-

Treasuries hold gains as investors fret over U.S. policy

-

Chinese factory output boosts copper, industrial metals

Stocks in Europe gained as positive economic data from China lifted mining shares, following declines in Asian and American equities after a fresh personnel shakeup in the Trump administration spurred concerns about a unilateral approach to trade, national security and foreign affairs.

The Stoxx Europe 600 Index edged higher, with raw-material producers outperforming after factory output and investment growth in China, the biggest consumer of mining commodities, unexpectedly accelerated in the first two months of the year. U.S. index futures also advanced. Benchmarks dropped across Asia earlier after the sudden firing of U.S. Secretary of State Rex Tillerson. U.S. Treasuries held gains while the dollar steadied. The euro weakened and German bund yields edged lower.

“Markets have quickly moved on from worrying about an inflation scare to focusing on continued political uncertainty in the U.S.,” said Tai Hui, the Hong Kong-based chief Asia market strategist at JPMorgan Asset Management Ltd. . “Hopefully the Fed can provide some stability in market confidence next week by clarifying its position on monetary policy.”

Tillerson’s ouster raised concerns of a new guard in the White House that may take a harder line on trade, advancing President Donald Trump’s agenda of imposing tariffs. Trump nominated CIA director Mike Pompeo, an ex-congressman who has endorsed “pushing back against the Chinese threat,” to replace Tillerson. The change comes as the administration considers tariffs on a broad range of Chinese imports, with Politico reporting one proposal is to take measures against more than $30 billion of goods a year.

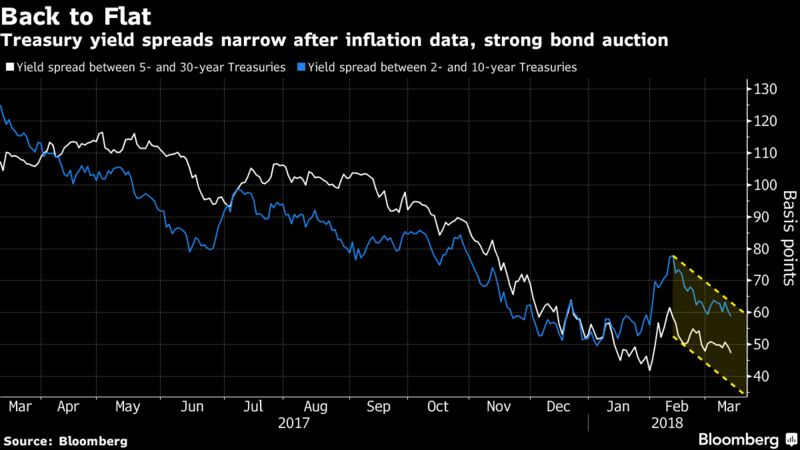

Meantime, the U.S. inflation report Tuesday did little to rock traders’ bets on the path for Federal Reserve policy tightening, though the 10-year Treasury yield did slip to 2.84 percent as market gauges of inflation expectations fell on the data. Reports on retail sales and wholesale prices Wednesday may shed more light on the U.S. economy as the Federal Reserve prepares to review policy next week.

Most industrial metals climbed, with copper headed for the highest in more than a week.

Terminal users can read more in our markets blog.

Here are some of the key things happening this week:

- U.S. retail sales and wholesale price data are out on Wednesday.

- Factory output Wednesday and inflation data Thursday are focal points in the euro area.

- Also this week, Germany’s Angela Merkel is inaugurated to a fourth term, and EU27 government officials discuss the European Union’s Brexit position.

- New Zealand GDP data is out Thursday.

- Russians will go to the polls on Sunday to vote in a presidential election that Vladimir Putin is widely expected to win. Meanwhile the U.K. is due to set out retaliation measures against Russia over a nerve agent attack on its territory.

And these are the main moves in markets:

Stocks

- The Stoxx Europe 600 Index gained 0.1 percent as of 8:28 a.m. London time.

- The U.K.’s FTSE 100 Index climbed 0.2 percent.

- Germany’s DAX Index rose 0.2 percent.

- Futures on the S&P 500 Index increased 0.3 percent.

- The MSCI Asia Pacific Index fell 0.5 percent.

- Japan’s Topix index dropped 0.5 percent, Hong Kong’s Hang Seng sank 1 percent, South Korea’s Kospi lost 0.3 percent and Australia’s S&P/ASX 200 slid 0.7 percent.

Currencies

- The Bloomberg Dollar Spot Index gained less than 0.05 percent.

- The euro dipped 0.2 percent to $1.2369.

- The British pound decreased 0.1 percent to $1.3946.

- The Japanese yen fell 0.1 percent to 106.66 per dollar.

Bonds

- The yield on 10-year Treasuries decreased one basis point to 2.84 percent, the lowest in almost two weeks.

- Germany’s 10-year yield decreased one basis point to 0.62 percent, the lowest in seven weeks.

- Britain’s 10-year yield declined two basis points to 1.487 percent.

- Japan’s 10-year yield fell less than one basis point to 0.05 percent.

Commodities

- West Texas Intermediate crude rose 0.1 percent to $60.75 a barrel.

- Gold fell 0.2 percent to $1,324.30 an ounce.

- LME copper climbed 0.5 percent to $6,982.00 per metric ton, the highest in more than a week.

By Robert Brand – March 14, 2018, 7:39 PM GMT+11

— With assistance by Joanna Ossinger, Andrew Janes, En Han Choong, and Adam Haigh

Source: Bloomberg