The US$ index closed higher for the week but so, too, did the EUR index. The US$ remains trapped in a recent trading channel and I still consider we need to see a decisive breakout before decent trending FX markets will return.

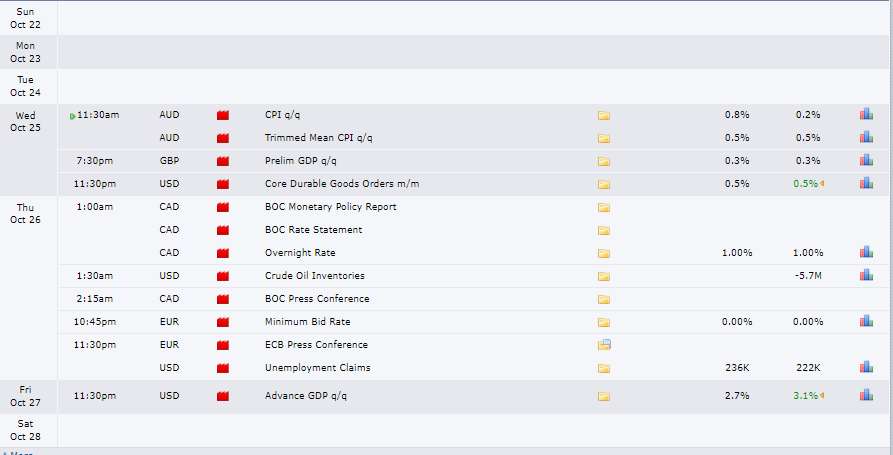

Data: the high impact data for next week is shown below. Not a lot until Wednesday:

USDX daily: watch the channel trend lines for any breakout:

EURX weekly: the Bull Flag option is still alive here. Watch with the ECB rate update:

Gold daily: watch the triangle trend lines for any new breakout:

EUR/USD 4hr: watch the triangle trend lines for any new breakout. There is the ECB rate update to impact here next week:

EUR/JPY 4hr: looking bullish but watch for any double top activity. Watch with the ECB rate update:

AUD/USD 4hr: looking a bit bearish but watch 0.78 for any support. Watch with AUD CPI data:

AUD/JPY 4hr: looking bullish but watch the 89 level for any new make or break:

NZD/USD: looking bearish but watch the multi-month trend line for any support:

Kiwi 4hr:

Kiwi weekly:

GBP/USD 4hr: watch the triangle trend lines for any new breakout. Watch for impact from Prelim GDP data:

USD/JPY daily: looking bullish but watch the next e trend lines for any new breakout:

GBP/JPY 4hr: looking bullish but watch the 150 level for any new make or break:

GBP/AUD 4hr: watch the 1.70 level for any new make or break:

GBP/NZD 4hr: looking bullish but watch the 1.90 level for any new make or break:

AUD/NZD 4hr: looking bullish after the triangle breakout and testing then rejecting the 6-year trend line:

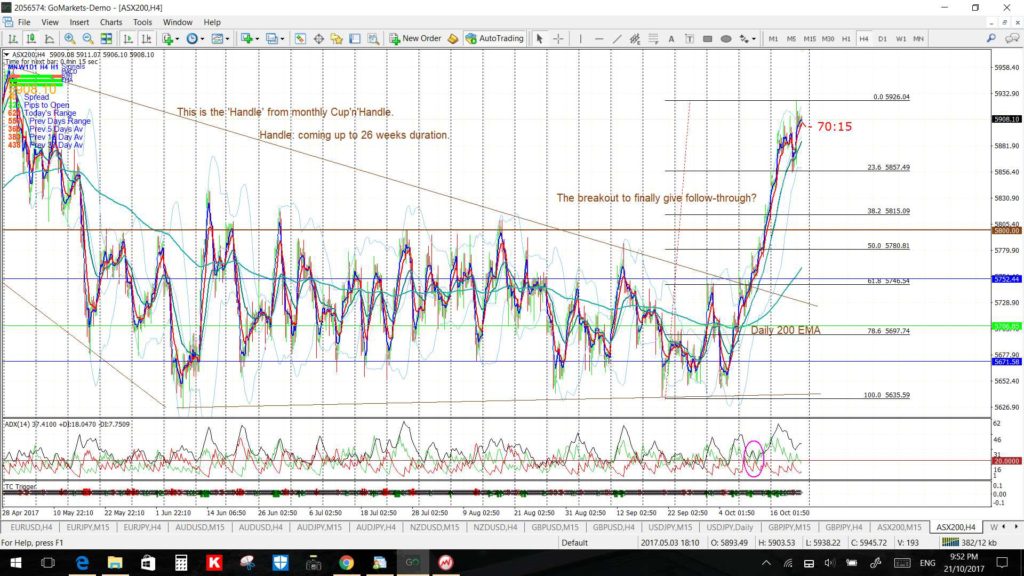

ASX-200 4hr: also looking bullish but watch for any test of the key 5,800 level: