Jerome Powell is in the midst of his semi-annual “Humphrey-Hawkins” testimony to the House Financial Services Committee, and so far, the Fed Chairman has struck a dovish note, despite last week’s better-than-expected jobs report.

The highlights from Powell’s prepared remarks follow (emphasis ours):

- UNCERTAINTIES SINCE JUNE FOMC CONTINUE TO DIM OUTLOOK

- MANY AT JUNE FOMC SAW CASE FOR SOMEWHAT EASIER POLICY

- HOUSING, MANUFACTURING LOOK TO HAVE DIPPED AGAIN IN 2Q

- GROWTH IN BUSINESS INVESTMENT SEEMS TO HAVE SLOWED NOTABLY

- THERE IS A RISK THAT WEAK INFLATION WILL BE EVEN MORE PERSISTENT THAN WE CURRENTLY ANTICIPATE

An elementary reading of just the first two bullet points solidifies the case for an interest rate cut later this month: if “many” central bankers already saw the case for “somewhat easier policy” in June, and “uncertainties” since then “continue to dim” the outlook, then the case for a cut should be very strong indeed.

Not surprisingly, traders are have fully priced in a rate cut at the end of this month, with the market-implied odds of a 50bps “double” cut ticking up to around 20%. In a testament to the effectiveness of the Fed’s communication strategy, the central bank has met market expectations in all 81 of its meetings over the last decade, raising interest rates nine times and leaving them unchanged 72 times; we doubt this month’s meeting will be any different.

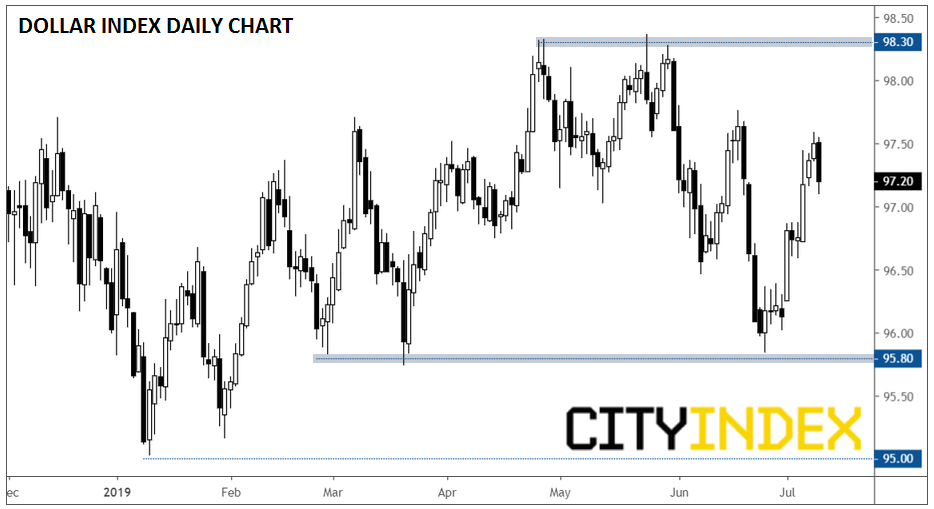

After last week’s solid US jobs report, the dollar index rallied back above 97.50 as some aggressive traders considered the possibility that the Fed may hold off on cutting interest rates. Today’s testimony implies that a rate cut is a “done deal,” and the greenback has dropped back toward 97.00 as a result.

Source: TradingView, FOREX.com

Barring any significant developments on the US-China Trade War front, the dollar index may hold within its 95.80-98.30 range for the near term while traders wait for more clarity on Fed policy through the rest of the year.

JULY 10, 2019 3:38 PM

Source: CityIndex