An ECB Governing Council member suggests markets hadn’t priced in the extent of the stimulus measures coming next month.

Today’s podcast

Overview: ECB’s bazooka primed for September

- Great bond rally continues with US 10yr yield intra-day low of 1.47%, US 30yr sub-2%, and German 10yr -0.71%

- Moves driven by ECB’s Rehn: “has [a] big bazooka primed for September”; better to overshoot than undershoot

- EUR naturally weaker (-0.3%), USD (DXY) stronger (+0.2%), and AUD outperforming (+0.6%)

- No end in sight to US-China trade tensions; conflicting headlines though created volatility for stocks

- US data strong with retail sales beating expectations, but the Cass Freight Index falling for the 8th month in a row

- Coming up: Quiet domestically, offshore US Housing Starts and Consumer Confidence

The global bond rally continued overnight driven by prospects of aggressive ECB stimulus. In a WSJ journal interview titled “ECB has big bazooka primed for September”, the ECB’s Rehn foreshadowed an aggressive policy response at the upcoming September meeting. European bonds rallied hard on the news with German 10 year bund yields -6.3bps and hitting another record low of ‑0.71%. Notions that such a package will include a revamped QE program have also seen a sharp rally in Italian, Spanish and Portuguese debt, with Italian 10yr yields down a sharp -17.6bps to 1.3270%. US rates moved in sync with US 10yr yields -8.8bps and trading through 1.50% for the first time since July 2016, while yesterday US 30yr yields went sub-2% for the first time ever. With aggressive ECB stimulus likely, the EUR fell -0.3% to 1.11, while the USD (DXY) rose 0.2%. FX outperformers overnight were the Aussie with the AUD +0.5% to 0.6777 supported by the employment beat yesterday, and GBP +0.4% to 1.21 as Parliamentarians finally bare their teeth against a no-deal Brexit.

First to ECB stimulus hopes. There has been much speculated over recent weeks how aggressive a program will be. Overnight the ECB’s Rehn explicitly hinted at a very aggressive package in a WSJ interview titled “ECB has a big bazooka Primed for September, top officials says” (see article for details). Such a program should include a re-vamped QE that is “substantial and sufficient” (here the 33% buying cap would need to be amended) along with a likely deposit rate cut, while the ECB could also sweeten term funding by lowering their interest rate (likely as a consequence to a cut in the deposit rate) and/or extend their maturities. Overall the package looks to be being designed to “overshoot than undershoot, and better to have a very strong package of policy measures than to tinker”. Markets currently expect the ECB will cut the deposit rate by 10bps (to -0.50%) as well as under bond purchases of around €50bn a month.

If the ECB undertakes such substantive stimulus, it is unlikely to do so alone given the upward pressure it would put on the USD. A taste for that perhaps overnight with the EUR -0.3% to 1.11 and the USD (DXY) +0.2% to 98.17. Also such an aggressive package is in reaction to a Eurozone economy that has deteriorated over the past couple of months which will also weigh on the global economy. The Fed’s Bullard (voter) played into this view overnight, stating “I think we’re in the middle of a global slowdown and we’re just going to have to assess how this is going to affect the U.S. economy”. We might be able to avoid a downturn “if we play our cards right”. The later comment adds to notions of further “insurance” rate cuts despite ok US economic data overnight (see below). Bullard also noted that market moves “might be a little overdone”, but will be watching closely.

US data overnight was on the whole positive with Retail Sales beating expectations on the back of the two-day Amazon prime event. The key control measure rose 1.0% m/m, well exceeding the 0.4% consensus. Though as noted the strength was driven by non-store (or online) sales which were up a sharp 2.8% m/m while ex-non-store was a more mild 0.6%. Jobless claims also remained at relatively low levels, though did climb very slightly to 220k against a consensus of 212k. Overall the two prints suggest the US consumer has not been affected by the slowing seen in the industrial side of the economy. Highlighting industrial weakness though, industrial production was weaker than expected at -0.2% m/m against the +0.1% consensus, driven by falls in manufacturing (-0.4% m/m) and oil output (-2.9% m/m). The first regional manufacturing surveys were also released overnight with both beating expectations (Empire 4.8 against 2.0 expected and 4.3 previously) (Philly Fed 16.8 against 9.5 expected and 21.8 previously).

Less closely watched but worth noting is the US Cass Freight Index which was negative for the 8th consecutive month with the y/y volumes down -5.9% in July and the weakest annual rate since around November 2009. Cass note this strengthens their “concerns about the economy and the risk of ongoing trade disputes” (see Cass report for details). Fears over the extent of the slowing seen in the industrial side of the US economy will continue to underpin concerns about the health of the US economy and likely will sustain the rally we have seen in bonds to date.

Stocks had a volatile session on conflicting US-China headlines, but on net there remains no end in sight and the S&P500 closed marginally 0.2% higher. China’s State Council Tariff Committee said China “has no choice but to take necessary measures to retaliate” to Trump’s latest tariff measures. Subsequent comments though painted a mild conciliatory tone that China “hopes the US will meet China halfway and implement the consensus reached by the two leaders in Osaka”. Nevertheless it is clear that China is willing to play the long game, meaning to de-escalate tensions this will have to come from the US side. Playing to this view was the Editor of the Global Times (who is seen as having a line to Beijing) who noted “The US economy doesn’t appear as strong as Trump said. Chinese society has full confidence to fight a prolonged battle with the US. Trade war and Hong Kong riots have hit US’ positive image in China. Chinese society is more united politically and can afford a long-term fight.”

UK Parliamentarians are finally starting to bare their teeth against a no-deal Brexit with GBP up overnight +0.4% to 1.2100. Labour opposition leader Corbyn invited MPs from opposition parties to support Labour in forming an emergency government for a “strictly time-limited” period to avert a no deal Brexit and arrange for fresh elections. Corbyn said he would bring forth a no confidence motion in PM Boris Johnson’s government at the “earliest opportunity when we can be confident of success”. However, reception was mixed with the Liberal Democrats preferring a pro-remain Conservative veteran MP as an interim leader (and it is unclear whether pro-remain Tories would want Corbyn as an interim leader in the first place). Bettering odds for a no-deal Brexit have consequently drifted down to 37.5%. It is worth noting though even if Parliament succeeds in avoiding a no-deal Brexit, the subsequent general election could give a multitude of outcomes which may not be GBP positive – such as a Labour led government or a Brexit Party that helps to form government.

Finally, the AUD outperformed overnight, up +0.6% to 0.6777, supported by stronger than expected employment data. Employment grew by 41.1k in July against 14.0k expected. The unemployment rate also held steady at 5.2% for the fourth consecutive month, though it has increased from an eight-year low of 4.9% back in February. The ongoing strength in employment will be reassuring for the RBA, though there is still significant spare capacity in the labour market given the RBA estimates the NAIRU at 4.5%. Furthermore, overall underutilisation rose as underemployment ticked up 0.2ppt to 8.4%. NAB continues to see the RBA having to cut rates further.

Coming up today

A very quiet day ahead in APAC and Europe with no top-tier data scheduled. In the US focus will be on housing starts and the university of Michigan consumer sentiment survey:

- NZ Manufacturing PMI (10.30am local; 8.30pm AEST): Not usually market moving and no consensus is available; prior was 51.3.

- EZ Trade Balance (11.00am local; 7.00pmAEST): Not usually market moving. The consensus looks for a surplus of €18.5bn for June, down from May’s €20.2bn

- US Housing Starts/Permits (8.30am local; 10.30pm AEST): Housing starts are expected to rise 0.3% m/m, while permits are expected to rise by 3.1%.

- US Uni Michigan Consumer Confidence (10.00am local; 00.00am AEST): Consumer sentiment is expected to fall slightly in August to 97.0 from 98.4. Downside risks could be likely given falls in equity markets and the recent intensification in the US-China trade war.

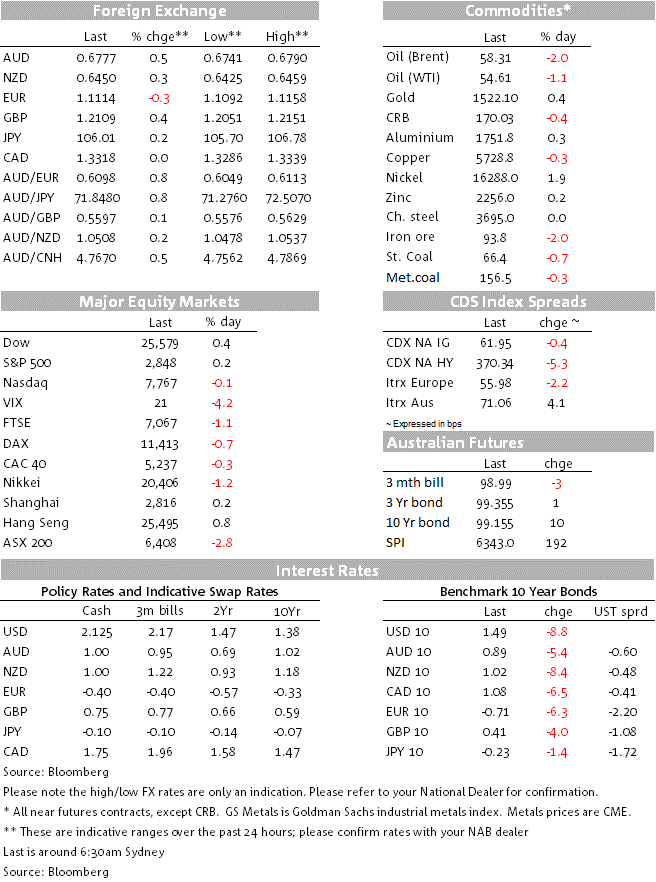

Market prices

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

16 Aug 2019

Source: NAB