader that wants to move to the next level then Forexsites can help through its many worldwide contacts. You may want to enter the Hedge Fund industry but don’t know where to start Forexsites can assist in this process and assess through its contacts whether you have what it takes in this specialist field.

You may be entering the forex markets for the first time and are unsure where to start Forexsites will guide and inform you of what you are doing right and where you are going wrong.

The forex industry is growing daily and there are thousands of sites offering information. Forexsites goal is to deliver information to not only foreign exchange traders but all traders worldwide in a convenient format easily accessed and of consistently high quality.

Follow Forexsites on Twitter. For editorial inquiries please e-mail: [email protected]. For advertising opportunities please email [email protected].