The pound has already weakened on the latest Brexit delay.

Today’s podcast

Overview: Tubthumping

- EU and US equities end the week on a sour mood. Boeing down 6.8%, soft China GDP not helping either

- USD eases again on Friday with GBP leading the charge

- AUD and NZD join the party and make further gains against the USD

- EU yields buoyed by soft Brexit hopes

- UST curve mildly steeper as Fed Clarida leaves door open for an October Fed funds cut

- Brexit saga continues – Weekend developments

- MPs support Letwin motion to withhold approval of PM Johnson Brexit proposal. PM unable to get vote on his Brexit Withdrawal Agreement Bill (WAB)

- Johnson sends Brexit extension request, but doesn’t sign letter. In a second signed letter the PM makes it clear that he doesn’t favour an extension

- Defeat at the Commons is a setback, but government remains determined on passing WAB before the end of October

- The PM may have the votes to pass WAB, but bill amendments and a Confirmatory Vote also look likely

- The new week: Quiet in AU and NZ; Brexit; ECB meets; flash US and EZ PMIs

I get knocked down, but I get up again, You are never gonna keep me down- Chumbawamba

Brexit has been the main theme in FX with GBP leading the charge against a broadly weaker USD on Friday. AUD and NZD also outperform, notwithstanding underwhelming China GDP data. PM Johnsons fails to get vote on his Withdrawal Agreement Bill (WAB) on Saturday, but the government remains defiant and may still get Brexit done this week. GBP gives back some of last week’s gains at the open as we now await for a vote on WAB ( likely Tuesday). European and US equities end the week on the back foot not helped by a 6.8% collapse in Boeing shares. European core yields edge higher on Brexit hopes while the UST curve steepens as Fed speakers, specially Clarida, leave the door open for an October Fed funds cut.

GBP led the charge against the USD on Friday as the market became increasingly confident PM Johnson was going to be able to get his WAB passed by parliament on Saturday. Cable closed the week at 1.2976, +0.72% on the day and +2.49% on the week. On Saturday’s special parliament session PM Johnson was blindsided by MPs support for Letwin’s motion .The motion is essentially an insurance policy aimed at making sure the PM is unable to trigger a no-deal exit if there was any delays in the WAB legal requirements.

So like a good drama the Letwin motion triggered a new twist in the Brexit saga. Boris Johnson was on Saturday forced to write to the EU seeking a delay to Brexit, he did but he did not signed the letter. In addition he also attached a second signed letter making it clear that he did not support Parliament’s request for an extension. The government was only defeated by 322 votes to 306 and many who voted for Letwin’s motion could in theory support the PM’s amended deal, they just didn’t trust the PM could angle for a hard Brexit outcome.

Speaking to the BBC overnight, Foreign Secretary Dominic Raab said he was confident enough MPs would back the deal this week. The extension request however opens the door for MPs to seek amendments to the bill while at the same time it increases the chances of a “confirmatory vote” to the deal. Prior to the extension request PM Johnson had the leverage to threaten a hard Brexit if MPs didn’t back his deal, that leverage is now no longer effective.

The stronger GBP continued to have a positive spillover effect on the euro with the latter closing the week up 0.4% to 1.1170. This combination saw USD indices fall further, to their weakest level since July, with the DXY index down 0.3% for the day and 1% for the week. That said some of this GBP positive vibes have reversed a little this morning with the pound now trading at 1.2926, down 0.5% as the market digests Brexit developments over the weekend (EUR now at 1.1155).

The NZD and AUD both gained about 0.5% on Friday, reaching monthly highs in the process and closing the week around 0.6380 and 0.6855 respectively (both have opened little changed this morning, only a couple of pips lower). There was no adverse effect from China’s data release, where Q3 GDP growth showed annual growth slowing to a fresh multi-decade low of 6.0% y/y, a touch below consensus. It wasn’t all bad news though, with industrial production for September picking up more strongly than expected.

US-China trade tensions are weighing on China’s manufacturing and export sectors while Beijing’s measured fiscal and monetary stimulus are only an offsetting force. China’s economic growth is slowing as officials have one eye on US tensions while at the same time they strive to tidy up the financial system and limit excessive credit growth. If US tariffs are not removed, further economic slowdown looks likely with deflationary pressures now emerging as an additional macro concern. Given the larger than expected slowdown in China’s growth in Q3, we have revised down our near term forecasts. Growth for 2019 is forecast at 6.1% (from 6.25% previously), while growth in 2020 is forecast at 5.9% (compared with 6.0% previously).

European and US equity markets ended the week in a cautious mood

The negative lead from Asia on the back of softer China GDP was later compounded by a 6.79% drop in Boeing following reports a high-ranking Boeing pilot had expressed misgivings on the 737 Max three years ago. The fall in Boeing’s shares accounted for about two-thirds of the decline in the Dow (-0.95%), while weakness in the IT sector weighed on the NASDAQ (-0.83%) and S&P 500 (-0.39%).

Brexit development pushed core European yields higher with the 10y Bunds up 2.8bps to -0.3840% while the move lower in shorter tenors steepened the UST yield curve. We had a few Fed speakers on Friday, but influential Vice-Chair Clarida had the biggest impact in the move lower in the front end of the curve. Clarida affirmed expectations for an October rate cut (now priced at 88%), saying the outlook for US growth is favourable but there are “some evident risks,” as business fixed investment has slowed “notably” and “global growth estimates continue to be marked down.”. Clarida then added that central bank will “act as appropriate” to sustain the economy’s expansion.

Coming up

- It’s a quiet week for Australia with only an interview on benchmark reform with Assistant Governor Chris Kent scheduled on Wednesday.

- Japan’s trade data and all industry activity index are the data highlights today.

- Apart from Brexit developments, EU Flash October PMI releases will dominate on Thursday; the same day the ECB meets.

- The Markit US flash PMIs (also Thursday) will provide a signal on whether activity in October is any better or worse than that revealed in both Manufacturing and Non-manufacturing September ISMs. Earning season is in full swing with reports due from: Amazon, Microsoft, Ford, Kia, Kyundai, Caterpillar, UBS, Barclays and Procter & Gamble – to name a few.

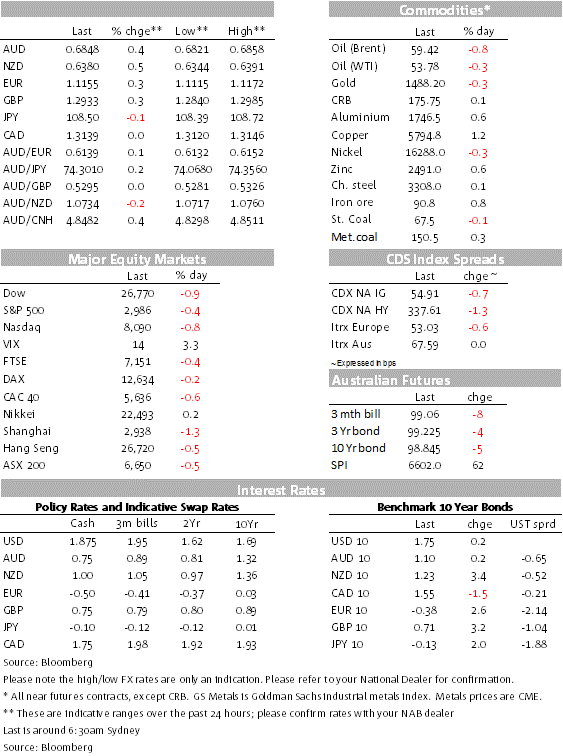

Market prices

21 Oct 2019

Source: NAB

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets