-

Euro weakens as BTP yields surge; bunds lead core bonds higher

-

Treasuries steady as dollar edges up; Asian stocks gain

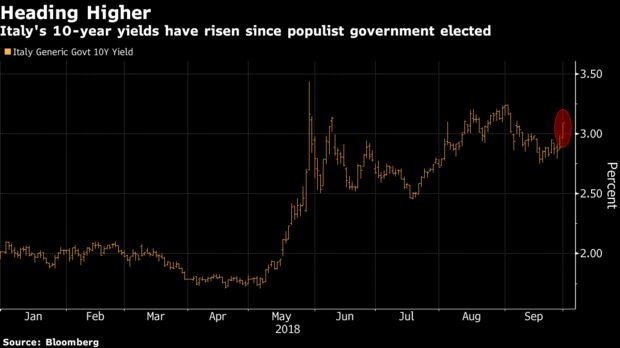

Stocks in Europe dropped at the end of a volatile month as political concerns returned to center stage. Italian bonds plunged after the country’s populist leaders gained the upper hand in a battle over spending.

Political risks have returned to the top of investors’ agenda at the end of a quarter dominated by central banks and emerging-market crises. In Italy, populists won their battle to fund costly campaign promises, while infighting over Brexit is embroiling the U.K.’s Conservative Party ahead of a conference next week. In the U.S., the confirmation of President Donald Trump’s Supreme Court pick, Brett Kavanaugh, has turned toxic amid allegations of sexual assault. Data on spending and prices may return the focus to the American economy later Friday.

Terminal subscribers can read our Markets Live blog.

These are the main moves in markets:

Stocks

- The Stoxx Europe 600 Index fell 0.3 percent to 385.29 as of 8:08 a.m. London time.

- Futures on the S&P 500 Index dipped 0.1 percent.

- The MSCI All-Country World Index decreased 0.1 percent to the lowest in more than a week.

- The U.K.’s FTSE 100 Index declined 0.2 percent.

- Germany’s DAX Index rose 0.4 percent.

- The MSCI Emerging Market Index sank 0.3 percent.

Currencies

- The Bloomberg Dollar Spot Index increased 0.1 percent.

- The euro fell 0.2 percent to $1.1616, the weakest in more than two weeks.

- The British pound declined 0.1 percent to the weakest in more than two weeks.

- The Japanese yen decreased less than 0.05 percent to 113.40 per dollar, the weakest in more than nine months.

Bonds

- The yield on 10-year Treasuries dipped one basis point to 3.04 percent, the lowest in more than a week.

- Germany’s 10-year yield dipped four basis points to 0.49 percent.

- Britain’s 10-year yield declined three basis points to 1.565 percent.

- Japan’s 10-year yield gained one basis point to 0.125 percent.

Commodities

- West Texas Intermediate crude gained 0.2 percent to $72.28 a barrel, the highest in almost four years.

- Gold dipped 0.1 percent to $1,181.52 an ounce, the weakest in six weeks.

- Copper decreased 0.1 percent to $2.78 a pound, the lowest in more than a week.

By Adam Haigh and Robert Brand

September 28, 2018, 5:15 PM GMT+10

Source: Bloomberg