-

Europe shares, U.S. futures follow Asia slide; oil steadies

-

Bunds, Treasuries rise amid concern on Italy’s fiscal position

A downbeat mood settled over markets on Tuesday, as fears surrounding the populist Italian government’s fiscal plans topped a list of reasons for caution. The euro dropped a fifth day, European stocks and U.S. futures followed Asian declines, while Treasuries and bunds advanced.

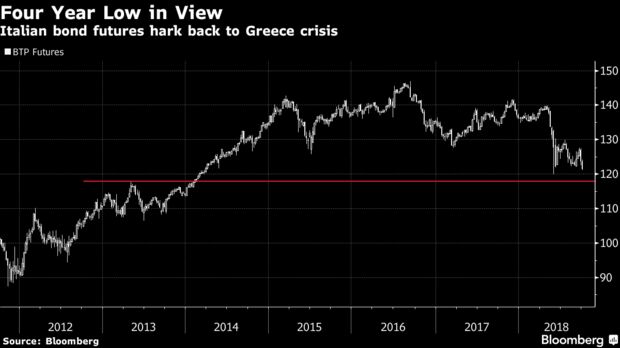

The common currency fell to the weakest in six weeks after the head of Italy’s lower house budget committee said the nation would have solved its fiscal problems with its own currency, and the leader of the European Commission warned of a Greek-style crisis. Reassurances that the country has no plans to ditch the euro failed to calm nerves, and Italian bonds extended a recent slump, while the region’s safer “core bonds” climbed. The Stoxx Europe 600 Index fell for only the second time in six days as equities in Italy declined.

While a deal between the U.S. and Canada to revamp the Nafta trade deal with Mexico gave global risk appetite a boost at the start of the week, investor sentiment remains fragile amid a laundry list of threats to markets. Beyond Italy, Sino-American tensions are back in focus after the Chinese navy dispelled a U.S. missile destroyer from waters near South China Sea islands, in Beijing’s account of the incident. Meanwhile, political drama in Washington still swirls around President Donald Trump’s Supreme Court nominee, which may feed through to November congressional elections and affect the outlook for the administration’s agenda.

Elsewhere, oil traded near its highest in almost four years as a slowdown in U.S. drilling adds to concern over supply losses from Iran and Venezuela. Indonesia’s rupiah fell past 15,000 per dollar for the first time since 1998 a day after inflation came in slower than forecast.

Terminal users can read our Markets Live blog.

Here are some key events coming up this week:

- U.K. Prime Minister Theresa May speaks Oct. 3. in Birmingham.

- A central bank policy decision from the Reserve Bank of India is due Friday.

- U.S. employment reports for September also due Friday.

These are the main moves in markets:

Stocks

- The Stoxx Europe 600 Index declined 0.8 percent as of 11:04 a.m. London time, the lowest in almost two weeks.

- Futures on the S&P 500 Index fell 0.3 percent.

- The U.K.’s FTSE 100 Index fell 0.6 percent to the lowest in more than a week on the largest fall in almost four weeks.

- Germany’s DAX Index sank 0.9 percent to the lowest in almost two weeks.

- The MSCI Emerging Market Index declined 1.5 percent to the lowest in two weeks.

- The MSCI Asia Pacific Index declined 0.8 percent to the lowest in two weeks.

Currencies

- The Bloomberg Dollar Spot Index climbed 0.4 percent to the highest in more than three weeks.

- The euro dipped 0.5 percent to $1.1515, reaching the weakest in six weeks on its fifth straight decline.

- The British pound declined 0.6 percent to $1.2958, the weakest in more than three weeks.

- The Japanese yen rose 0.2 percent to 113.73 per dollar.

Bonds

- The yield on 10-year Treasuries decreased three basis points to 3.06 percent.

- Germany’s 10-year yield decreased four basis points to 0.43 percent, the lowest in almost three weeks.

- Britain’s 10-year yield decreased five basis points to 1.542 percent.

- Italy’s 10-year yield gained 10 basis points to 3.403 percent, the highest in more than four years.

Commodities

- West Texas Intermediate crude was unchanged at $75.30 a barrel, the highest in almost four years.

- Gold climbed 0.3 percent to $1,192.50 an ounce.

— With assistance by Mark Cranfield, and Andreea Papuc

October 2, 2018, 8:07 PM GMT+10

Source: Bloomberg