Featured Article

-

Performance Metrics of Su …

FXWW is a provider of professional services as well as being a network of professional traders in the interban …More>> -

Weekly Game Plan 2 Dec 19 …

We enter quite a busy week with central bank meetings, NFP and other data coming up above and beyond the usual …More>>

MOST RECENT ARTICLES

23 Sept: Trend table outlook for FX, Commodities, Indices: FXCharts

Safe haven demand returned on Friday with the Jpy, Chf and Gold all feeling the benefit, and which looks as though it could continue early in the coming week. I still like to sell Gold into strength though, in anticipation of the Head/Shoulder formation that is building on the charts although the pattern is now […]

Markets Today: Trump pours cold water on trade hopes By Rodrigo Catril

Hopes of a quick resolution to the US China trade dispute seem as unlikely as ever. Today’s podcast Overview: All or nothing at all President Trump spooks risk assets again saying he doesn’t want a partial trade deal Chinese trade delegation cancels US farm visits and heads back home earlier than planned Mixed Fed messages […]

French and German PMI View: FXWW

From the FXWW Chatroom – Those PMI’s both reacted 10 secs before release Im guessing the Algos are paying for a faster service, 3 mins prior but it was noticable on my time stamp. The EurUSd moved happened prior to French and German PMI exactly 10 secs before release time.

FIVE CENTRAL BANKS REPORT… VERY LITTLE LEARNT By Scott Pickering

As data goes, last week was a really huge week for top tier data with five Central Banks reporting. I expected to learn a huge amount to set me up for the coming weeks and months based on policies. However, given the “high beta” news releases that took place, I am more or less with […]

Forex Trading Opportunities for the Week Ahead 23 September 2019: FXRenew

Note that this is my current view, but if market conditions change my view can change too. Generally I will trade in alignment with what I have noted here, though I will wait for a set-up before I enter. I base my view on technical and fundamental information. This is my beliefs and you are welcome […]

The Hidden Truth of High Win Rate Trading Systems by Justin Paolini

By taking a casual stroll around typical platforms like MyFXBook or FXStat, it becomes impossible to ignore the 3 or 4-digit returns that some systems claim. Of course, these systems attract the largest amount of followers, hence giving the manager a very handsome compensation. I believe this is one reason why regulators are starting to […]

Pound slips from six-week high vs dollar as Johnson sticks to October 31 Brexit pledge: Reuters

LONDON (Reuters) – Sterling retreated from six-week highs against the dollar on Tuesday as Prime Minister Boris Johnson stuck to his pledge to take Britain out of the European Union by Oct. 31, vowing not to seek an extension to the deadline. He is required by a law passed this month to ask the EU […]

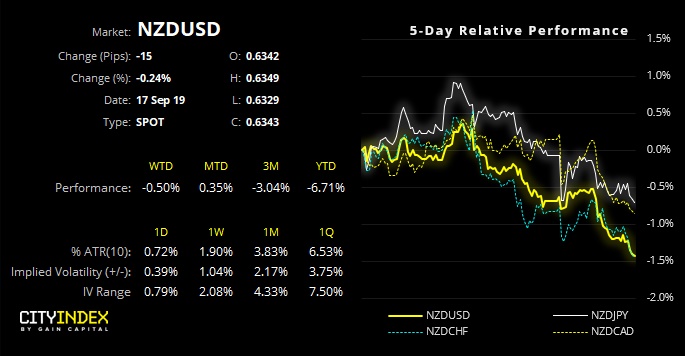

Kiwi Crosses Point Towards Further Weakness Ahead By Matt Simpson

NZD crosses are falling in tandem which suggests broader weakness awaits. NZD/USD remains in a clear downtrend, and the retracement from the 0.6269 low appears to have had its day. The correction failed to retest the 38.2% Fibonacci level and, after a few days of consolidation, printed a bearish pinbar which was also a bearish […]

About Forexsites

Forexsites was established in 2002 and cater primarily for beginner to intermediate traders.

Forexsites offers currency specific information, sector-specific news, and many other useful features helping to create informed trading decisions.

If you are a trader that wants to move to the next level then Forexsites can help through its many worldwide contacts. You may want to enter the Hedge Fund industry but don’t know where to start Forexsites can assist in this process and assess through its contacts whether you have what it takes in this specialist field.

You may be entering the forex markets for the first time and are unsure where to start Forexsites will guide and inform you of what you are doing right and where you are going wrong.

The forex industry is growing daily and there are thousands of sites offering information. Forexsites goal is to deliver information to not only foreign exchange traders but all traders worldwide in a convenient format easily accessed and of consistently high quality.

Follow Forexsites on Twitter. For editorial inquiries please e-mail: [email protected]. For advertising opportunities please email [email protected].