-

Euro jumps on report about Italian budget plan, stocks gain

-

Lira slips on Turkey inflation; Aston Martin falls after IPO

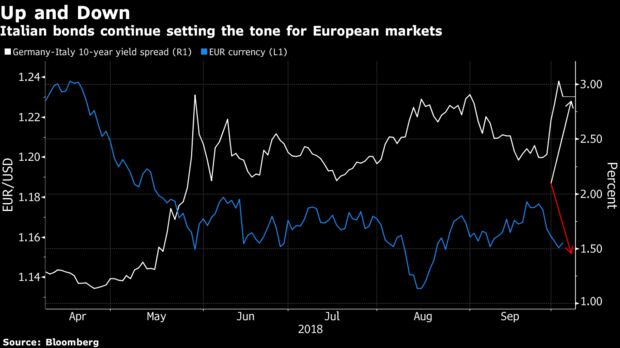

European stocks climbed alongside the euro and Italian bonds rallied onreports the government will rein in spending plans. Asian stocks dropped as investors weighed continuing concerns in Indonesia and India and strength in commodity prices.

MSCI Inc.’s Asia Pacific share index fell for a third day, with Japanese and South Korean equities leading declines. The rupiah and the rupee remained under pressure on surging oil prices. Crude in New York climbed above $75 a barrel, trading near the highest level in almost four years.

Investors remain on edge this week with the market impact of European politics and emerging-market strains still high on the agenda. A close call between a U.S. and a Chinese warship in the disputed South China Sea added to tensions between two countries already embroiled in an escalating trade war. Meanwhile, Treasury yields remain near the top of the recent range after Federal Reserve Chairman Jerome Powell welcomed wage growth but expressed confidence that low unemployment won’t spur a takeoff in prices that forces more aggressive tightening.

Elsewhere, the pound climbed ahead of a major speech from U.K. Prime Minister Theresa May. In India, the focus is back on the country’s financial sector after Prime Minister Narendra Modi’s government took control of Infrastructure Leasing & Financial Services Ltd., promising to end the group’s string of defaults.

Terminal users can read our Markets Live blog.

Here are some key events coming up this week:

- U.K. prime minister May speaks Wednesday at her party’s annual conference.

- The Reserve Bank of India’s policy decision is due Friday.

- U.S. employment reports for September also due Friday.

These are the main moves in markets:

Stocks

- Futures on the S&P 500 Index advanced 0.2 percent as of 9:28 a.m. London time, the highest in almost two weeks.

- The Stoxx Europe 600 Index climbed 0.3 percent.

- Germany’s DAX Index sank 0.4 percent.

- The U.K.’s FTSE 100 Index increased 0.4 percent.

- The MSCI Asia Pacific Index sank 0.6 percent to the lowest in more than two weeks.

- The MSCI Emerging Market Index declined less than 0.05 percent to the lowest in two weeks.

Currencies

- The Bloomberg Dollar Spot Index advanced less than 0.05 percent.

- The euro increased 0.2 percent to $1.1569, the first advance in more than a week and the biggest increase in almost two weeks.

- The British pound gained 0.1 percent to $1.2997, the largest rise in more than a week.

- The Japanese yen decreased 0.2 percent to 113.84 per dollar.

Bonds

- The yield on 10-year Treasuries gained one basis point to 3.07 percent.

- Britain’s 10-year yield advanced one basis point to 1.541 percent.

- Germany’s 10-year yield advanced two basis points to 0.45 percent, the largest rise in more than a week.

Commodities

- West Texas Intermediate crude advanced 0.3 percent to $75.46 a barrel, the highest in almost four years.

- Gold declined less than 0.05 percent to $1,202.80 an ounce.

— With assistance by Samuel Robinson, Cormac Mullen, Adam Haigh, and Stephen Spratt

October 3, 2018, 6:34 PM GMT+10

Source: Bloomberg