The surprise news on Friday were reports that the German government might relax some of its spending rules to splash out and prevent a recession.

Today’s podcast

Overview: Wild thoughts

- German fiscal stimulus hopes buoy equities (S&P500 +1.4%) along with yields (German 10yr +2.8bps to -0.69%)

- Trump was worried about Wednesday’s stock market fall – held a conference call with Bank CEOs

- But, Trump is sticking to his guns: “I’m not ready to make a deal yet with China”

- AU housing market gaining traction with the preliminary auction clearance rate highest in over two years at 76.6%

- Coming up this week: Jackson Hole, Flash-PMIs, Minutes from Fed/ECB/RBA, Italian confidence vote, G7 summit

- Coming up today: Quiet domestically, offshore JN Trade Balance and Fed’s Rosengren

The possibility of German fiscal stimulus reared its head again on Friday, helping to buoy equities and sending yields higher. Nevertheless, subsequent commentary suggests such stimulus would only come in the event of a crisis and for now stimulus hopes – in the words of that Barbadian songstress Rihanna – are Wild Thoughts. Yields rose sharply on the initial headlines with German 10yr yields +8bps intraday, though retraced some of the moves to be +2.8bps to -0.69%. US yields largely moved in sync with 10yr yields +2.7bps to 1.55%. Equities were unsurprisingly buoyed with the Eurostoxx50 +1.4% and S&P500 up a similar +1.4% to 2,889. FX moves on Friday were largely contained apart from the NZD (-0.3% to 0.6433) on the back of a weak Manufacturing PMI, and GBP which rose as Parliamentarians continue to discuss how to avoid a no-deal Brexit (GBP +0.4% to 1.2163). Major FX was little moved with the USD (DXY) flat at 98.20 with EUR -0.1% to 1.1093 and USD/Yen +0.3% to 106.46. The AUD was little moved and is currently fetching 0.6791.

First to German stimulus thoughts. Der Spiegel reported on Friday that Germany would be prepared to take on new debt to counter a possible recession. There was though some pushback saying such action isn’t imminent. An interview with Germany’s Finance Minister Scholz confirmed this sentiment, while also implying Germany could muster €50bn of extra spending in a crisis. Further, according to the original Der Spiegel article it looked like any new debt would be part of letting the automatic stabilisers kick-in which doesn’t suggest a pro-active approach to fiscal stimulus. For now hopes of German fiscal stimulus is tied to the economic outlook. Nevertheless, hopes of fiscal stimulus will be important to watch with a broad-based global expansion of fiscal policy still being one way to scare a bond market with yields at extreme lows.

Yields moved sharply intra-day on the German stimulus headlines, with German 10 year yields moving by 8bps intra-day, though retraced some of the moves to be +2.8bps to -0.69%. US yields largely moved in sync with 10 years +2.7bps to 1.55%. There was larger movement in the long-end of the curve with the US Treasury discussing the possibility of 50-100 year bonds though no decision has been made and similar notions were floated in 2017. The US 30 year yield as a consequence increased by 6bps with the yield curve steepening. Moves at the shorter end were contained with heightened speculation of Fed rate cuts supported by weaker than expected consumer sentiment data overnight.

US Consumer Sentiment fell to a seven-month low of 92.1, below expectations of 97.0and down from last month’s 98.4. The decline was driven by the expectations component which correlated with the stock market, suggesting should stocks fall further consumer confidence would decline. Still the level of 92.1 overall still points to a healthy consumer outlook. More information on the health of the US consumer will come this week with updates from Home Depot and Target among others.

It wasn’t only Consumers who were jittery about stock market falls. Media report that President Trump held a conference call with bank CEOs on Wednesday amid the sharp fall in stocks. Sources suggest the CEOs responded by saying the consumer is doing well, while the trade dispute is damaging the outlook for capital spending. While this at face value suggests President Trump is sensitive to stock market falls, a sharper fall in stocks is likely needed to see the President change tack. This sentiment was confirmed this morning with Trump in an interview stating he is not ready to make a deal with China and that the US can do a lot of things if the economy slows down. That suggests Trump will be jawboning/relying on the Fed to stimulate the economy with Trump stating “if it slowed down it’s because I have to take on China and some other countries”. Kudlow also on the weekend played into this view, stating the US is in a “kind of technological war with China”. On Huawei, the temporary licences that are due to expire today could be extended, though Trump has said he will make his decision tomorrow.

In FX, the major moves were in the NZD and GBP. The Kiwi fell some -0.3% to 0.6433 with a weak Manufacturing PMI weighing – the PMI hits its lowest level since 2012 at 48.2 with weakness in the Employment and New Orders Indexes. Moves in GBP were driven by further talks amongst Parliamentarians to avoid a no-deal Brexit (GBP +0.4% to 1.2163). So far talks are only in the preliminary stages with push-back on suggestions of having Corbyn as a temporary PM, but it is a space worth watching closely when Parliament resumes in September. Betting markets currently ascribe around a 40% chance of a no-deal Brexit.

Australia’s Housing Market looks to have continued its stabilisation with the preliminary auction clearance rate at its highest level in over two years at 76.6% (the final rate is expected to be around 70% which would be the highest since May 2017). The one area of caution though is that volumes are down by around 35% compared to last year with around 1,221 auctions on the weekend.

Finally, with the RBA having limited conventional scope to ease policy, speculation has picked up on what form an Australian-style QE could take and under what conditions it would be warranted. Former RBA Deputy Governor Stephen Grenville this morning writes in the AFR that QE has “proven to have only limited uses – and none of them apply to Australia outside of a crisis” (see AFR article for details).

Coming up today and week ahead

It is a very day quiet ahead for markets with little on the radar apart from the NZ Services PMI and Japanese Trade Balance. The week though will start to pick-up from Tuesday with a number of key risk events, including the possibility of a no-confidence vote in the Italian Parliament, FOMC Minutes on Wednesday, ECB Minutes on Thursday along with the flash PMIs. The flash PMIs will be important in helping to assess whether the known slowdown in the manufacturing sector is weighing on the larger services sector – Germany’s Q2 GDP last week suggests it is starting to. In central bank speak the Fed’s Jackson Hole Symposium on “Challenges for Monetary Policy” starts on Thursday and is going through to Saturday. Fed Chair Powell speaks at the Symposium on Friday along with Australia’s own RBA Governor Lowe on Saturday, while at home the RBA Minutes come out on Tuesday though are unlikely to contain new information given Lowe’s recent Parliamentary Testimony. Markets will also be focused on any developments on trade, some development may occur with G7 leaders meeting at the weekend. As for today’s events in detail, we get:

- NZ Services PMI (10.30am local; 8.30pm AEST): Greater than usual focus given the Manufacturing PMI hits its lowest level since 2012 at 48.2 with weakness in the Employment and New Orders Indexes. Last month the Services PMI was 52.7.

- JN Trade Balance (8.50am local; 9.50am AEST): Trade balance is expected to contract with both exports and imports expected to be -2.3% y/y, leaving the adjusted trade balance at -¥150.8bn.

- EZ Final-CPI (11.00am local; 7.00pm AEST): The final-CPI for July is expected to leave Core CPI at 0.9% y/y, though the headline is expected to be revised lower to 1.1% from the flash of 1.3%.

- Fed’s Rosengren (voter, hawkish) (time unknown): Rosengren is speaking in an exclusive Bloomberg interview. Note Rosengren dissented from the July rate cut and focus will be on whether he holds this view despite the recent deterioration in global sentiment. His dovish counterparts appear to be becoming more concerned about the outlook and last week hinted at more pre-emptive action being necessary.

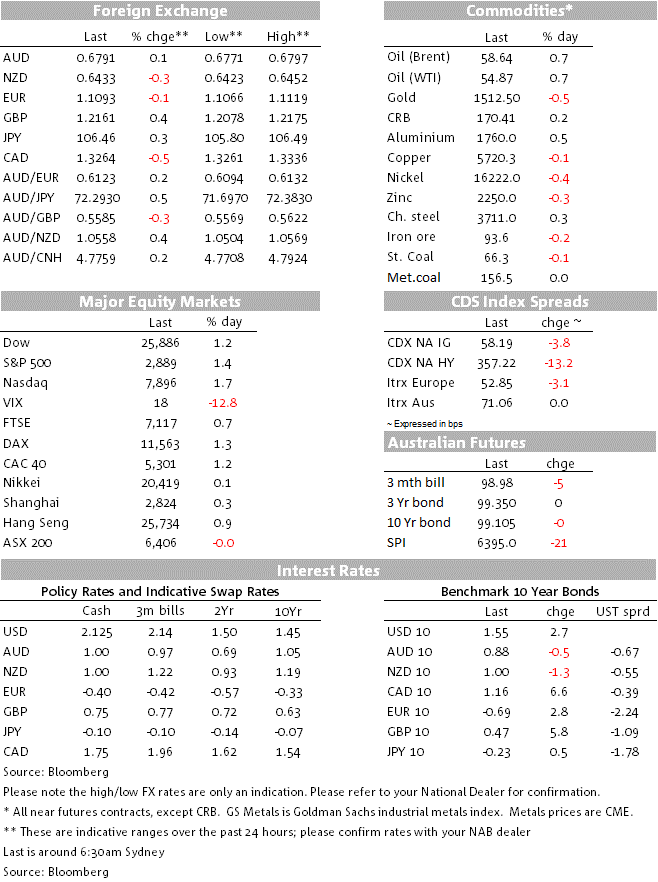

Market prices

19 Aug 2019

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets