Featured Article

-

Performance Metrics of Su …

FXWW is a provider of professional services as well as being a network of professional traders in the interban …More>> -

Weekly Game Plan 2 Dec 19 …

We enter quite a busy week with central bank meetings, NFP and other data coming up above and beyond the usual …More>>

MOST RECENT ARTICLES

FX: Option expiries for today’s NY cut (10:00 NY, 15:00 London)

EUR/USD: 1.0800 (848M), 1.0850 (251M), 1.0900 (1.3BLN) GBP/USD: 1.5080-90 (420M), 1.5200 (264M) AUD/USD: 0.7780-90 (560M) – NB: another AUD 1.1bln here Tues’ NZD/USD: 0.7575 (283M) USD/CAD: 1.2035-50 (700M), 1.2165 (859M), 1.2200 (8107M) USD/JPY: 118.40-50 (520M), 119.00 (768M), 120.00 (1.8BLN)

FX Flows via FXWW Chatroom

UsdCad ended at 1.2180 in Toronto on Friday and we suspect 1 or 2 banks had stops to do above 1.2200. Market printed 1.2205 before the official Monday open and went straight to 1.2193 at the turn of the hour. UsdCad stayed in the nineties then slipped lower to 1.2183. Orderbook is light on the […]

Westpac: Softer USD to support AUD/USD over week via FXWW Chatroom

The two most important Australian data releases this month have both surprised on the fi rm side, injecting new uncertainty into the RBA decision on 5 May. Pricing for a cash rate cut to 2.0% in May had been around 75% before the strong Mar employment report and fell to almost 50/50 in the wake of the […]

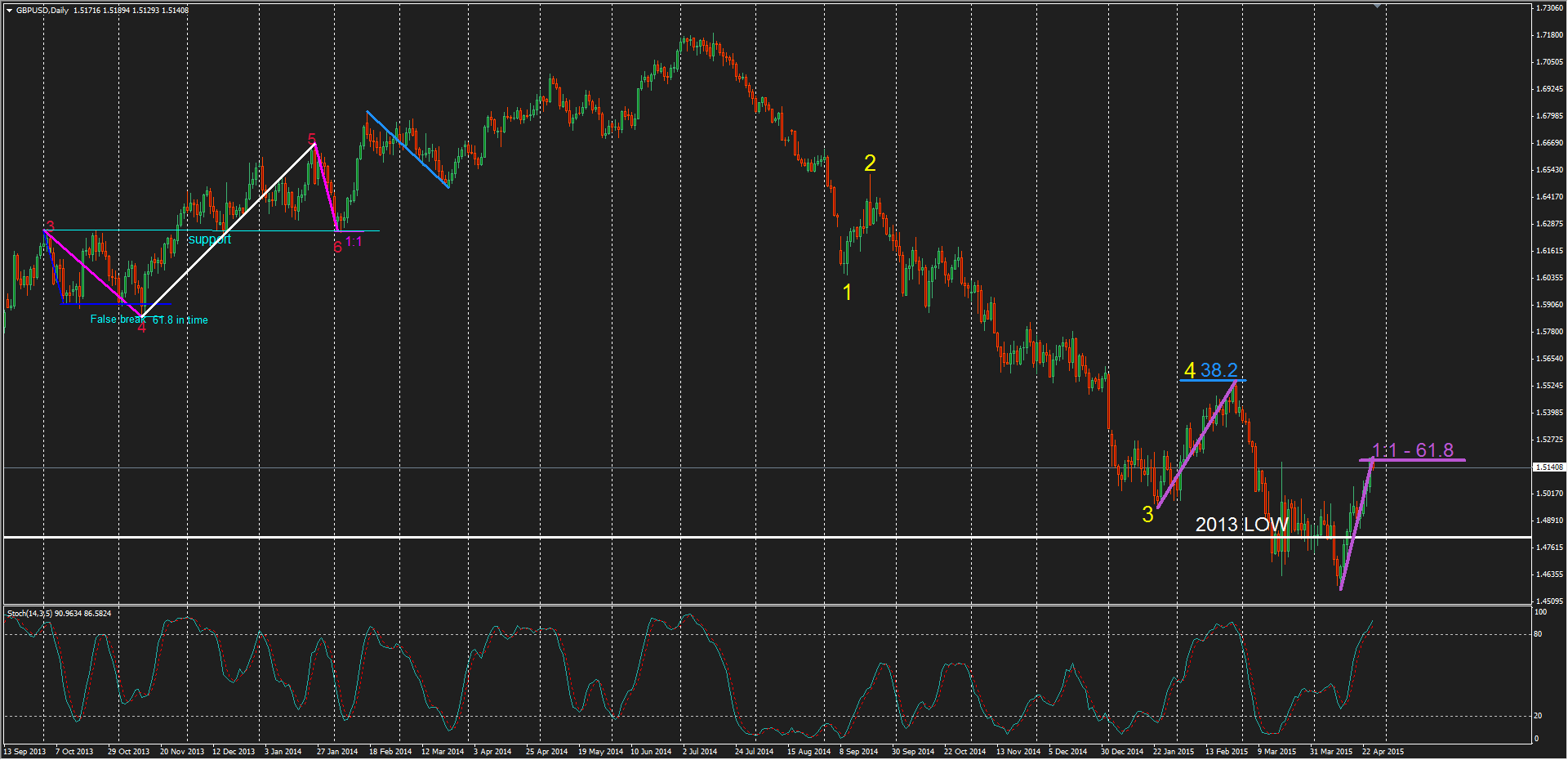

Cable: Bears eying resistance at 1.51750

GBPUSD Daily Cable bears will be closely eying the 1:1 (Purple) and 61.8 Fib resistance that coincide at 1.51750, this resistance level has already seen some decent selling throughout Asian trade, with the market currently 50 pips below the high. As long as the market can continue to hold below this level in the coming […]

Citi & Morgan Stanley Trade Idea of the Week: Sell NZD/JPY

Citibank and Morgan Stanley have the same trade of the week recommendation: NZD/JPY Citi: Sell NZDJPY at 90.49, target 89, stop loss 91.20 MS: Sell NZDJPY at 91.20, target 87.30, with a stop at 92.50 The post Citi & Morgan Stanley Trade Idea of the Week: Sell NZD/JPY appeared first on www.forextell.com.

AUD/USD: heading for a test of major 0.795 resistance by Mary McNamara

The AUD/USD seems to be off and running today buoyed by a lift with the iron ore price. The Aussie has been range bound within a trading channel defined by 0.795 and 0.755 for almost three months now. This recent bout of US$ weakness might just help to keep this pair supported but there is major […]

Weekly Outlook: EURJPY, GBPAUD, EURGBP, NZDJPY by FX Charts Daily

EURJPY: 129.25 EURJPY: 129.25 the cross traded with a choppy but overall positive bias last week in making a higher low (127.44) and higher high 130.10 and looking as though 130.00 could come under pressure again in the next few days. If so, then beyond here would target 130.40 (daily cloud base) and 130.85 (weekly Tenkan) […]

US$ weakens under the ‘Double Top’ by Mary McNamara

USDX Monthly: The April candle is still printing a bearish coloured ‘Inside’ candle. This candle has yet to close but it does seem to hint at a possible change given it follows on from 9 months of bullish candles. The 100 level is still proving to be some resistance. Monthly Ichimoku: The April candle is […]

About Forexsites

Forexsites was established in 2002 and cater primarily for beginner to intermediate traders.

Forexsites offers currency specific information, sector-specific news, and many other useful features helping to create informed trading decisions.

If you are a trader that wants to move to the next level then Forexsites can help through its many worldwide contacts. You may want to enter the Hedge Fund industry but don’t know where to start Forexsites can assist in this process and assess through its contacts whether you have what it takes in this specialist field.

You may be entering the forex markets for the first time and are unsure where to start Forexsites will guide and inform you of what you are doing right and where you are going wrong.

The forex industry is growing daily and there are thousands of sites offering information. Forexsites goal is to deliver information to not only foreign exchange traders but all traders worldwide in a convenient format easily accessed and of consistently high quality.

Follow Forexsites on Twitter. For editorial inquiries please e-mail: [email protected]. For advertising opportunities please email [email protected].