-

Euro bounces on Italy finance minister rejection; dollar slips

-

U.S. futures advance as Kim Jong Un summit appears back on

Traders kicked off the week in a tentative risk-on mood, with European and Asian stocks edging higher and U.S. futures climbing on signs an America-North Korea summit is back on track. The euro gained after Italy’s president rejected a euro-skeptic finance minister.

The equity moves represent a positive start to the week following a tumultuous few days in global markets, but investors may well be slow to throw caution to the wind. It’s difficult to know if sentiment will hold when traders in both London and New York return; U.S. negotiations with North Korea have proved unpredictable, and while the failure of populist leaders to form a government in Italy removes a threat to the euro area for now, it raises the prospect they will cement their power in a follow-up election.

“We may now be in for an extended period of heightened uncertainty ahead of fresh elections, assuming that’s where we’re headed,” said Ray Attrill, head of foreign-exchange strategy at National Australia Bank Ltd. in Sydney.

Elsewhere, emerging-market stocks and currencies gained. The lira was the stand out performer, rallying after the central bank took steps to simplify its monetary policy. Gold fell.

Terminal users can read more in Bloomberg’s Markets Live blog.

These are some key events to watch this week:

- U.S. markets are closed Monday for Memorial Day. U.K. markets are closed for the spring bank holiday.

- European Union foreign ministers meet in Brussels Monday to discuss developments related to North Korea, Yemen, and the Iran nuclear deal.

- EU trade chief Cecilia Malmstrom and U.S. Commerce Secretary Wilbur Ross are scheduled to meet Wednesday in an informal World Trade Organization ministerial in Paris.

- U.S. employment report for May is due Friday.

- On Saturday U.S. Secretary of Commerce Wilbur Ross will travel to Beijing for more talks with Vice Premier Liu He on topics including ZTE Corp. and trade.

These are the main moves in markets:

Stocks

- The Stoxx Europe 600 Index advanced 0.1 percent as of 9:28 a.m. London time.

- Futures on the S&P 500 Index advanced 0.4 percent, the biggest gain in a week.

- The MSCI Asia Pacific Index gained 0.1 percent, the largest rise in more than a week.

- Germany’s DAX Index increased 0.4 percent.

- The MSCI Emerging Market Index jumped 0.4 percent.

Currencies

- The Bloomberg Dollar Spot Index decreased 0.1 percent to 1,169.77.

- The euro climbed 0.3 percent to $1.1682, the largest increase in more than two weeks.

- The British pound advanced 0.1 percent to $1.332.

- The Japanese yen declined less than 0.05 percent to 109.45 per dollar.

- The Turkish lira jumped 1.3 percent to 4.6539 per dollar.

Bonds

- Germany’s 10-year yield gained one basis point to 0.42 percent.

- Italy’s 10-year yield fell two basis points to 2.436 percent.

Commodities

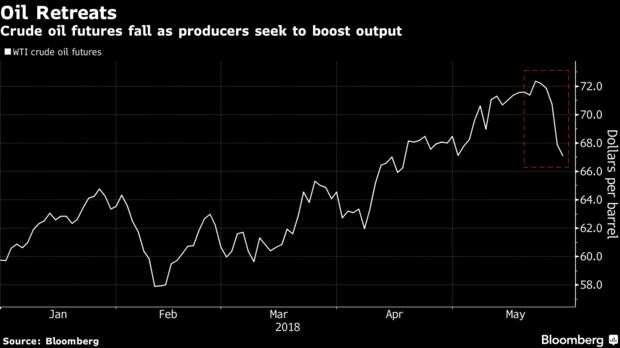

- West Texas Intermediate crude decreased 1.7 percent to $66.71 a barrel, reaching the lowest in almost six weeks on its fifth consecutive decline.

- Gold dipped 0.4 percent to $1,297.09 an ounce, the largest decrease in almost two weeks.

- Brent crude fell 1.7 percent to $75.15 a barrel, the lowest in almost three weeks.

By Samuel Potter – May 28, 2018, 6:41 PM GMT+10

— With assistance by Ruth Carson, and Andreea Papuc

Source: Bloomberg