Dovish Fed minutes have further weakened the USD and this has given many pairs a reprieve from testing recent lows. This may allow for some bounce moves, at a minimum, and so possible target levels will be considered.

USDX: the USDX has broken below a daily support trend line. I’m looking for a possible test of the 61.8% fib and 81.50 region:

Forex:

E/U: the E/U has broken up and out of a recent trading channel. It is struggling to break up and out from the 4hr Ichimoku Cloud though. Success here however might allow a bit of a bounce, even given the ongoing discrepancy between EUR and USD economic health. The daily chart below reveals possible bullish targets. ECB President Draghi speaks later tonight and this might determine the fate of any possible bounce move here:

E/U 4hr:

E/U 4hr Cloud:

E/U daily: possible targets include the 1.30, 1.325 and 1.35 levels as these tie in with fib levels:

A/U: this continues within the ‘Flag’ pattern ahead of AUD employment data BUT it has managed to close above the 4hr Cloud and above the possible ‘Double Bottom’ neck line. Â I’m not sure whether this Employment data result will translate into much movement for this pair though given the uncertainty surrounding the modified reporting of this metric. The 61.8% fib of the recent bear run is at 0.91 and may offer a target if this bullish bounce continues:

A/U:

A/U 4hr Cloud: note the break above the Cloud and Double Bottom ‘neck line’. Be careful around AUD Employment data. This could be a real wild card!

Kiwi: this continues to hold above 0.77 support but it hasn’t managed to break up and out of its 4 hr Cloud yet. Success here though might allow for a continued bounce and the daily chart reveals possible bullish targets:

Kiwi 4hr:

Kiwi 4hr Cloud: the bullish Tenkan/Kijun cross hasn’t got going but any close back above the 4hr Cloud would be a significant achievement. Watch for any break and hold above the 4hr Cloud /’neck line’ region:

Kiwi daily: any move back above the 4hr Cloud might allow for more of a bounce here. If so, the 0.80, 0.82 and 0.84 S/R levels also tie in with key fib levels and might be reasonable targets:

Cable: this is still adrift within the larger, daily-chart bullish wedge pattern and below its 4hr Cloud. There is high impact data here tonight with GBP Interest rates. I’d be waiting for a break and hold above the daily chart wedge trend line here but success here might suggest a move back up to 1.67 (see daily chart below):

Cable 4hr:

Cable 4hr Cloud:

Cable daily: for any bullish wedge breakout I’d be looking for a test of the 1.67 region as this is the 61.8% fib of the recent bear move BUT, also, the monthly 200 EMA and this has been a major S/R level for this pair:

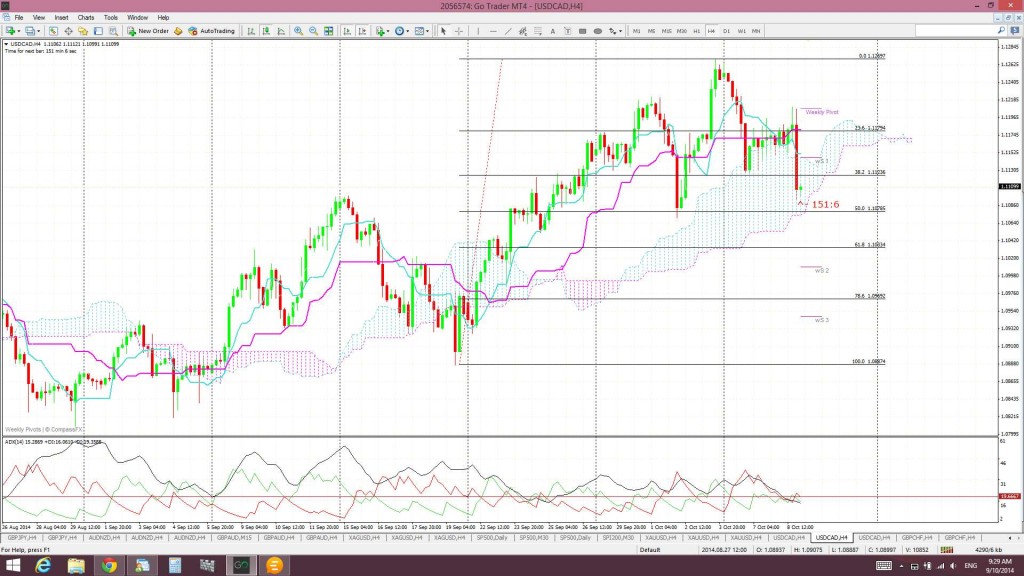

Loonie: USD weakness has seen this pair pair pull back and I’d expect the 1.10 level to be at least tested. The 1.10 level, apart from being a key S/R level, also ties in with a 61.8% pull back of the recent bull run! Any continued USD weakness could see this pair fall further though so I’m wary here. I do note that this pair is holding, for now at lest, above the major monthly triangle trend line:

Loonie 4hr:

Loonie 4hr Cloud: a close and hold below the Cloud would be bearish. Note how a 61.8% fib pull back of the last major swing move would bring price down to the key 1.10 level!

Loonie: remember there has been a major triangle breakout here:

Gold: this has also broken up and out from a descending trading channel and is trying to break free of the 4hr Cloud.

Gold 4hr:

Gold 4hr Cloud:

S&P500: stocks loved the Fed news as the 30 min S&P500 chart reveals:

The post FX: a look at some USD pairs (with targets) after FOMC. appeared first on www.forextell.com.