-

Dollar nudges up as China confirms Washington talks on course

-

Europe bonds edge higher as Treasuries steady; lira retreats

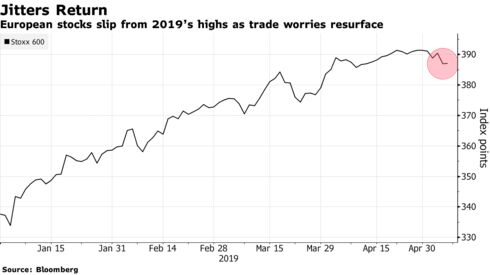

Stocks in Europe dropped alongside U.S. equity-index futures on Tuesday as a slew of trade headlines continued to buffet markets. The dollar edged higher as Treasury yields were steady.

Investor sentiment remains fragile as traders wait for the next development in the trade dispute between the world’s two biggest economies. China’s government confirmed Tuesday that Vice Premier Liu He would visit the the U.S. for trade talks on May 9 and 10, after American Trade Representative Robert Lighthizer told reporters Monday the Trump administration still plans to increase duties on imports from the Asian nation.

“Reality is setting in that they are not going to get the master deal, the grand deal that they are hoping for and there’s a lot of work to be done,” Oliver Pursche, Bruderman Asset Management’s chief market strategist, told Bloomberg TV. “Our best guess is that these tariffs will be implemented on Friday, but will then be reversed relatively quickly.’’

Elsewhere, Turkey’s lira slumped and stocks tumbled as investors interpreted a decision to redo Istanbul’s municipal vote as yet another manifestation of President Recep Tayyip Erdogan’s influence over independent institutions. The Australian dollar strengthened after the country’s central bank refrained from cutting rates. WTI crude oil dropped after the Trump administration dispatched warships to the Middle East in a warning to Iran.

Here are some notable events coming up:

- The Reserve Bank of New Zealand meets Wednesday.

- China releases trade data Wednesday, and the U.S. does so on Thursday.

- South Africa holds national elections Wednesday.

- China reports on inflation Thursday. The U.S. releases the April CPI report Friday.

- A Chinese trade delegation is expected to arrive in Washington for talks.

These are the main moves in markets:

Stocks

- The Stoxx Europe 600 Index dipped 0.2 percent as of 10:23 a.m. London time to the lowest in four weeks.

- Futures on the S&P 500 Index fell 0.5 percent.

- The MSCI All-Country World Index fell 0.1 percent to the lowest in almost four weeks.

- The U.K.’s FTSE 100 Index declined 0.7 percent.

- The MSCI Emerging Market Index climbed 0.1 percent.

Currencies

- The Bloomberg Dollar Spot Index increased 0.1 percent.

- The euro decreased less than 0.05 percent to $1.1197.

- The British pound advanced less than 0.05 percent to $1.3097.

- The Japanese yen rose 0.1 percent to 110.63 per dollar, the strongest in almost six weeks.

Bonds

- The yield on 10-year Treasuries advanced one basis point to 2.48 percent.

- Germany’s 10-year yield fell two basis points to -0.01 percent.

- Britain’s 10-year yield fell three basis points to 1.188 percent.

- Japan’s 10-year yield fell one basis point to -0.052 percent.

Commodities

- West Texas Intermediate crude dipped 0.6 percent to $61.86 a barrel.

- Gold advanced less than 0.05 percent to $1,281.22 an ounce, the highest in a week.

- The Bloomberg Commodity Index decreased 0.4 percent to the lowest in almost four months.

By Robert Brand – 7 May 2019, 19:33 GMT+10

— With assistance by Ravil Shirodkar, and Andreea Papuc

Source: Bloomberg