Two familiar stories dominated the markets overnight.

Today’s podcast

Overview: December song

- Positive mood music on China-US trade fuelling equity, bond yields gains; both highest in a month

- UK House speaker continues to frustrate PM’s desire for vote on his Brexit agreement

- Slim pickings on the data/events front today; Canadian election results in a few hours’ time

Positive mood music on US-China trade developments is keeping the risk fires burning, the S&P 500 closing back above 3,000 for the first time since September 19th, bond yields are higher across the globe by some 4bps on average and the US dollar remains on the defensive, albeit currently little changed from last Friday’s New York closing levels.

To get Brexit out of the way first up

We’re still not much the wiser than we were on Saturday, when former Tory MP Sir Oliver Letwin successfully frustrated PM Johnson’s efforts to get an up and down vote on the Brexit agreement he had struck with the EU last Thursday. House of Commons. speaker John Bercow refused to allow this on Monday, claiming it was the same bill as that already tabled last Saturday, but which never got to a vote after the Letwin amendment passed. The reality remains that the legal text of the Withdrawal Agreement Bill (WAB) first needs to be approved by parliament, as per the Letwin amendment, and unless or until it is, Boris Johnson’s wishes will continue to be frustrated.

The UK media for the most part continues to suggest that more likely than not the government can just get enough votes to see the agreement over the line, but the risk is that opposition MPs will introduce amendments to the WAB – such as insisting the whole of the UK remains inside the Customs Union and/or that the agreement should be put to a confirmatory vote or even a full-blown Referendum. So while markets haven’t seen fit to reverse last week’s optimism that saw Sterling smartly higher, they aren’t yet prepared to take the pound up to the next level, that successful passage of the Brexit agreement would presumably entail.

US equity markets have just closed with the S&P 500 +0.7% at 3,006.7, its highest closing level since September 19th. Sector wise, IT (+1.4%) energy (+1.9%) and financials (+1.1%) have led the charge higher. The VIX index continues to trade comfortably below 15, as it has done for over a week now.

Fuelling the positive mood music have been comments from President Trump’s chief economic adviser Larry Kudlow saying that while down to Trump, he sees the possibility of taking off the threatened December tariff increases, as China requested, if the trade talks go well. This follows a report in the Wall Street Journal at the weekend that at an 8th October meeting in the White House (so a few days before the Trump-Liu He handshake ‘Phase -1’ agreement), advisers told Trump that the Chinese tariffs were hurting his re-election chances and that Trump appeared to concede that he couldn’t just blame the Fed. The latter plays very much to our very that Trump’s intense verbal attacks on the Fed are merely designed to create a political scapegoat for any economic slowdown resulting from the tariffs.

Bond yields are universally higher

10-year US Treasuries currently up 4.4bps at 1.8%, the highest level since September 17th, following similar sized yield rises in Europe (e.g. German Bunds +4.0bps to -0.346%). 2-year treasury yields are also higher, +4.7bps to 1.621%

In FX

The USD is coming into the New York close little changed in index terms (DXY +0.04%) with a mixed performance across G10 currencies. NZD and CAD are both +0.3% and top of the leader board, the latter just ahead of preliminary results from Canada’s general election expect in a few hours’ time. The AUD is 0.16% higher at 0.6867 do pretty much where we left it on Monday evening, while the GBP and EUR have both given back a small fraction of their strong gains from the latter part of last week, currently both -0.18%.

And finally in news just in

Fonterra has increased its 2019/2020 forecast Farmgate Milk Price range from $6.25 – $7.25 per kgMS to $6.55 – $7.55 per kgMS. It says the 30 cents lift in the midpoint would inject $450m into the economy. This is not a major surprise – our resident BNZ cow whisperer Doug Steel had lifted his mid-point forecast to $7.10 last Friday vs. Fonterra’s now $7.05. NZD is little affected.

Coming up

Nothing to see in Australia today save the weekly ANZ consumer confidence reading (not market moving).

Brexit developments and how this impacts GBP will be more important than anything on the European data calendar, which in any event only sees UK public finances and the CBI trends survey.

Preliminary results from Monday’s Canadian General Election are expected to be available anytime from 11:00 AEDT

Data wise, Canada has retail sales and the US the Richmond Fed Manufacturing Index, US Existing Home Sales and monthly budget numbers

On the US earnings front, MacDonald’s and Procter & Gamble top the list of household names reporting Tuesday (both prior to the market open).

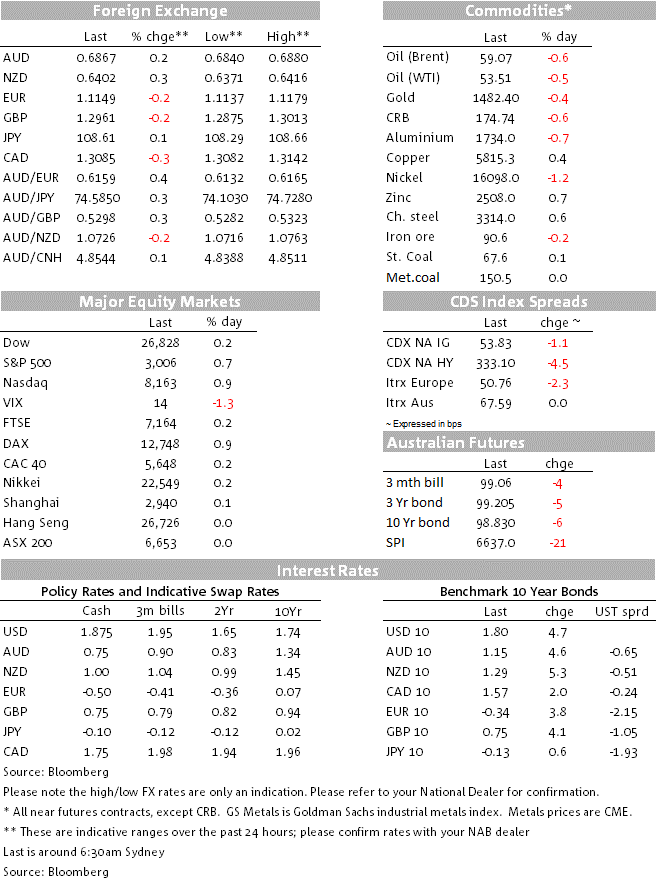

Market prices

By Ray Attrill

Source: NAB

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets