Featured Article

-

Performance Metrics of Su …

FXWW is a provider of professional services as well as being a network of professional traders in the interban …More>> -

Weekly Game Plan 2 Dec 19 …

We enter quite a busy week with central bank meetings, NFP and other data coming up above and beyond the usual …More>>

MOST RECENT ARTICLES

NZD/USD ran into good resistance; back sub-0.74 by Milan Cutkovic

NZD/USD ran into decent tech resistance between 0.7420 and 0.7430 Upside momentum has waned as the USD remains bid across the board Despite slightly less dovish RBNZ, NZD is likely to stay under pressure against the Greenback First support seen at 0.7320, then not much until the 0.7200-20 area I’m short NZD/USD from 0.7407 with […]

Trade update for GOLD by Reece Marini

GOLD M30 I have now moved my stop into breakeven and will look for a test of the overnight low. If a solid break is seen I will look to hold onto the trade for a test of the stops below 1130.00, however if there is any sign of a failure to take out the […]

GOLD: Sellers return at 1166.50, see why? by Reece Marini

GOLD M30 Sellers have returned on the 1:1 (Blue) at 1166.50, I mentioned the importance of this Elliott Wave/Gann level in my earlier post. As long as the market stays below the 1:1 (Blue) high I expect the selling to continue with the large stops that are likely sitting below 1130.00 the overall target. * […]

RE: RBA should sell the $A to solve its problems by Dane Williams

Wednesday the Australian Financial Review published an opinion piece titled “RBA should sell the $A to solve its problems” There’s some valid points but I can’t agree that currency intervention is the answer to some of the problems that Stevens and the RBA are facing. Have we not learned anything from the rest of the […]

USD weakness at this major 100 level could trigger some ‘risk on’ by Mary McNamara

The USDX has failed at its first attempt at crossing the 100 level and I’ll be watching to see how further efforts progress. Any new weakness here could enable a bit of a ‘risk on’ bounce across some instruments and some look like their getting ready for just such an opportunity. US Retail Sales and […]

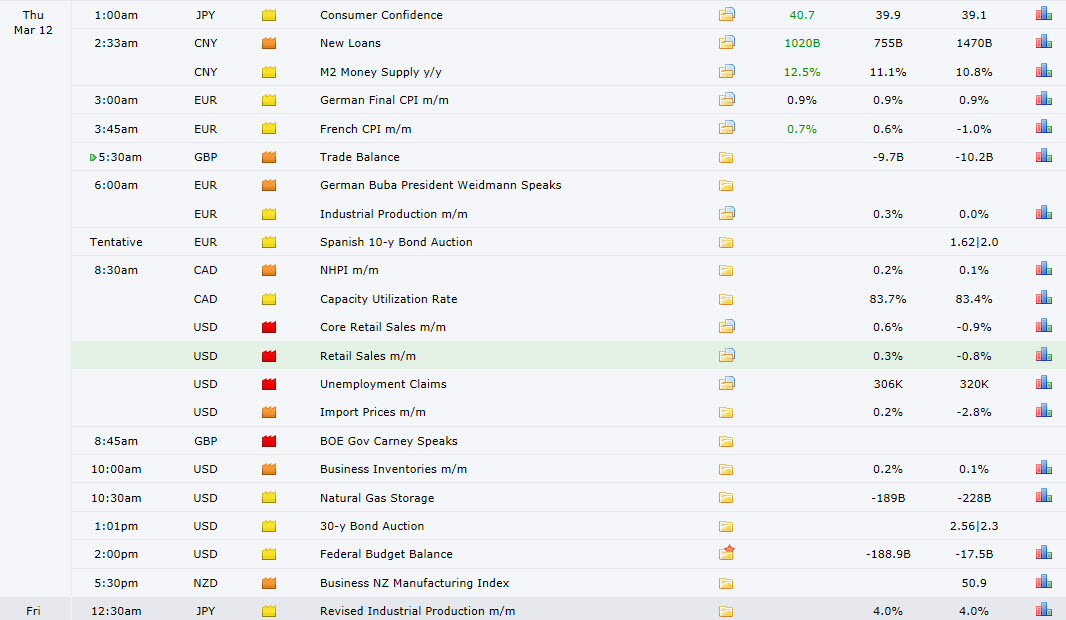

Session Data for Thur Mar 12 (GMT-5:00 ET)

How to be a Global Macro Currency Trader by Sam Eder

How does your current trade fit into the big picture? If the trades you take fit nicely into the larger scheme of things, you will find it much smoother sailing than butting heads against a macro trend. When you have a strong view about a currency pair based on its fundamentals, it helps in several […]

Daily Global Market Wrap – Forex, Commodity & Global Market Strategy Outlook 12 March 2015

Every day the Invast team review the major economic, fundamental and technical events that are important for traders who are looking to trade the global markets, focusing in particular on the Forex & Commodity markets. Daily Global Market Wrap Missed a session? Click Here

About Forexsites

Forexsites was established in 2002 and cater primarily for beginner to intermediate traders.

Forexsites offers currency specific information, sector-specific news, and many other useful features helping to create informed trading decisions.

If you are a trader that wants to move to the next level then Forexsites can help through its many worldwide contacts. You may want to enter the Hedge Fund industry but don’t know where to start Forexsites can assist in this process and assess through its contacts whether you have what it takes in this specialist field.

You may be entering the forex markets for the first time and are unsure where to start Forexsites will guide and inform you of what you are doing right and where you are going wrong.

The forex industry is growing daily and there are thousands of sites offering information. Forexsites goal is to deliver information to not only foreign exchange traders but all traders worldwide in a convenient format easily accessed and of consistently high quality.

Follow Forexsites on Twitter. For editorial inquiries please e-mail: [email protected]. For advertising opportunities please email [email protected].