The US$ remains trapped and I keep reminding traders that I don’t think we will see decent trending FX markets until the US$ makes a decisive breakout from its recent congestion zone.

NB: I am still away so this is just a brief update.

Calendar: watch the following high impact items:

Gold daily: looking bullish as it holds above the 6-year broken trend line, following a text-book style test of this region, and as it moves back above $1,300

EUR/USD 4hr: also looking a bit perky as it sits above 1.18. There are two ECB President Draghi speeches and two Fed Chair Yellen speeches to monitor this week:

EUR/JPY 4hr: still chopping either side of 133. There is a BoJ Gov Kuroda speech to monitor as well as EUR data:

AUD/USD 4hr: looking bullish so watch the 61.8% fib here. Watch for impact from the RBA Monetary Policy Meeting Minutes, AUD Employment data and CNY GDP and Industrial production data:

AUD/JPY 4hr: looking bullish here too so watch the 61.8% fib as this fib ties in with the 89 S/R zone. Watch for impact from the RBA Monetary Policy Meeting Minutes, AUD Employment data and CNY GDP and Industrial production data:

NZD/USD 4hr: looking bullish as well so watch the 61.8% fib as this fib ties in with the 0.73 S/R zone. Watch with NZD CPI, CNY GDP and Industrial production data this week:

GBP/USD 4hr: has been a bit choppy but watch the 61.8% fib here. There is a bit of GBP data this week with CPI, Employment and Retail Sales data as well as a BoE Gov Carney speech:

USD/JPY 4hr: looking a bit vulnerable so watch the 61.8% fib here:

GBP/JPY 4hr: holding above 147 S/R for now but also watch the 4hr chart triangle trend lines:

GBP/AUD 4hr: watch the 1.70 level and bear trend line:

GBP/NZD 4hr: watch the 4hr chart trend lines:

EUR/AUD 4hr: back below 1.50:

EUR/NZD 4hr: note how price rejected the previous S/R level of 1.675! Watch for any make or break at the support trend line:

USD/MXN weekly: the 19 level is the one to watch here for any new make or break activity:

Indices:

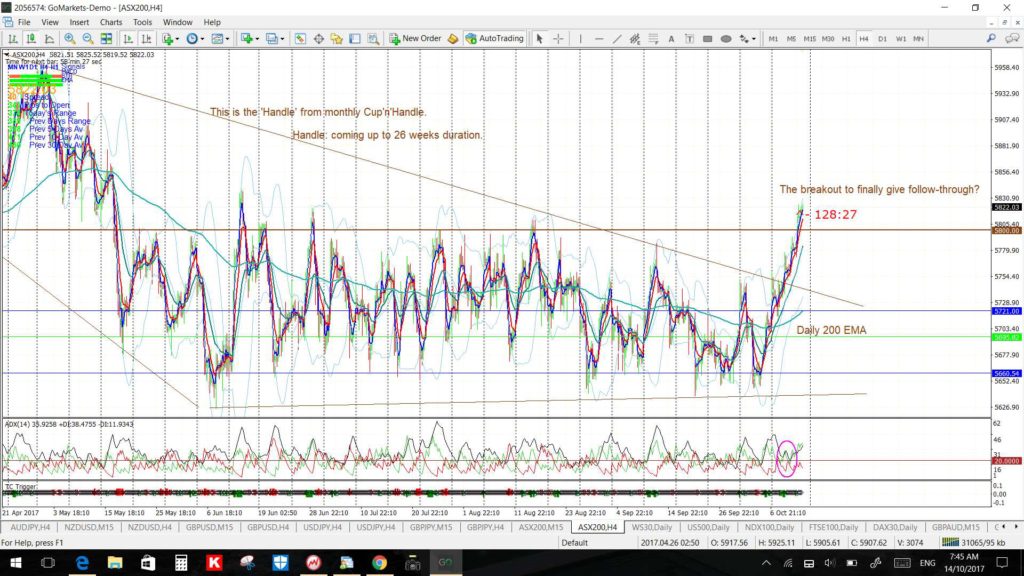

ASX-200 / XJO: this is looking rather bullish now and I’m wondering if this is the decisive breakout we have been waiting over 6 months for!

ASX-200 4hr:

XJO weekly: a Cup’n’Handle breakout underway?

XJO monthly: the bigger picture move though is to watch for any new ascending triangle breakout:

German DAX: has been reviewed in a separate post here.