It seems kind of relevant to be raising this question today given the importance of this particular date. Today, Wed Oct 21st 2015, is Back to the Future Day, that is, the date plugged into the famous DeLorean Time Machine. Quite a few of the BTTF technologies have evolved and a summary of these can be found through this link. So, what of the future for the markets? Will it be Dystopian or Utopian and what vehicle might take us there? For me, I’m watching the major market index of the S&P500 as I think we need to see it breakout from its recent consolidation before other instruments might start to get a move on.

The S&P500 closed down for the day and it seems that some upbeat housing data was not enough to moderate disappointing company earnings; from IBM in particular. The S&P500 remains trapped and in a daily-chart triangle and many other trading instruments remain in consolidation-style patterns as well. I’m thinking we may not see too much general market movement until the major stock index gives us some kind of a lead.

S&P500 daily: this chart has not updated for today’s data but the slightly lower close means it remains trapped under the bear TL of the triangle.

S&P500 weekly Cloud: it also remains trapped within the weekly Cloud:

USDX weekly: this remains trapped in a Flag. I’m also not expecting to see too much market movement until this either breaks up or down:

Gold weekly: this may have broken up and out from a bullish descending wedge but it remains under the $1,200 level for now:

Forex: there is the BoC Interest Rate announcement today and a BoE Gov Carney speech to navigate through.

USD/CAD 4hr: I’ve put this pair first today given the 4hr chart triangle, the fact it is hanging near a key S/R level at 1.30 and there is major data later today with the BoC Interest Rate announcement. This might be the pair to watch today!

The monthly USD/CAD chart reveals how important the 1.30 level is as both support and resistance:

GBP/AUD 4hr: not much momentum just yet and so the TLs have been revised. Watch for any BoE Gov Carney inspired breakout:

GBP/NZD 4hr: I mentioned yesterday that this might head to test the key 2.30 level and price is struggling up there now. Also watch for any BoE Gov Carney inspired move here too:

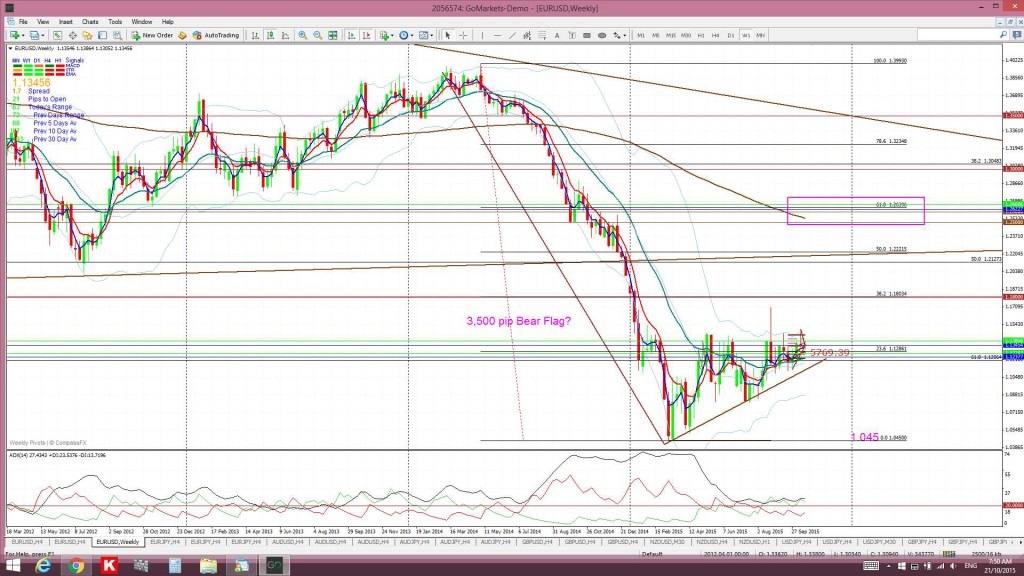

EUR/USD: consolidating within a 4hr triangle and within a weekly Flag ahead of Thursday’s ECB update.

E/J daily: still triangle-bound. Maybe ECB tomorrow will trigger a move?

A/U 4hr: still within a triangle:

A/J 4hr: ditto here:

Kiwi 4hr: tried to make a break higher last night but this failed as it didn’t like the GDT price index result and is thus back below 0.68 but… note the lack of momentum:

Cable 4hr: the 1.55 level remains key here and so watch for any reaction off this level, either up or down, with tonight’s GBP BoE Carney speech:

U/J daily: still un-inspiring:

GBP/JPY daily: the 4hr chart isn’t giving too many clues but we might be starting to see some increasing upside momentum here. Worth watching with tonight’s GBP BoE Carney speech perhaps? Any close and hold above the daily 200 EMA (brown line) would be encouraging:

The post Markets: Dystopian or Utopian future?? appeared first on www.forextell.com.