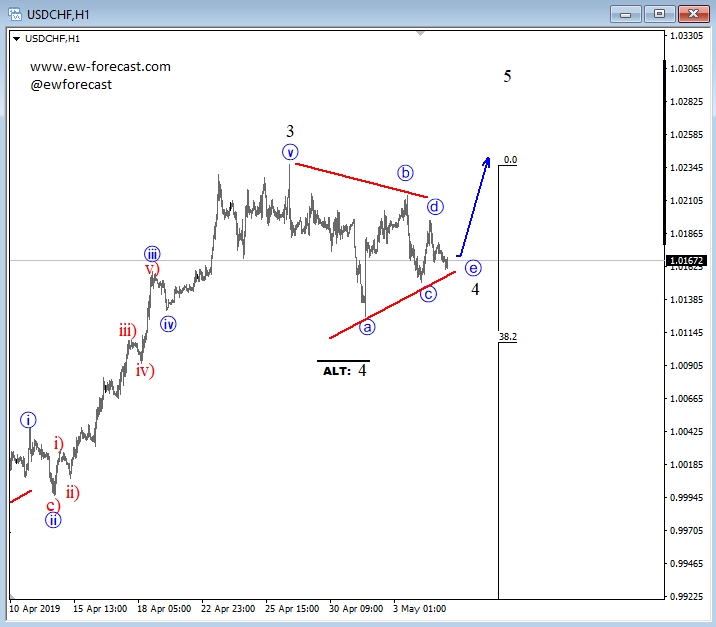

USD/CHF is stuck in a correction, so we remain bullish as this consolidation looks like a triangle. It’s a continuation pattern that suggests higher prices for wave five this week, while the market is above 1.0125.

USD/CHF, 1 Hour

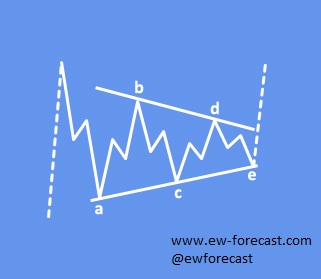

A Triangle is a common 5-wave pattern labeled A-B-C-D-E that moves counter-trend and is corrective in nature. Triangles move within two channel lines drawn from waves A to C, and from waves B to D. A Triangle is either contracting or expanding depending on whether the channel lines are converging or expanding. Triangles are overlapping five wave affairs that subdivide 3-3-3-3-3.

Triangles can occur in wave 4, wave B, wave X position or in some very rare cases also in wave Y of a combination.

An example of a triangle correction:

May 07, 2019 04:46AM ET

Source: Investing.com

By

By