Markets have taken a hit as much of yesterday’s optimism subsides.

Today’s podcast

Overview: Hot n cold

- US equities turn south amid US-China trade uncertainty

- Guarded mood weighs on longer dated UST yields and increases demand for gold

- US Consumer survey surprises showing resilience against expectations for a softer print

- GBP outperforms on hopes a no deal Brexit may be avoided

- AUD and NZD drift lower

- AU Q2 construction work done, German consumer confidence today’s data highlights. Fed Daly and Barking on speaking duties

Cause you’re hot then you’re cold, You’re yes then you’re no, You’re in and you’re out…. – Katy Perry

The up and down (hot n cold) pattern in equity markets continues with US stocks turning south after initially jumping higher following a positive lead from Asia and Europe. Monday’s optimism on the back President Trump’s remarks that China was keen to do a deal faded overnight amid no new news from the US front while media reports from China left the impression that the two parties are not quite yet ready to find a compromise. The risk off environment has triggered a bid for longer dated USTs and gold while in FX the USD is little changed, JPY is stronger and growth/risk sensitive currencies such as the AUD and NZD have followed EM FX lower. GBP outperforms on hopes a no deal Brexit may be avoided.

After a positive end to the Asia session, the mood remain groovy during the Europeansession helped along by news of a new Chinese policy aimed at easing new car purchases while higher oil also helped the energy sector. The move in oil up in oil was boosted by comments from OPEC and friends suggesting oil stockpiles should fall sharply on the back of wider production cuts. US equities opened higher, but turn south soon after as the market became a bit more wary on the validity of Trump’s optimistic comments the day before.

Trump’s claim that US and Chinese negotiators had spoken over the weekend, which provided the impetus for Monday’s equity market rally, has been rebuffed again by Chinese officials, with a Ministry of Finance spokesperson saying yesterday he had not heard of this taking place. Media reports from China have also played a role on the guarded mood in markets with the editor of the Global Daily, who is seen to be close to high levels of the Chinese government, tweeted that China was focused on supporting domestic demand and “not putting so much emphasis on trade talks.” In the same tweet, he added that “China’s economy is increasingly driven internally, it’s more and more difficult for the US to press China to make concessions.” China’s State Council yesterday unveiled some targeted measures aimed at supporting consumption, including loosening restrictions on buying cars. Meanwhile, Bloomberg reported on claims by unnamed Chinese officials that Trump’s credibility was a key obstacle to a trade deal and that only a few negotiators on the Chinese side saw a deal as possible before the 2020 US presidential election (in part because of wariness that Trump might subsequently renege).

So after a positive start to the new week which saw the S&P 500 closed 1.1% higher on Monday, US equity markets have closed broadly lower today with the S&P500 down 0.32% while the NASDAQ is -0.34% and the Dow closed -0.47. Most S&P sectors ended the day with negative returns with materials, communications and utilities the exceptions. The later seemingly benefiting from higher oil prices ( WTI +2.50% Brent +1.36%) while on the other end of the spectrum, financials were the big losers down 0.69%, not helped by the UST curve bull flattening which resulted in the 2y10y curve inverting gain to -4bps. A flatter curve is usually associated with downward pressure on commercial banks’net interest margins. 10Y UST now trade at 1.47% 5.2bps lower on the day while the 30y bond is down 7.5bs to 1.96%. This is the third time the 10y UST note has broken below the 1.50% mark in August, the 10y UST remains in a downtrend and many will be looking at the June 2016 lows of 1.3180% as a potential target for an extension to the current decline in yields.

A better than expected US Consumer survey also played into the UST curve flattening theme limiting the decline in the front end of the curve ( 2y closed -1.7 at 1.5230%). The US Conference Board survey for August showed headline confidence levels remaining near record high levels against expectations for a fall (135.1 vs 129 exp.). Notably too, the so-called ‘labour market differential’, which measures the difference between those survey respondents saying jobs are ‘plentiful’ less those saying jobs are ‘hard to get’, rose to its highest level since September 2000. This indicator is consistent with a continued trend lower in the unemployment rate, although the market is much more focused on the potential economic fall-out from the recent escalation in the trade war.

Elsewhere, Italian government bond yields moved sharply lower overnight after signs of progress in coalition talks between the PD (democrats) and Five Star parties. Bloomberg quoted unnamed officials as saying the two parties would seek keep the deficit under the 3% limit set by the European Commission, if a coalition agreement can be formalised. Italy’s 10 year yield fell 18bps, while the spread to the 10 year German bund fell to its narrowest level since May last year, at 183bps

Moving onto FX, main USD indices are little changed although it has edged higher against EM and ASIA FX. DXY has remained with a 98 handle with the risk off environment helping JPY outperform ( 0.34% USDJPY ¥105.75) while AUD and NZD have followed EM FX lower. NZD is -0.47% relative to yesterday’s levels and now trades at 0.6362, NZD has probed fresh lows on trade war concerns and with more expected upside in USD/CNY our analysis suggests a move into a USD 0.60-0.63 zone is inevitable. In a similar vein, but to a lesser degree AUD is 0.32% lower over the past 24 hours and now trades at 0.6753. Given our expectations for further CNY weakness, like NZD we think the AUD is also likely to remain under pressure over the coming months. CNY drifted a little bit higher again and now trades at 7.16 ( up 0.01), we think the trade war between the US and China is getting a bit uglier and hence USD/CNY ‘s path of least resistance is still higher.

Last but not least, , the GBP has been the star performer on some emerging optimism that a no-deal Brexit might be able to averted. The GBP is 0.6% stronger to almost 1.23, its highest level in a month. The Guardian reported that there was tentative optimism on both the UK and EU side after recent meetings between Boris Johnson and Merkel and Macron. EU officials were ready to look at “realistic” proposals for an alternative to the Irish backstop although, as yet, such a solution has proved elusive. EU officials are also wary that even if Johnson were able to come up with a deal, the parliamentary arithmetic and limited time until 31st October might scupper its chances of passing in time.

Separately, Labour leader Jeremy Corbyn met with opposition parties to determine a route forward to prevent a no-deal Brexit. Lacking agreement among opposition parties on who might lead an interim government, if a vote of no confidence were to succeed, MPs are reportedly coalescing around the use of legislative measures to force Johnson into extending the Brexit date beyond October 31st. The BBC reports that anti-Brexit MPs are planning to apply for an emergency debate as soon as next week to set out dates where parliament could legislate to force Johnson’s hand. The betting markets still assign around a 40% chance of a no-deal Brexit this year.

Coming up

- Q2 construction work done data is out in Australia today. Our economists expect a fall of 1.2% in total work done for the quarter (mkt: -1%) with residential construction the main drag, down 3%. This is the first GDP partial of the Q2 GDP print due for release next week where NAB expects 0.5% growth in the quarter, underpinned by a 0.4ppt contribution from net exports.

- Germany gets the September GfK consumer confidence and the markets is expecting a small slide in the headline index from 9.7 to 9.6. In February the index was at 10.6 and the 10y average is 7.4. The Eurozone (Jul) M3 money supply (4.7% exp. vs 4.5% prev.) is also due for release tonight.

- Mortgage applications are released in the US and the Fed’s Barkin and Daly ( in NZ discussing inflation targeting) are on speaking duties. Q&A sessions are expected after both speeches.

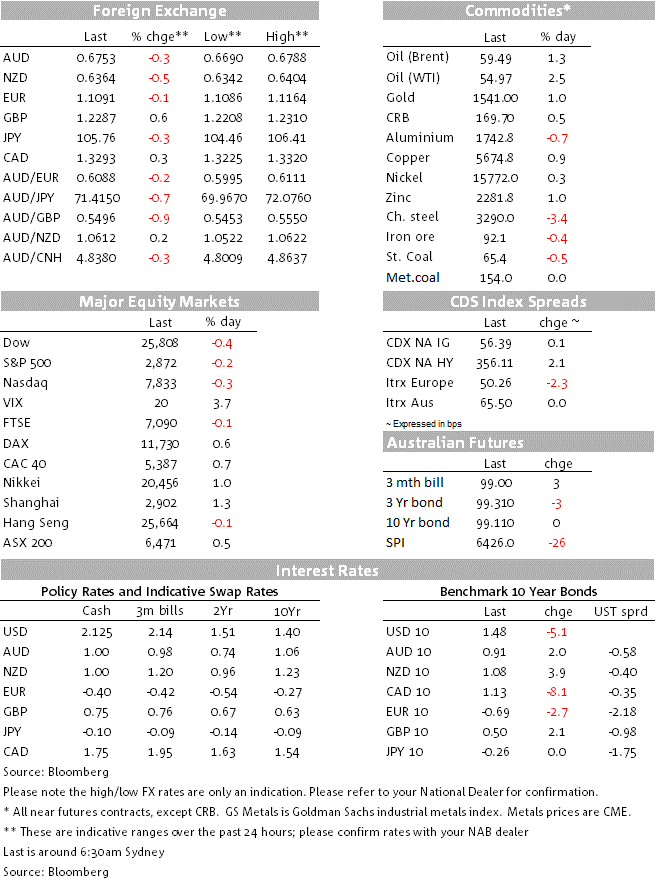

Market prices

28 Aug 2019

Source: NAB

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets