Featured Article

-

Performance Metrics of Su …

FXWW is a provider of professional services as well as being a network of professional traders in the interban …More>> -

Weekly Game Plan 2 Dec 19 …

We enter quite a busy week with central bank meetings, NFP and other data coming up above and beyond the usual …More>>

MOST RECENT ARTICLES

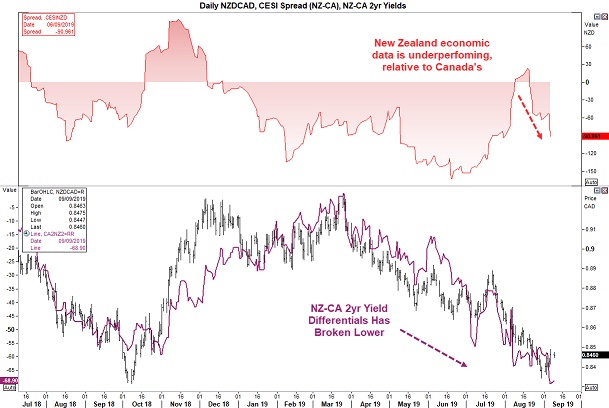

[Video] Monitoring A Potential Bear Flag Breakdown on NZD/CAD By Matt Simpson

NZDCAD has been a trend that has kept on giving. We’ve been following its demise closely, since identifying its test of a long-term bearish trendline back in March, it’s double-top in April and potential 300-pip slide in June. After breaking below the 0.8500 target, the cross remains in an established bearish channel and shows the potential for a bear-flag […]

Macro Weekly – World trade and manufacturing remain under pressure: ABN AMRO

Global manufacturing business confidence improves a touch But world trade remains under pressure Hard to see where material improvement will come from 190906-Macro-Weekly.pdf (260 KB) Download Business confidence in manufacturing globally, as measured by the global PMI manufacturing improved a little in August but remains weak: 49.5 versus 49.2. This was partly thanks to an […]

Forex Trading Opportunities for the Week Ahead 9 September 2019: FXRenew

Note that this is my current view, but if market conditions change my view can change too. Generally I will trade in alignment with what I have noted here, though I will wait for a set-up before I enter. I base my view on technical and fundamental information. This is my beliefs and you are welcome […]

9 Sept: Trend table outlook for FX, Commodities, Indices: FXCharts

The FX markets were fairly rangebound on Friday despite the NFP missing expectations although the Aud and Nzd were firm and this looks as though this theme could continue, at least early in the week, so buying either seems to be the immediate plan, against the US$, Euro and the Jpy. As usual I would […]

Markets Today: Trade war impacts as ECB prepares to pull out the stops By Ray Attrill

US payrolls numbers disappointed a little on Friday and China’s trade numbers over the weekend demonstrated what impact the trade war is having. Today’s podcast Overview: Over Under Sideways Down The Peter Lee surveys are now taking place. If you have appreciated NAB’s research support please let your company’s representative know US Payrolls undershoots expectations […]

Global Daily – Trade conflict continues to weigh on global growth: ABN AMRO

Global macro: Fresh US-China tariffs a further drag on growth – On 1 September, a new round of bilateral US-China import tariffs came into force. The US implemented 15% tariffs on an additional USD 110bn of imports from China; a second batch is due on 15 December. China has also started levying 5-10% import tariffs on […]

3 Sept: Trend table outlook for FX, Commodities, Indices: FXCharts

Given the US holiday it has been a fairly rangebound session although Sterling headed lower and looks heavy heading into Tuesday trade. Otherwise there is little to go on today and it may be that we see mostly sideways trade although RBA Meeting may produce some action for the Aud$. Elsewhere in the FX markets, […]

3 Forces Shaping Investment Climate As Markets Head Into September By Marc Chandler

Three forces are shaping the investment climate. The U.S.-China trade conflict escalates at the start of September as both countries will raise tariffs on each other’s goods and are threatening another round in mid-December (U.S. 25% tariffs on $250B of Chinese imports will increase to 30% on October 1). Some third parties may benefit from the […]

About Forexsites

Forexsites was established in 2002 and cater primarily for beginner to intermediate traders.

Forexsites offers currency specific information, sector-specific news, and many other useful features helping to create informed trading decisions.

If you are a trader that wants to move to the next level then Forexsites can help through its many worldwide contacts. You may want to enter the Hedge Fund industry but don’t know where to start Forexsites can assist in this process and assess through its contacts whether you have what it takes in this specialist field.

You may be entering the forex markets for the first time and are unsure where to start Forexsites will guide and inform you of what you are doing right and where you are going wrong.

The forex industry is growing daily and there are thousands of sites offering information. Forexsites goal is to deliver information to not only foreign exchange traders but all traders worldwide in a convenient format easily accessed and of consistently high quality.

Follow Forexsites on Twitter. For editorial inquiries please e-mail: [email protected]. For advertising opportunities please email [email protected].