-

Treasuries fall; U.S. exchanges to reopen after holiday break

-

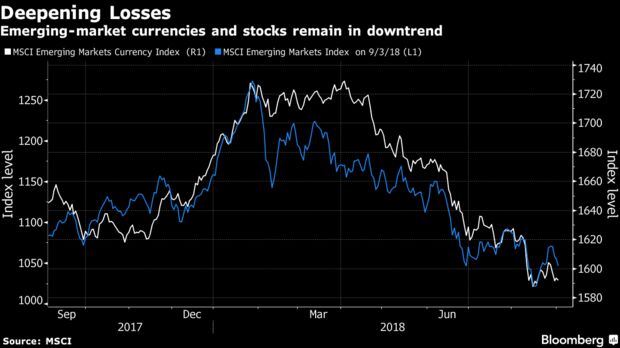

EM stocks halt decline; Mexican peso slips with rand, rupiah

European stocks climbed and U.S. futures pointed to a higher open on Tuesday after a listless session in Asia. The dollar strengthened and emerging-markets equities nudged higher for the first time in a week.

Investors are shifting focus to the U.S., where exchanges reopen after a holiday during which Argentina’s urgent financial measures increased concern about more volatility in emerging-market stocks and currencies. The jitters may add to the outperformance of developed markets, which have held up during the summer despite trade salvos from President Donald Trump, a Federal Reserve that’s heading toward another rate hike and steady economic growth.

Meanwhile, U.S. trade negotiators are in difficult talks with their Canadian counterparts over a revision of the North American Free Trade Agreement already agreed to by the U.S. and Mexico. On the China front, Trump may announce implementation of tariffs on as much as $200 billion in additional Chinese products as soon as Thursday.

Elsewhere, copper fell and the pound extended a decline before Bank of England officials including Governor Mark Carney testify in parliament.

Terminal users can read more in our Bloomberg Markets Live blog here.

Here are some key events coming up this week:

- Bank of England Governor Mark Carney on Tuesday testifies on the August inflation report and policy decision.

- Executives from Facebook, Twitter and Google on Wednesday testify on social media, Russia meddling.

- U.S. PMI data is due Tuesday, and employment reports for August are set to follow Friday.

These are the main moves in markets:

Stocks

- The Stoxx Europe 600 Index increased 0.2 percent as of 8:18 a.m. London time.

- Futures on the S&P 500 Index rose 0.3 percent.

- The MSCI All-Country World Index decreased less than 0.05 percent to the lowest in more than a week.

- The MSCI Emerging Market Index increased 0.1 percent, the first advance in a week and the largest climb in more than a week.

Currencies

- The Bloomberg Dollar Spot Index increased 0.3 percent to the highest in more than two weeks.

- The euro sank 0.4 percent to $1.1578, the weakest in more than a week.

- The Japanese yen decreased 0.3 percent to 111.36 per dollar.

- The Turkish lira fell 0.3 percent to 6.6575 per dollar, the weakest in more than three weeks.

- South Africa’s rand fell 0.8 percent to 14.986 per dollar, the weakest in more than two years.

- The MSCI Emerging Markets Currency Index declined 0.3 percent to the lowest in 14 months.

Bonds

- The yield on 10-year Treasuries gained two basis points to 2.88 percent, the biggest advance in a week.

- Germany’s 10-year yield climbed two basis points to 0.35 percent.

- Britain’s 10-year yield declined two basis points to 1.404 percent, the lowest in more than a week.

Commodities

- The Bloomberg Commodity Index declined 0.3 percent to the lowest in a week on the biggest fall in a week.

- West Texas Intermediate crude gained 0.7 percent to $70.29 a barrel, the highest in eight weeks.

- LME copper fell 1 percent to $5,910.00 per metric ton, reaching the lowest in almost three weeks on its fifth consecutive decline.

- Gold dipped 0.5 percent to $1,195.84 an ounce, the weakest in more than a week.

By Andreea Papuc and Eddie van der Walt

— With assistance by Cormac Mullen

September 4, 2018, 5:21 PM GMT+10

Source: Bloomberg