-

Gold, swissie pare Monday gains; oil hovers near 5-month high

-

North Korea claims the right to shoot down U.S. war jets

Markets attempted to stabilize as investors digested a host of catalysts from North Korean war threats and central-bank policy to tailwinds for oil and the aftermath of the German election. The euro weakened as European stocks drifted, while safe havens such as gold took a breather.

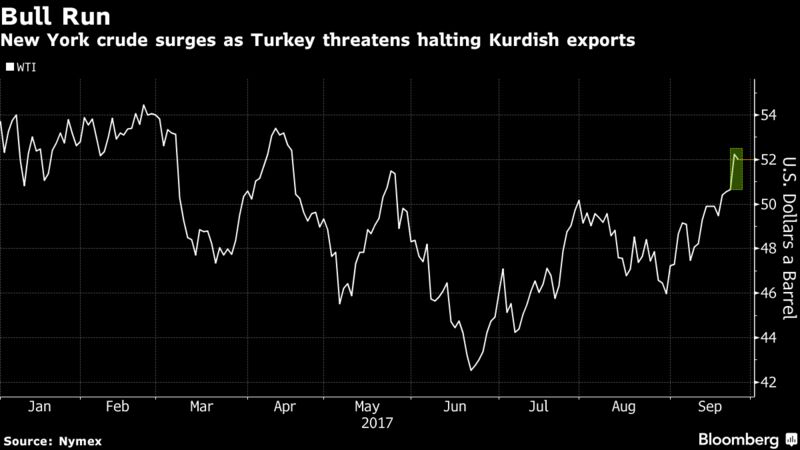

The yellow metal and the Swiss franc pared some of yesterday’s gains, which followed North Korea’s declaration it could shoot down U.S. warplanes. Emerging-market stocks headed for only their second four-day retreat this year, while equities were directionless in Europe as America continues to pursue a diplomatic solution to the crisis. WTI crude fell, but remained close to a five-month high after also surging on Monday as Turkeythreatened to shut down Kurdish crude shipments.

Markets seem to have been oscillating between risk-on and risk-off stances since early August as tensions simmer on the Korean Peninsula. Equities have edged away from recent record highs as the U.S. and North Korea trade threats, and now an assortment of global political risks look set to further cloud the outlook.

Read more in our story, Global Markets on Edge as Elections Thrust Politics Back to Fore.

Alongside geopolitics, this week’s bevy of central bank speakers continues to offer more clues to the path of monetary policy and the fate of stimulus. It’s Federal Reserve Chair Janet Yellen’s turn on Tuesday, who will weigh in as policy makers continue to disagree on whether to raise U.S. interest rates again this year. Finally investors will be monitoring the ongoing saga that President Donald Trump’s domestic policies have become in a bid to gauge the chances of any meaningful tax reform in the world’s biggest economy.

Terminal subscribers can read more in our Markets Live blog.

What to watch out for this week:

- The central bank speaking roster continues. Markets will be watching a speech by the Fed’s Yellen on Tuesday. Later in the week, Bank of England Governor Mark Carney appears, as does soon-to-depart Fed Vice Chairman Stanley Fischer.

- U.S. data on new-home sales Tuesday and durable-goods orders, GDP and personal spending later in the week will provide further clues as to the Fed’s policy path.

- Brexit negotiations are getting underway again.

- Spanish Prime Minister Mariano Rajoy will meet U.S. President Donald Trump in Washington Tuesday while his team back in Madrid attempts to turn the screws on a secessionist push in Catalonia.

- The euro-area inflation rate may have accelerated a touch to 1.6 percent in September from 1.5 percent but the core will probably remain at 1.2 percent when data is out on Friday.

And here are the main moves in markets:

Stocks

- The Stoxx Europe 600 Index dipped 0.1 percent as of 9:55 a.m. London time.

- The U.K.’s FTSE 100 Index dipped 0.2 percent, as did Germany’s DAX Index.

- The MSCI All-Country World Index declined 0.2 percent to the lowest in more than two weeks.

- The MSCI Emerging Market Index sank 0.5 percent to the lowest in four weeks.

- Futures on the S&P 500 Index decreased 0.1 percent.

Currencies

- The Bloomberg Dollar Spot Index gained 0.2 percent to the highest in almost four weeks.

- The euro fell 0.3 percent to $1.1817, the weakest in more than a month.

- The British pound increased 0.1 percent to $1.3483.

- The Swiss franc sank 0.3 percent to $0.9698.

Bonds

- The yield on 10-year Treasuries climbed less than one basis point to 2.22 percent.

- Germany’s 10-year yield increased less than one basis point to 0.40 percent.

- Britain’s 10-year yield gained one basis point to 1.346 percent.

Commodities

- The yield on 10-year Treasuries climbed less than one basis point to 2.22 percent.

- Germany’s 10-year yield increased less than one basis point to 0.40 percent.

- Britain’s 10-year yield gained one basis point to 1.346 percent.

Asia

- Japan’s Topix index closed flat after trading in a narrow range. South Korea’s Kospi index fell 0.3 percent and Australia’s S&P/ASX 200 Index lost 0.2 percent.

- Hong Kong’s Hang Seng Index added 0.1 percent after slumping 1.4 percent on Monday as Chinese property developers tumbled on fresh mainland home curbs. Read how one of the world’s most extreme stock rallies gets a reality check.

- The Japanese yen climbed less than 0.05 percent to 111.72 per dollar.

— With assistance by Adam Haigh