The pound took another hit today, now at its lowest level since March 2017.

Today’s podcast

Overview: Pound the alarm (refrain)

- Sterling sinks as markets scale up risk off early election and/or Oct 31st no deal Brexit

- Aussie 3yr bonds close yesterday at 0.8%, fall extends to 0.79% overnight

- AU building approvals, BoJ today

No escaping from all things Sterling in overnight markets, where the GBP/USD exchange rate has hit its lowest levels since March 2017 and is rapidly closing in on its post-referendum (ex-flash crash) lows of around $1.20.

AUD/GBP is still a bit below its 0.5672 mid-July high at 0.5646 (when the AUD/USD rate was pushing up toward 0.71, so some 2.5% up on where it is now) and well below its post-referendum highs near 0.63. This is readily achievable in so far as we see risk of at least another 10% fall for Sterling in the event of either a no deal 31st October Brexit or an early election, the latter either at UK PM Boris Johnson’s behest or because one is foisted on him as a result of a successful no-confidence motion, assuming he is not going to back off his ‘whatever it takes’ attitude toward delivering Brexit at the end of October.

Speculation that Johnson will himself choose to run to the polls, in September or early October, has been heightened by the weekend opinion poll in the UK Times showing the new Johnson-led Tory government opening up a 10 percentage point lead over Labour with a 6-point surge in support since Johnson’s elevation to the party leadership and prime ministership. It’s worth noting though that this is no more, in fact a bit less, than the bounce in Tory support following Theresa May’s election to the leadership in 2016. Her subsequent dash to the polls to shore up her support in the House of Commons blew up quite spectacularly as you’ll recall.

Odds on a no-deal Brexit have risen – now to close to 40% according to Belfair – after Johnson made clear he would not talk to the EU unless they agree to re-open the Withdrawal Agreement and in particular with respect to the contentious Irish backstop, which the EU has made abundantly clear is not up for renegotiation.

Elsewhere in currencies, it’s a little surprising to not see the Euro suffer some collateral damage from the weakness of Sterling, but which suggests it is the fear of an early UK general election that is the dominant force on Sterling just at the moment rather than the fear of the economic fall-out from a no-deal Brexit. This is something which would add additional downward pressure to an already weaken Eurozone, bearing in mind some 16% of EU exports go to the UK. Or perhaps it’s just that the FX market has bigger fish to fry with GBP at the moment than take on board what this means for economies and markets beyond the UK’s shores.

What the GBP fall has done is mechanically lift USD indices; given the 10%+ weight this has in some USD indices, through this is now 0.1% or back from its intra-night highs to be about flat relative to Friday’s New York close. Currency markets have been little affected by President Trump’s latest trade. To wit:

“The Fed “raised” way too early and way too much. Their quantitative tightening was another big mistake. While our Country is doing very well, the potential wealth creation that was missed, especially when measured against our debt, is staggering. We are competing with other countries that know how to play the game against the U.S. That’s actually why the E.U. was formed….and for China, until now, the U.S. has been “easy pickens.”

“The Fed has made all of the wrong moves. A small rate cut is not enough, but we will win anyway! The E.U. and China will further lower interest rates and pump money into their systems, making it much easier for their manufacturers to sell product. In the meantime, and with very low inflation, our Fed does nothing – and probably will do very little by comparison. Too bad!”

AUD has been flirting with levels sub-0.69 (low of 0.6895) to be the second weakest currency on Monday after GBP.

US equities have had a relatively quiet night in front of the Fed and with no major household names reporting earnings. The S&P has meandered around the 3020 level to finish -0.16%, the Dow +0.1% and NASDAQ -0.4%.

In bonds, US yields are within half a basis point of Friday’s closed and little changed from Monday afternoon Tokyo levels. Aussie 3-year bonds hit 0.8% yesterday (low of 0.775)and just closed the Sycom session with an implied yield of 0.795%. RBA Governor Lowe’s comments last week to the effect that rates will be staying low for a long time and a money market that fully prices a 0.5% Cash Rate by mid-next year, continue to ring in the bond market’s ears. Q3 CPI is tomorrow morning

Coming up

The BoJ is next cab off the rank as far as major central banks are concerned, though coming just in front of Wednesday night’s FOMC conclusion, the potential for any sort of market moving outcome is limited. There will be updated forecasts, though the latest (April) forecast for the target CPI-ex fresh food measure for FY19 was a very unambitious 0.9% (vs. the 0.8% FY18 2018 outcome) and for GDP 0.8% which is the same as the FY18 outcome; so neither numbers look to be in immediate need of surgery as a prelude to possible further easing actions. That remains a story for another day, and in particular once we see how the economy is faring out of the October 1st consumption tax hike from 8% to 10%.

Before the BoJ outcome, latest Japan unemployment data is expected to show an unchanged 2.4% rate and industrial production a 1.8% monthly fall (largely reversing the 2.0% May rise).

Australia has June building approvals, which NAB forecasts to unwind last month’s rise, falling 1% in June. The consensus is for a 0.2% rise.

Offshore tonight, France has preliminary Q2 GDP (seen +0.3%, the same as Q1) and Germany preliminary July CPI (seen falling to 1.3% from 1.5% on an EU harmonised basis).

The US has July pending home sales and the Conference Board’s consumer confidence reading (latter expected at 125 from 121.1, a stronger rise than for the University of Michigan version published on 20th July (98.4 from 98.2, likely reflecting the further gains in US stocks to new record high territory since then.

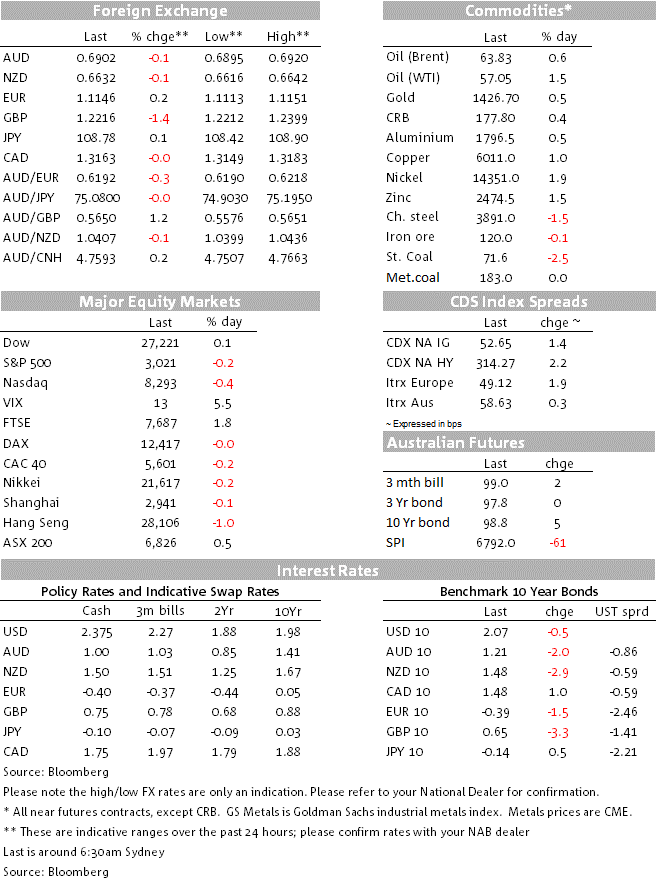

Market prices

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets

Source: NAB

30 Jul 2019